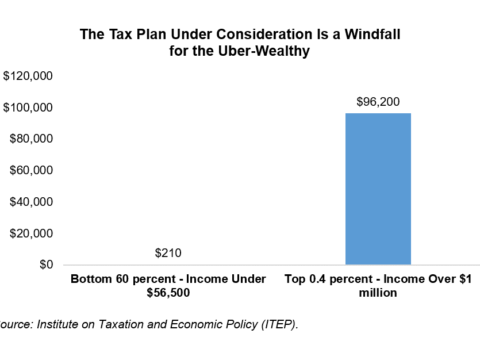

Federal Tax Cut Framework Is Designed for Millionaires

Under the tax framework released last week by the Trump administration and Congressional leaders, the wealthiest 1 percent of Kentuckians...

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap