After many years of tight state budgets, Kentucky is now experiencing healthy but temporary revenue surpluses that are growing its rainy day fund, the state’s emergency savings account, to an unprecedented size. What the legislature does next with these resources has major implications for our state’s recovery from a pandemic and two natural disasters, and for what kind of commonwealth we will be far into the future.

The surpluses are the result of aggressive federal pandemic aid that is now drying up and COVID-induced inflation that is slowly coming down. Yet under House Bill 8 (HB 8) passed in the 2022 legislative session, these temporary surpluses are triggering large, permanent tax cuts going disproportionately to the wealthy. If allowed to continue, these tax cuts will quickly squander the rainy day fund and/or force major budget cuts to important services all Kentuckians rely on to thrive. The state’s potential to create jobs would take a hit in the process, with tax cuts preventing investments in what builds a strong economy.

With concerns about a recession in the near future mounting, and pressing immediate needs facing the commonwealth, Kentucky needs to make responsible and careful fiscal policy decisions. As experts recommend, the General Assembly should preserve an amount equal to 15% of the budget in the rainy day fund for near-term recession protection. It should use the remainder for immediate needs including flood-related rebuilding and mitigation expenses, and to continue addressing ongoing concerns including the public sector worker shortage and a looming child care funding cliff. To make that possible and to build a strong future for all Kentuckians, the General Assembly should not approve additional tax cuts in the 2023 legislative session.

Temporary factors are driving revenue surpluses

After more than 20 rounds of budget cuts in the 15 years after the Great Recession, Kentucky’s budget situation suddenly improved recently despite the COVID-19 recession. It is important to understand why. Unlike in the aftermath of the Great Recession, Congress acted aggressively during the pandemic to combat job loss and economic hardship. Through stimulus checks, expanded unemployment benefits, a monthly child tax credit, state and local aid and much more, the federal government poured an enormous $45 billion into the Kentucky economy over several years (more than three times the state’s annual General Fund budget).1

That relief kept money flowing through communities and spurred the restoration of jobs in record time. Rapid growth tightened labor markets, leading to wages rising for many workers who had not seen their paychecks increase for decades.2 At the same time, production bottlenecks due to COVID-19 and the war in Ukraine spurred global price increases.

Those two factors — a strong economy and inflation — have resulted in higher state tax receipts. The result is evident in the state’s two biggest tax sources, income taxes and sales taxes, which together make up 76% of General Fund revenue. Income tax receipts increased 18% in fiscal year 2022 as wages rose and workers rapidly filled job openings, while sales tax receipts grew 11% as consumer spending was strong and prices increased.

The result is large revenue surpluses each of the last two years that have increased the balance in the state’s rainy day fund (officially called the Budget Reserve Trust Fund). Even after spending $213 million to provide aid for the eastern Kentucky floods in a special legislative session in August, the state still has $2.5 billion in its rainy day fund. That is an amount equal to 18.1% of the state General Fund appropriations, a dramatic increase from its typical levels. In fact, before the pandemic the balance of the fund has never been greater than 5% of annual appropriations, going back to its creation in 1993.3 Further, the General Assembly appropriated another $248 million to the fund during the regular legislative session, which the state will deposit next June. That will increase the balance to $2.8 billion, or 19.9% of General Fund spending.

The fund may grow even further in the near term. Revenues are still strong, with growth in the first two months of the fiscal year 8.2% higher than the same period last year. If the state simply collects as much revenue this fiscal year as it did last year, Kentucky will have a revenue surplus at the end of June of $943 million. If that happens, the rainy day fund balance would increase to $3.7 billion, or 26.6% of General Fund expenditures.

While the news is very good for now, the factors driving these large revenue surpluses are unlikely to continue. Much of the federal pandemic aid has now expired. Inflation is starting to abate, with gas prices down, supply chain bottlenecks beginning to clear, wage growth slowing, and measures of inflation expectations showing reduced concern. Federal Reserve actions to raise interest rates in response to inflation are creating considerable risk of tipping the economy into recession in the next few years, which will harm tax revenue growth in addition to creating economic hardship.

Current state tax policy will squander surplus and make state worse off

It is critical to understand that the current surpluses are the result of external factors and not state policy decisions. Nearly all states are seeing strong tax receipts and revenue surpluses — those that have progressive income taxes and those that have no income taxes at all, those that are right-to-work and those that are union-friendly.4 The causes of the current surpluses should make the General Assembly reconsider enacting permanent revenue reductions based on them.

But the General Assembly already began making permanent policy changes based on these temporary conditions by enacting HB 8 during the 2022 regular session. That bill creates a formula authorizing reductions in the state’s current 5% income tax rate based on 1) the size of the rainy day fund; and 2) the amount of revenue collected compared to the amount of spending during the prior fiscal year. The measures are not indicative of the long-term health of the state economy, and do not take future revenue needs into account. They are instead a point-in-time snapshot based on a single year that may create an illusion that reducing rates further is sound. The formula can lead to permanent rate reductions and revenue loss without consideration of unique external circumstances like Kentucky is now facing, or future needs in the commonwealth.5

Already, HB 8 is forcing a reduction in the income tax rate from 5% to 4.5% starting January 1, 2023. HB 8 also includes a modest expansion of the sales tax base to include new services, but the resulting revenue raised from the expansion comes nowhere close to offsetting the revenue losses from the income tax rate cut. Reducing the income tax rate to 4.5% will result in a loss to the General Fund of $247.6 million in fiscal year 2023 (the 4.5% rate would be in effect for only half of the fiscal year) and $487.6 million in 2024 even after taking into account the additional sales tax revenues.

In addition, the HB 8 formula establishes the conditions for a further reduction in the income tax rate from 4.5% to 4% starting January 1, 2024. For that reduction to take effect, the General Assembly must take action in the 2023 legislative session.6 If the legislature chooses to reduce the rate to 4%, the lost revenue from HB 8 grows to an estimated $891 million in 2024 and $1.2 billion by 2025.

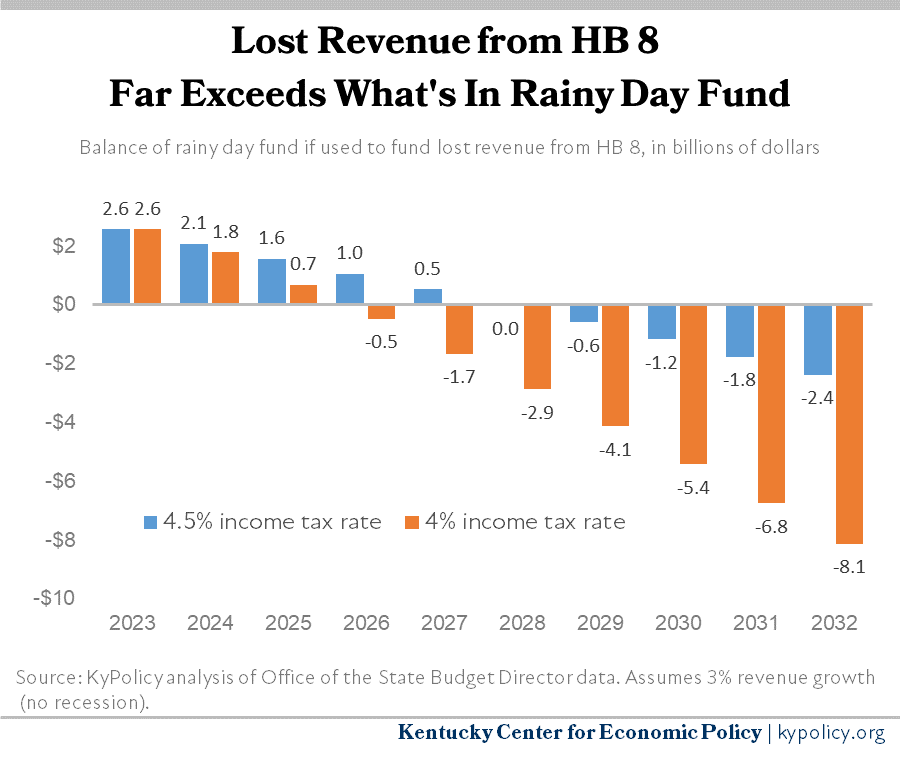

This serious flaw in HB 8 — setting the stage for permanent tax cuts based on temporary revenue conditions — creates a dangerous budget situation. If the legislature chooses to make up for the lost revenue by drawing down the rainy day fund, as opposed to cutting services or raising taxes, it will completely deplete the fund in 5 years with a 4.5% income tax rate and in 3 years with a 4% income tax rate, as shown in the graph below. The income tax is the state’s largest revenue source, providing 41% of General Fund receipts. Cutting the rate even by small amounts is extraordinarily expensive.7

The graph above assumes no recession hits the economy in the next 10 years, but that scenario is unlikely. Recent downturns have occurred on average every 8.6 years.8 When a recession hits, state tax receipts typically falter unless the federal government intervenes with an aggressive stimulus as they did during the COVID-19 recession. Given the political dynamics in Washington, there are serious doubts about what kind of federal aid will be available during the next downturn.

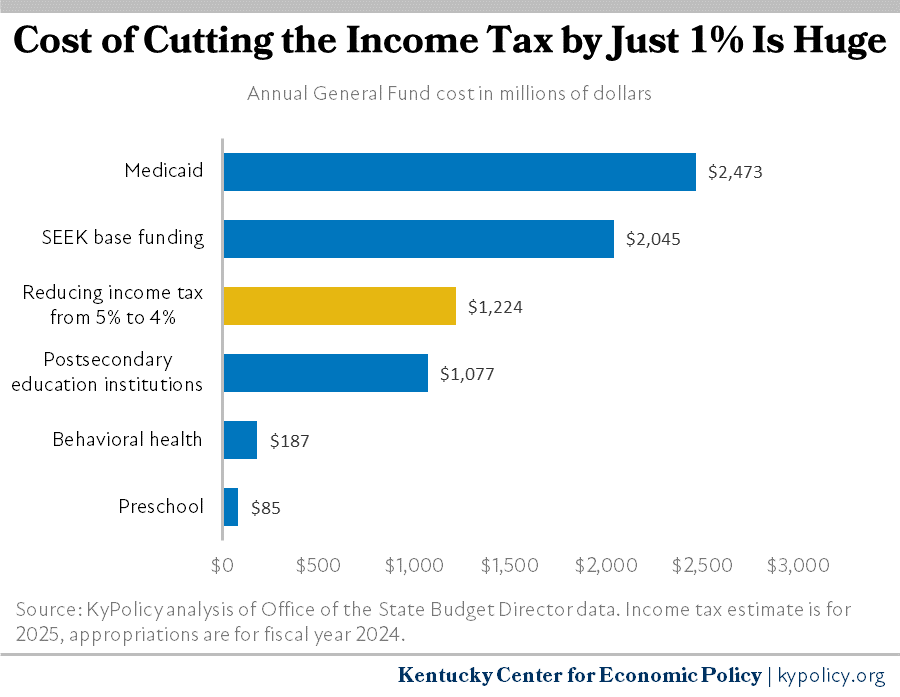

The large rainy day fund provides little cushion from the revenue blow that will occur if the General Assembly continues to reduce the income tax rate based on the conditions established by HB 8. If the state were to cut services instead of drawing down the fund, a reduction in the income tax rate to 4% would require $1.2 billion in annual cuts by 2025, or an amount greater than Kentucky spends on all of higher education — 8 universities and 16 community colleges — as shown in the graph below.

If the state were to take the unlikely course of raising the sales tax rate to make up the lost revenue, the legislature would have to increase the rate to approximately 7.4% to make up for the cut to 4%, which would give Kentucky the highest state sales tax in the country.9 That shift would be a tax increase for low- and middle income Kentuckians, who spend a higher share of their income out of necessity, while the wealthiest would receive a large net tax cut. Such a shift will also disproportionately harm Kentuckians of color and those who live in rural areas.10

State needs rainy day fund for immediate needs, and must have adequate and sustainable revenue for the long term

The legislature should not allow the income tax rate to continue declining following the HB 8 formula because existing rainy day fund resources will be necessary to address short-term needs, and strong and stable revenues will be required in the future to address increased costs. Making permanent tax cuts is both short-sighted and irresponsible.

As mentioned above, the risks of a recession have increased dramatically due to the Federal Reserve raising interest rates. Fed Chair Jerome Powell said recently that there is a “very high likelihood” of reduced growth as a result.11 As we described in a 2021 KyPolicy report, Kentucky should ideally set aside 15% of the budget in its rainy day fund to prepare for future recessions.12 While in that report we indicated that Kentucky could build up to that level over several years, given the increased risks of recession the state should protect that amount in its rainy day fund immediately. Other states are similarly questioning prior fiscal decisions and budgeting more cautiously given the concerning economic outlook.13

In addition, there are immediate costs and needs the state must address with rainy day fund dollars above the 15% level. One critical looming issue concerns flood-related expenses, including the need to put money into safe new housing and flood resilience. In fall 2022, the General Assembly appropriated $213 million to help with some emergency costs resulting from devastating flooding in eastern Kentucky. But the package did not include resources for permanent housing despite a proposal for $50 million from Senator Brandon Smith and advocacy from affected communities.14 The expensive rebuilding of infrastructure, schools and other needs will also require significant resources. In addition, unlike a growing number of other states, Kentucky has not created a fund for flood resilience investments to limit future harms, despite the fact that it has had more declared natural disasters for flooding than any other state.15

The state also has ongoing needs that require adequate and sustainable sources of revenue. Compensation to address the public employee and teacher shortage is a key example. While private sector employment has returned to pre-COVID levels, public sector jobs still lag far behind.16 The state faces growing shortages of teachers and public employees due to budget cuts as well as inadequate pay, cuts to retirement benefits and difficult workloads. While the state did include an 8% raise for state employees in the 2023 budget and set aside $200 million for raises in the 2024 budget (along with additional targeted raises for certain positions), those measures are only a first step after many years of eroding compensation.17 The state did not specifically fund a teacher and school employee raise in the budget, and state school funds were not enough for many districts to provide adequate raises.18 The legislature should do more to address this critical short- and long-term subject.

Another pressing issue is child care. High quality child care is critical to child development, job stability and the economy as a whole. Yet half of Kentuckians live in a child care desert, costs are increasingly out of reach, job quality in the sector is low and many providers have closed their doors over the last decade because they cannot operate as viable businesses. Thankfully, the American Rescue Plan Act (ARPA) provided $763 million to Kentucky for child care that has helped prop up the industry in the short term by expanding eligibility for subsidies, increasing reimbursement rates, boosting worker pay and more. However, those federal funds end in September 2024, creating a “cliff” for the industry that Kentucky must address with state dollars. The consequences are severe if Kentucky does not step up, and the cost is at least hundreds of millions of dollars a year. According to a recent survey by the Prichard Committee, 22% of child care centers said they would close with the end of the funds, 27% said they would lay off staff, 39% said they would cut wages, and 72% said they would increase tuition.19 Kentucky should set aside funds now from the excess rainy day fund balance to continue ARPA-level investments in child care and the state must be able to continue that funding once the funds set aside are expended.

Legislature should suspend further tax cuts

If the income tax rate cuts continue, there are three bad options available to make up the lost revenues:

1) Deplete the rainy day fund, a short-term solution because it would be gone in a few years at best. That would give the state nowhere to turn to address an economic downturn;

2) Increase other taxes, but the revenues needed to make up for reductions in the income tax are massive. The necessary increase in the sales tax rate would be the highest in the nation and would disproportionately harm low- and middle-income Kentuckians;

3) Cut the budget, which will harm our schools, health and other foundational needs that still have not made up ground lost from more than 20 rounds of cuts over the past 15 years.

Claims that reductions in the income tax will trickle down and result in job and population growth are unfounded. States that have reduced income taxes in recent years, including Kansas, Arizona, North Carolina, Ohio, Maine and Wisconsin, have experienced reduced tax revenues as a result, not faster economic growth. States that have taken the opposite tax policy approach of increasing income taxes on millionaires are doing well economically. Meanwhile, a number of states with graduated income taxes have among the highest rates of population growth. Moving between states has been declining in recent decades, and careful academic studies have found that state and local taxes do not play a major role in the interstate migration that occurs.20

Along with suspending further reductions in the income tax rate due to HB 8, the General Assembly should avoid other permanent tax cuts, including those under consideration for the highly profitable bourbon industry, as well as corporate tax breaks that were proposed or introduced last session.21 The legislature should then protect an amount equal to 15% of its rainy day fund to ensure funding for core services in potential recession, and use remaining resources to address the pressing immediate needs mentioned above. Continuing to allow the state to reduce its strongest revenue sources will heighten short-term risks, worsen existing community problems, and force additional cuts to vital education, health and other services down the road.

- Committee for a Responsible Federal Budget, “COVID Money Tracker,” https://www.covidmoneytracker.org/. FRED, Total Personal Income in Kentucky, through Q1 2022, https://fred.stlouisfed.org/series/KYOTOT. [1] Dustin Pugel, “The State of Working Kentucky 2022,” Kentucky Center for Economic Policy, September 1, 2022, https://kypolicy.org/the-state-of-working-kentucky-2022/.

- Dustin Pugel, “The State of Working Kentucky 2022,” Kentucky Center for Economic Policy, Sept. 1, 2022, https://kypolicy.org/the-state-of-working-kentucky-2022/.

- Jason Bailey, “Unprecedented Surplus Presents Opportunity to Both Reinvest in Kentucky’s Budget and Build Rainy Day Fund,” Kentucky Center for Economic Policy, Oct. 20, 2021, https://kypolicy.org/unprecedented-surplus-opportunity-to-reinvest-in-kentucky-budget-and-build-rainy-day-fund/.

- National Association of State Budget Directors, “The Fiscal Survey of States, Spring 2022,” https://www.nasbo.org/reports-data/fiscal-survey-of-states. Justin Theal and Joe Fleming, “Budget Surpluses Push States’ Financial Reserves to All-Time Highs, Pew, May 10, 2022, https://www.pewtrusts.org/en/research-and-analysis/articles/2022/05/10/budget-surpluses-push-states-financial-reserves-to-all-time-highs.

- HB 8 will reduce the state’s 5% individual income tax rate by up to 0.5 points per year if two conditions are met: 1) The balance in the Budget Reserve Trust Fund (BRTF, or the state’s rainy day fund) is equal to 10% or more of General Fund receipts, and 2) General Fund receipts equal or exceed appropriations (minus contributions to the BRTF and extra pension contributions) plus the cost of a 1 percentage point reduction in the income tax rate. Jason Bailey, “Temporary Surplus Should Not Trigger Permanent Tax Cuts that Threaten Future Budgets,” Kentucky Center for Economic Policy, July 11, 2022, https://kypolicy.org/temporary-surplus-should-not-trigger-permanent-tax-cuts-that-threaten-future-budgets/.

- Jason Bailey, “Temporary Surplus Should Not Trigger Permanent Tax Cuts that Threaten Future Budgets,” Kentucky Center for Economic Policy, July 11, 2022, https://kypolicy.org/temporary-surplus-should-not-trigger-permanent-tax-cuts-that-threaten-future-budgets/

- The effects will start immediately: reduction in the income tax rate from 4.5% to 4% will make the 2024 budget out of balance by approximately $311 million.

- Bailey, “Unprecedented Surplus.”

- Federation of Tax Administrators, “State Sales Tax Rates and Food and Drug Exemptions,” Jan. 1, 2022, https://www.taxadmin.org/assets/docs/Research/Rates/sales.pdf.

- Anna Baumann, “Income Tax Cuts Will Widen Inequality in Kentucky,” Kentucky Center for Economic Policy, March 3, 2022, https://kypolicy.org/income-tax-cuts-will-widen-inequality-in-kentucky/.

- Ben Winck, “There’s a ‘Very High Likelihood’ of a Growth Recession as the Fed’s Inflation Fight Ramps Up, Powell Says,” Insider, Sept. 21, 2022, https://www.businessinsider.com/recession-odds-layoffs-federal-reserve-jerome-powell-economic-pain-outlook-2022-9. Jeanna Smialek, “The Fed Intensifies Its Battle Against Inflation,” The New York Times, Sept. 21, 2022, https://www.nytimes.com/2022/09/21/business/economy/fed-rates-inflation-powell.html.

- Bailey, “Unprecedented Surplus.”

- [1] Lisa Kashinsky, “States Get Stingy as Sour Economy Drains Their Surpluses,” Politico, Aug. 31, 2022, https://www.politico.com/news/2022/08/31/budget-surplus-covid-states-00054302.

- Jason Bailey and Pam Thomas, “State Must Go Beyond FEMA Aid to Adequately Address Housing Need from Eastern Kentucky Floods,” Kentucky Center for Economic Policy, Aug. 22, 2022, https://kypolicy.org/state-must-address-housing-need-eastern-kentucky-floods/. Jason Bailey, “Flood Relief Legislation Only a First Step, Leaves Out Housing Aid,” Kentucky Center for Economic Policy, Aug. 24, 2022, https://kypolicy.org/eastern-kentucky-flooding-relief-package/. R. Scott McReynolds, “Ky Leaders Need to Tell EKY Flood Victims They’ll Have to Wait a Lot Longer for Housing,” Lexington Herald-Leader, Aug. 29, 2022, https://www.kentucky.com/opinion/op-ed/article265032599.html.

- Pam Thomas and Jason Bailey, “Kentucky Must Do More to Increase Flood Resilience,” Kentucky Center for Economic Policy, Aug. 15, 2022, https://kypolicy.org/kentucky-must-do-more-to-increase-flood-resilience/

- Pugel, “The State of Working Kentucky 2022.”

- Dustin Pugel and Pam Thomas, “Personnel Cabinet Recommends Improving Compensation to Stave Off State Workforce Crisis,” Kentucky Center for Economic Policy, July 13, 2022, https://kypolicy.org/kentucky-personnel-cabinet-recommends-improving-compensation-to-stave-off-state-workforce-crisis/.

- Ashley Spalding, Dustin Pugel and Pam Thomas, “Most Kentucky Teachers and School Staff Start Year Without Meaningful Raises,” Kentucky Center for Economic Policy, Aug. 10, 2022, https://kypolicy.org/kentucky-teachers-and-staff-start-year-without-meaningful-raises/.

- Dustin Pugel, “Child Care in Kentucky Is Crucial and in Dire Need of Public Investment,” Kentucky Center for Economic Policy, Nov. 11, 2021, https://kypolicy.org/report-child-care-in-kentucky-is-crucial-and-needs-public-investment/. Prichard Committee, “A Fragile Ecosystem IV: Will Kentucky Child Care Survive When the Dollars Run Out?” Sept. 2022, https://prichardcommittee.org/wp-content/uploads/2022/09/FragileEcosystemIV.pdf

- Jason Bailey, “Income Tax Cuts Are a Way to Sink the Economy, Not Grow It,” Kentucky Center for Economic Policy, February 14, 2022, https://kypolicy.org/income-tax-cuts-are-a-way-to-sink-the-kentucky-economy-not-grow-it/.

- Bourbon Barrel Taxation Task Force, https://legislature.ky.gov/Committees/Pages/Committee-Details.aspx?CommitteeRSN=398&CommitteeType=Special%20Committee. Jason Bailey and Pam Thomas, “Corporate Tax Break Watch: 2022 General Assembly,” Kentucky Center for Economic Policy, April 5, 2022, https://kypolicy.org/corporate-tax-break-watch-2022-general-assembly/.