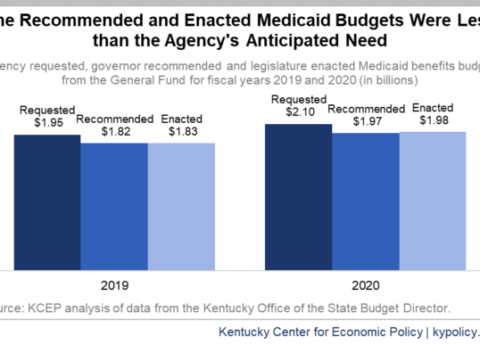

Manageable Medicaid “Shortfall” Was Created in Budget the Governor Originally Proposed

Recent testimony by Cabinet for Health and Family Services (CHFS) officials about a Medicaid “shortfall” over the next two fiscal...

Research That Works for Kentucky

Copyright © 2025 KyPolicy Privacy Policy Terms & Conditions Sitemap