Top House Priorities Show Conflict Between Reducing Revenues and Rising Costs

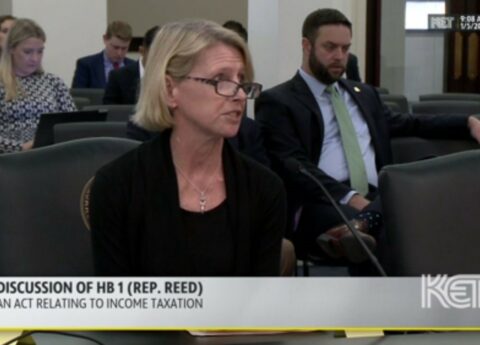

The House's top priority (HB 1) in the 2023 legislative session is a bill to continue reducing the state's income...

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap