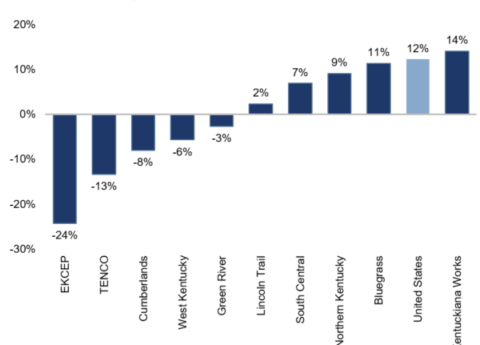

Lopsided Recovery Continues to Leave Out Eastern Part of State

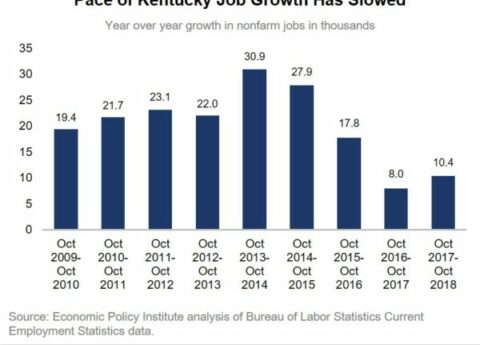

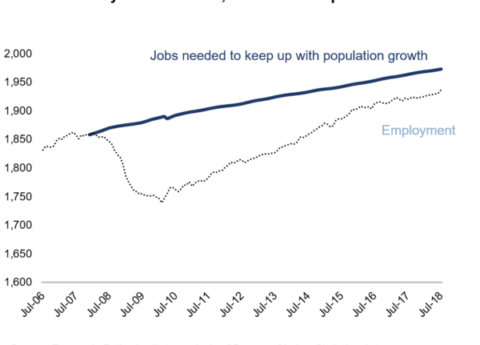

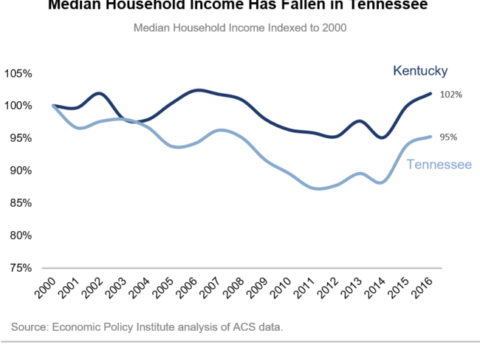

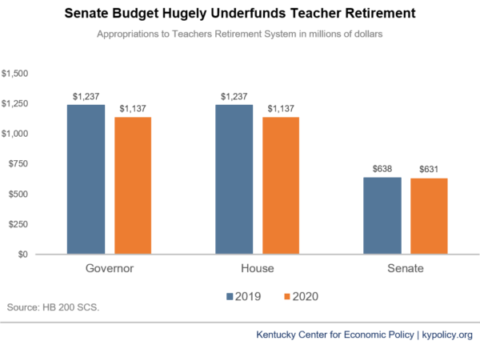

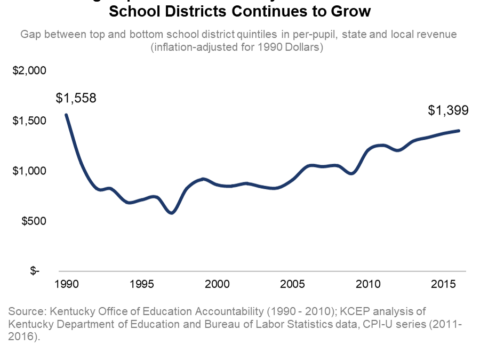

A recovering economy since the Great Recession has bypassed much of rural Kentucky and especially the eastern and northeastern regions...

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap