Kentucky Has Much to Lose if Supreme Court Strikes Down the Affordable Care Act

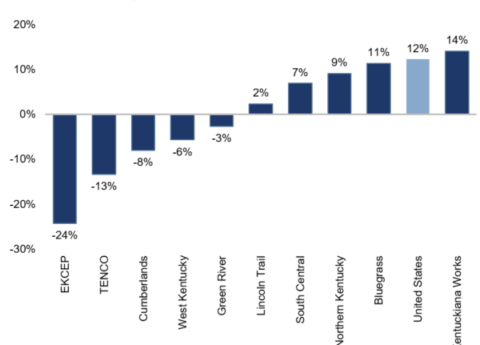

Kentucky has greatly benefitted from the 2010 passage of the federal Affordable Care and Patient Protection Act (ACA). Thanks to...

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap