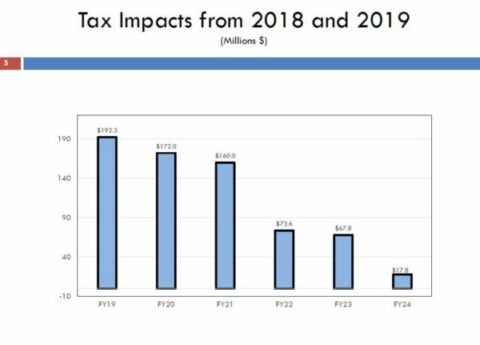

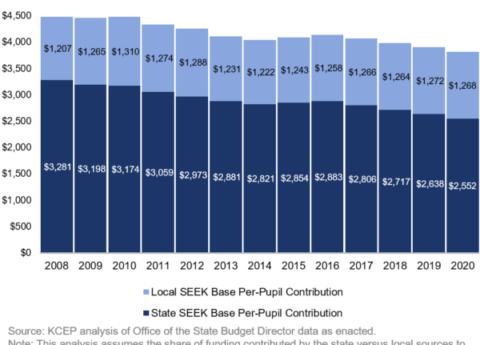

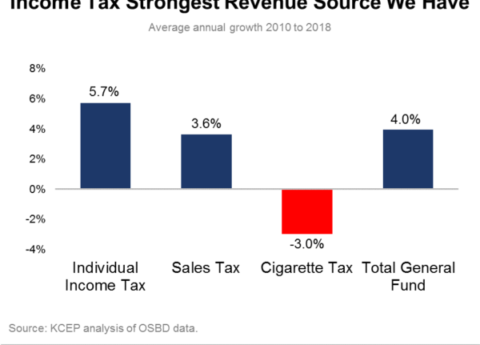

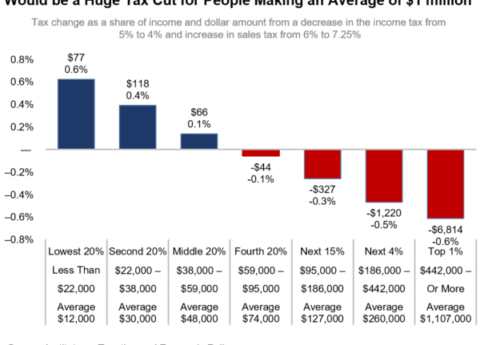

Troubling Revenue Picture Emerges Due to Recent Tax Cuts

Last week, the Consensus Forecasting Group (CFG), the official body charged with forecasting revenue for the commonwealth, met to determine...

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap