Trump Budget Eliminations Would Be Major Hit to Kentucky

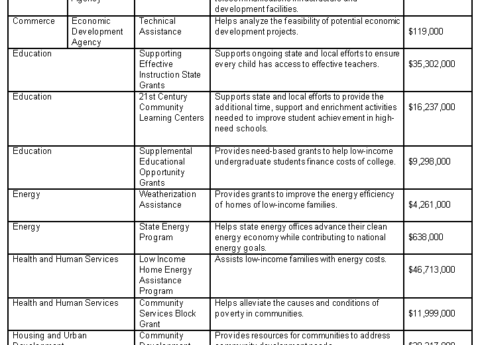

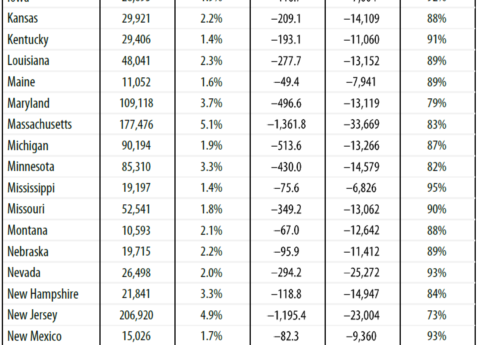

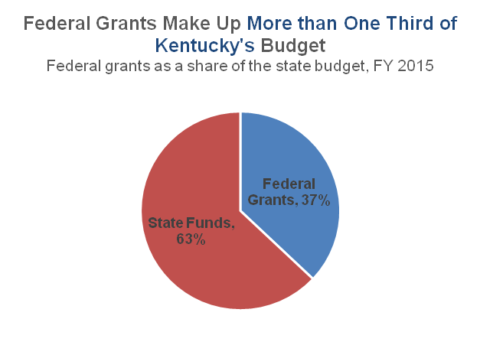

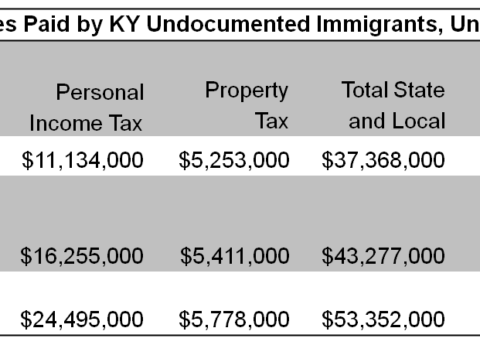

President Trump’s proposed budget would be a major hit to the investments that benefit Kentucky’s communities, as federal dollars play...

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap