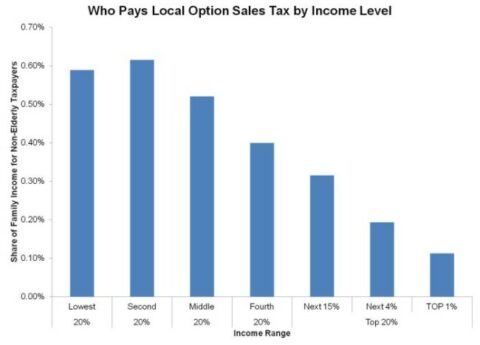

Corporations Shouldn’t Get Pass on Local Option Sales Tax

Large, profitable corporations are now saying they shouldn't have to pay their share if the legislature moves forward with putting...

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap