Since completing forms and mailing off checks may not inspire reflection on the bigger purpose of taxes, here’s a Tax Day reminder of what we are chipping in for:

Through our local, state and federal governments, our tax dollars are pooled together and invested in schools and universities, roads and bridges, social services for vulnerable children and adults and other public services essential for shared prosperity and thriving communities in the Commonwealth.

In other words, taxes are a critical tool for doing important things together we cannot do alone. Here in Kentucky, state tax dollars go for:

Education: Early childhood education and child care; K-12 education; higher education; adult education; worker training; vocational education; libraries; public television.

Health Care: Health insurance for people with disabilities, pregnant women, low-income children and adults, and the elderly in nursing homes through Medicaid; public health; mental health services; disability services; substance abuse services.

Human Services & Supports: Child and domestic violence protection; foster care and adoption; housing; nutrition assistance; support for low-income families; support for veterans; support for the elderly.

Infrastructure: Roads; water and sewer systems; public transit.

Environmental Protection: Land conservation; enforcement of laws protecting land, air and water; state parks; forest protection and management.

Public Safety & Justice: Court system; public defenders and prosecutors; state police; jails and prisons; disaster relief; consumer and worker safety protection.

Economic & Community Development: Small business development; tourism; job development; agricultural development; arts and culture.

Kentucky is projected to collect about $10.3 billion in revenue in its General Fund in 2016. Forty-one percent of the General Fund is expected to come from the individual income tax; thirty-three percent from the sales tax; six percent from the property tax; seven percent from corporate taxes and the remaining from the coal severance tax, cigarette tax, lottery and other sources.

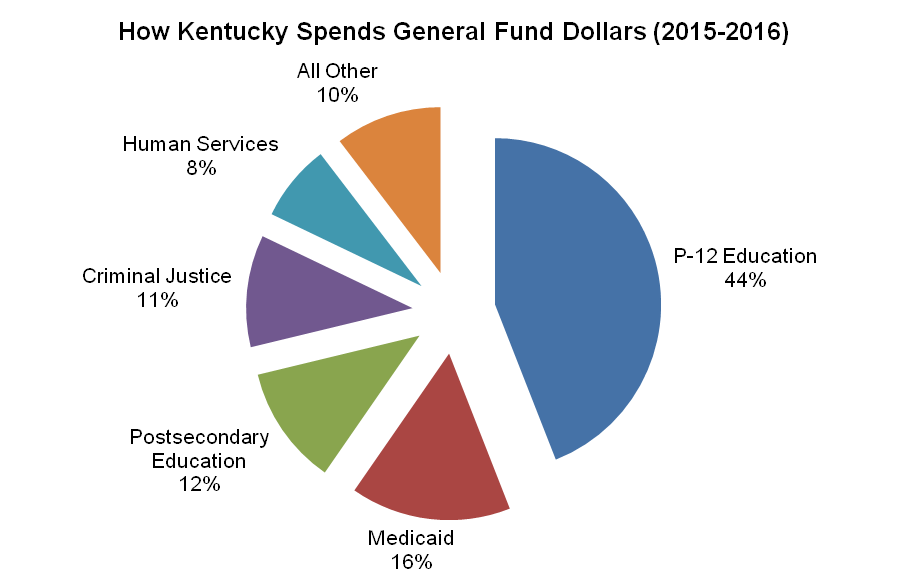

Over the current biennium, General Fund resources are allocated as follows:

Source: Office of the State Budget Director

For a closer look at how our state tax dollars get appropriated to different budget areas, click here. And to see where federal tax dollars go, click here.

Despite these essential investments, Kentuckians often hear we’d be better off reducing certain taxes. But starving the very public services and structures we need for a strong workforce and economy – through tax breaks powerful interests fight for and benefit from – is bad policy. Individual and corporate income tax cuts are not the way to a stronger economy and more jobs. What we actually need is to clean up our tax code of special interest tax breaks so we can restore our investments in the Commonwealth.

The important Tax Day takeaway is that by paying taxes, Kentuckians are investing in thriving communities and a stronger state.