New Report: “Kentucky’s Income Tax: Protecting and Strengthening a Key to Growth”

Kentucky’s Income Tax Is Key to Fairness and Economic Growth

Report Outlines Reasons to Protect Income Tax and Ways to Strengthen It

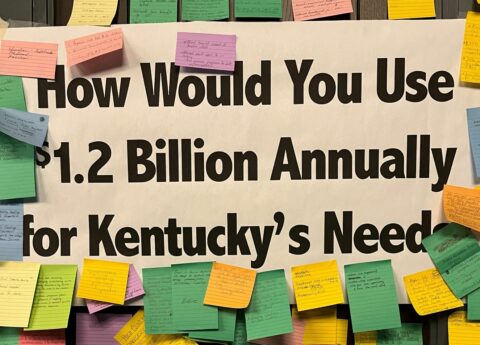

The individual income tax is the largest, most productive and fairest tool Kentucky has to generate needed revenues. It should be protected and strengthened as part of any tax reform plan, according to a new report by the Kentucky Center for Economic Policy (KCEP).

The report notes that the individual income tax is the single largest source of revenue for schools, health care and other needs, generating nearly 40 percent of Kentucky’s General Fund. Not only is it the foundation of an adequate state budget, but research also shows that income taxes are more effective than other major taxes at generating the revenues needed to keep pace with Kentucky’s needs over time.

In addition, the state income tax is the only major tax based on ability to pay, making it essential to a fairer tax system. The income tax is far more equitable than the sales tax—in Kentucky the poorest 20 percent pay 1.3 percent of their income in state and local income taxes, while the richest one percent pay 4.8 percent. In contrast, the poorest 20 percent of Kentuckians pay 5.6 percent of their income in sales and excise taxes, while the richest one percent pay only 0.9 percent.

“Reducing or eliminating the income tax would require huge increases in taxes on low- and middle-income Kentuckians and would mean less revenue over time for schools, health care and other needed investments,” said Jason Bailey, Director of the Kentucky Center for Economic Policy. “Strengthening the income tax by closing loopholes and making sure everyone pays their fair share, on the other hand, is a critical strategy for tax reform.”

The many benefits of income taxes are why 41 states have them. Most of those that don’t have unique economic characteristics that allow them to generate significant revenue through other means (such as natural resources taxes in Alaska or Wyoming), or they have much higher sales and property taxes that hit poor and middle-class residents harder.

Contrary to some claims, the research reviewed in the report shows that having an income tax (and increasing it) does not cause people to move out of a state, and income taxes are not a drag on economic growth. Rather, the public investments that the income tax makes possible are critical to economic development.

The report identifies four ways to strengthen Kentucky’s income tax: 1) eliminate or limit itemized deductions (as in Ohio, Indiana and West Virginia), which tend to benefit higher-income people; 2) modernize the tax brackets and rates so that they better reflect ability to pay, including introducing a higher rate for high earners; 3) create a state earned income tax credit to support working families; and 4) phase out the exclusion for pension income, by which many retirees pay little or no state income taxes.

###

The Kentucky Center for Economic Policy is a non-profit, non-partisan initiative that conducts research, analysis and education on important policy issues facing the Commonwealth. Launched in 2011, the Center is a project of the Mountain Association for Community Economic Development (MACED).

Kentucky’s Income Tax: Protecting and Strengthening a Key to Growth.pdf