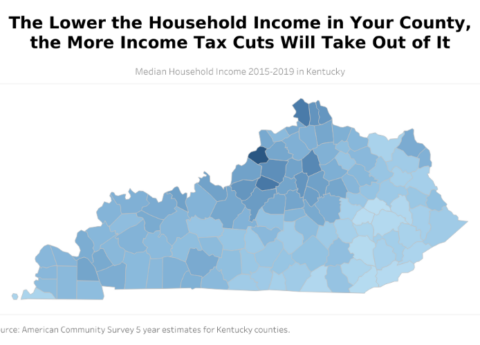

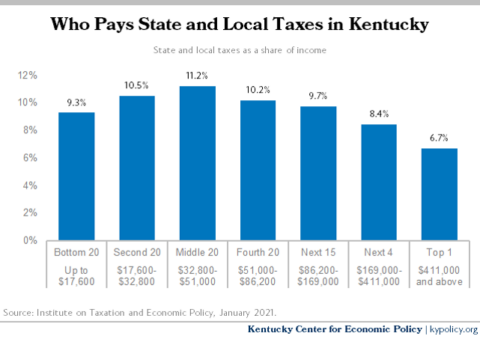

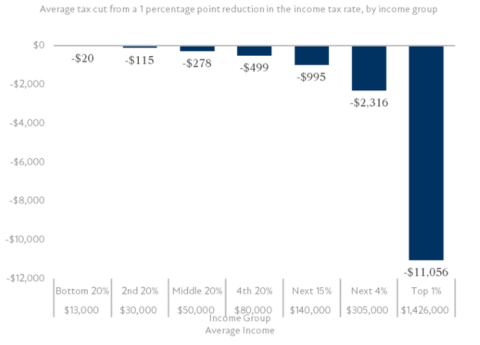

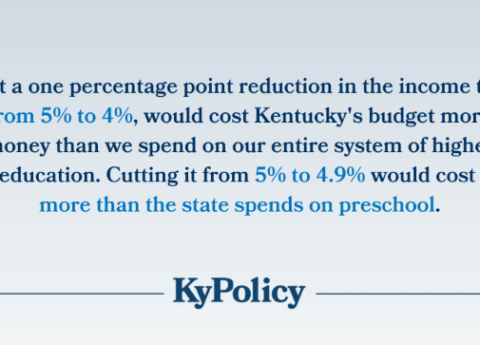

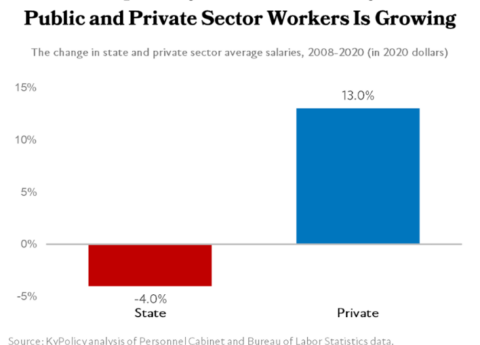

Income Tax Cuts Will Widen Inequality in Kentucky

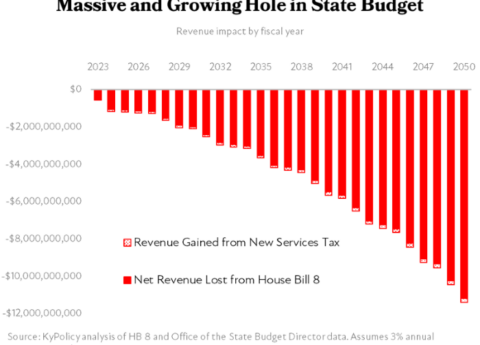

To pay at least in part for income tax cuts for the wealthy, the House budget proposal shorts investments in...

Research That Works for Kentucky

Copyright © 2025 KyPolicy Privacy Policy Terms & Conditions Sitemap