The series of reports from PFM on Kentucky’s pension systems overstate serious challenges with the condition of the state’s plans to justify drastic cuts in benefits. PFM overgeneralizes about assumptions in the plans to assert employers should contribute $1.8 billion more in 2019 above what prior assumptions would suggest, in some cases nearly doubling what contributions would otherwise be.1

While Kentucky has substantial unmet pension funding needs, exaggerated numbers do not help the problem and inaccurately imply radical action should occur to roll back and cut already-modest public pensions. Kentucky must responsibly pay down its pension liabilities over a period of decades. The need to meet our obligations to workers and retirees is one of many reasons the state must clean up our tax code to generate additional revenue, which will allow targeted extra dollars for pensions in the short term and consistent funding in the long term. But overblowing the problem encourages actions that would cause unnecessary additional harm to workers and retirees and could make the pension funding problem even worse.

We Should Address Actual Problems, Not Create More By Overstating Crisis

PFM bases its huge funding gap assertion on claims that wrong assumptions are being used in all Kentucky pension plans to calculate what should be contributed each year. Particularly, PFM is critical of the method of calculating contributions as a percent of payroll (and assuming payroll will grow in the future) and what they claim are too-high assumptions of future investment returns (assumptions were until recently 6.75 percent to 7.5 percent per year across plans).

Payroll growth

If you look at the last decade, payroll costs have not been growing in some of the plans (especially the Kentucky Employees Retirement System (KERS) non-hazardous system, which has had negative payroll growth). That’s due to round after round of state budget cuts that have shed employment and denied raises to employees, and because some employers in the KERS non-hazardous system have responded to pressure from rising pension liabilities by privatizing and outsourcing services. When contributions are pegged to how much is paid to employees and payroll does not grow as assumed, contributions are too small to adequately pay down liabilities. That is especially problematic for KERS non-hazardous because the plan is so poorly funded already.

But political leaders have gone far beyond that empirical statement to claim using a percent of payroll method is itself fundamentally flawed. But the state’s existing method is not controversial: actuaries consider it standard practice. The Conference of Consulting Actuaries identifies the method as its “model” policy, noting it is the best approach to match benefits like Kentucky’s that are based on the pay of the covered employees.2 The method allows employers to contribute a stable amount as a share of compensation expenses over time, rather than having to find and contribute much more money as a share of total expenses at first and then much less money in later years (which is necessary under the “level dollar” approach that PFM says Kentucky should be using in all its plans, in which employers contribute approximately the same dollar amount of money each year). PFM admits in their report the level percent of payroll approach is “common nationally and widely accepted.”3 And the Legislative Research Commission recently reported 41 of 50 states use level percent of payroll.4

For the plans that are experiencing payroll growth, such as the Teachers Retirement System (TRS) and the County Employees Retirement System (CERS), percent of pay remains the right approach. A level dollar method may be appropriate in the short-term for other plans, but Kentucky must return to a status where workforce and salaries grow in order to provide an adequate level of services and attract the qualified teachers, social workers and other employees needed. We cannot continue on our current payroll-cutting path, which has created unreasonable employee caseloads, eroding payscales and damaging gaps in public services that ultimately hurt communities across the commonwealth.

Investment returns

As for investment returns, because of the Great Recession returns fell short of the target over the last 10 years, although they come close to or even exceed the target over the last 5 years, 20 years and beyond.5

The poorly-funded KERS non-hazardous plan has a more difficult time achieving its investment targets due to depleted assets and negative cash flow necessitating a more liquid portfolio to pay benefits. Despite that challenge, the plan earned returns of 12.09 percent in the year that just ended, and thanks to investment earnings and additional state contributions in 2017, its cash flow is finally positive for the same time frame.

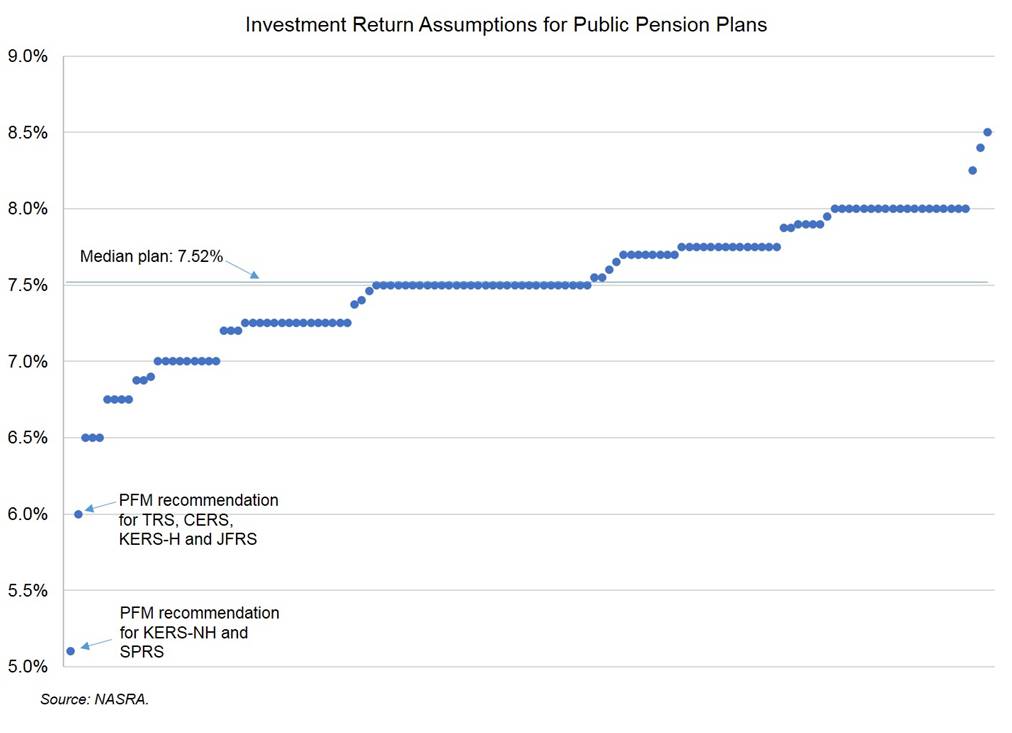

The better funded plans do not face the same barriers in achieving investment goals. Those plans’ return assumptions are in line with other pension plans around the country, and nationwide systems are a healthy 76 percent funded as a whole and their financial status is improving.6 That’s because governments in most states — unlike Kentucky — made the required annual payments to those systems. The median investment return assumption for plans nationally is 7.52 percent, with only 8 percent of plans using an assumption below 7 percent. None of the 127 plans surveyed by the National Association of State Retirement Administrators uses an assumption as low as 6 percent, which PFM recommends for TRS, KERS Hazardous, CERS and the Judicial Form Retirement System (and 5.1 percent for KERS Non-Hazardous and the State Police Retirement System), as shown below.7

PFM takes one-size-fits-all approach to assumption changes

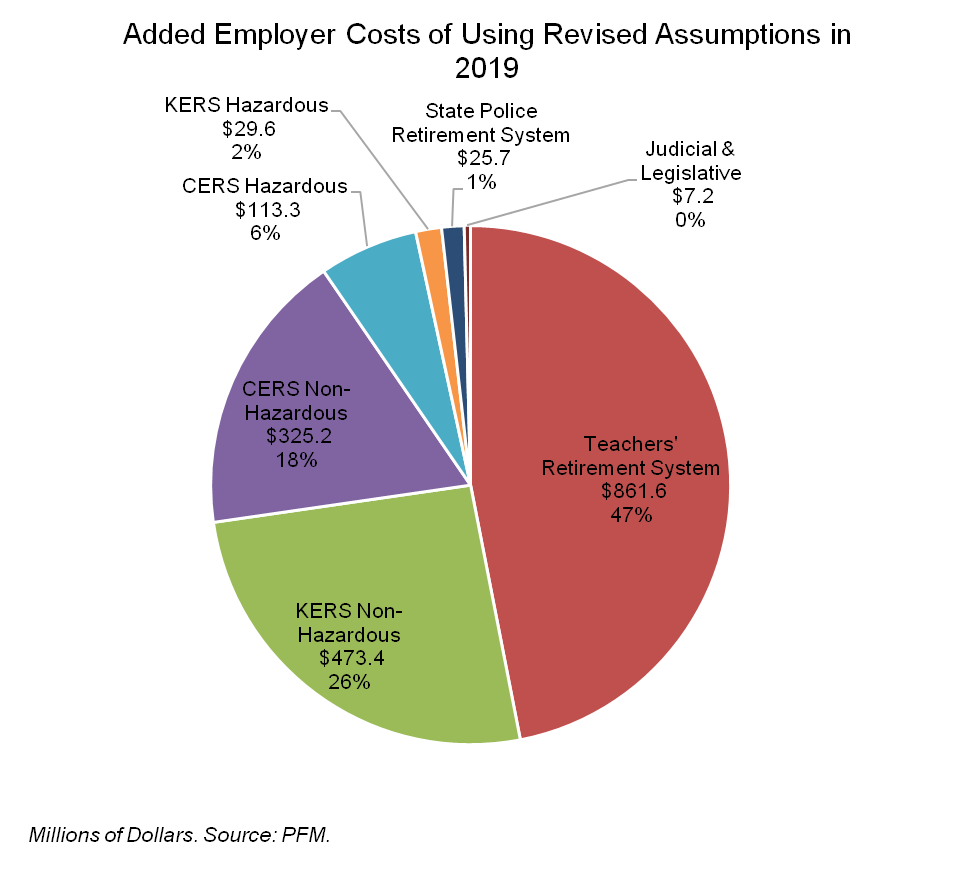

Dramatically and immediately adopting more conservative assumptions across the board causes the big increase in required contributions PFM says is necessary. Only 26 percent of the $1.8 billion in additional monies PFM calls for goes to the severely underfunded KERS non-hazardous plan, as shown the graph below. In contrast, 65 percent of those monies go to plans that are nearly 60 percent funded — TRS and the CERS non-hazardous plan.

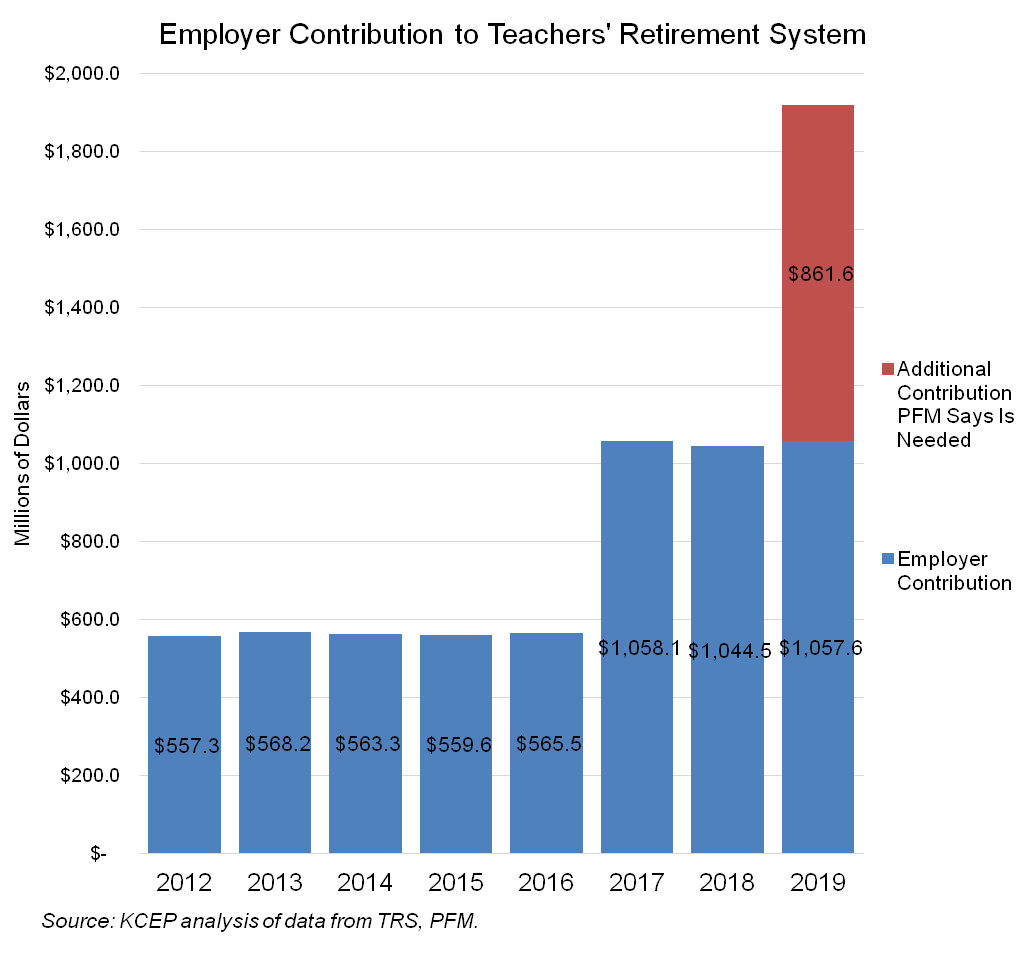

PFM does not present a sound case for that level and allocation of additional resources as the smartest or most practical for the next budget period — especially if it is met in significant part through cutting other parts of the state budget and slashing workers’ benefits. The $862 million more PFM alleges is needed for TRS is over 80 percent above what is now being contributed, as shown in the graph below. Kentucky finally stepped up to nearly paying its full ARC contributions to TRS in the 2017-2018 budget, and the state’s failure to pay the ARC before those years is the main reason TRS is underfunded. Kentucky is only just now on the right track for funding TRS, but PFM is claiming that contribution is far too small.

That higher number for TRS comes from using a level dollar assumption that teacher payroll will not grow over the next 30 years — meaning we will fail to add any teachers to keep up with a growing population and fail to pay them any more than we pay them now, both of which are implausible and would be deeply harmful. The number is also derived, as mentioned, from assuming the plan’s investments will earn 6 percent annual returns on average, as opposed to their current assumption of 7.5 percent. Although no one can guarantee future returns, TRS has $17 billion in assets from which to invest in financial markets, and it earned 15.4 percent returns in the year that just ended and 8.1 percent over the last 30 years. As noted above, in a national survey no plan had adopted an assumption as low as 6 percent and certainly not a plan with the assets of TRS.8 PFM itself was part of a survey of 35 investment advisors in 2016 that projected pension funds have a 48.8 percent chance of earning at least 7.5 percent returns over the next 20 years.9

Claims that dire actions are necessary today to radically increase contributions could lead to counterproductive and extreme changes to benefits. On the table now are clawbacks of past cost of living adjustments (COLAs) and elimination of future teacher COLAs, big increases in the retirement age and the closing of defined benefit plans to shift to less efficient and less attractive 401ks.10 Such cuts and changes will break promises to employees, reduce their standard of living, make it much harder to attract and retain qualified public servants and hurt the entire economy by reducing retiree spending in local economies.11 Existing benefits for employees and teachers are inexpensive for the state as long as they are properly funded, and have been reduced already through multiple rounds of benefit cuts including in 2008 and 2013 and a lack of employee raises that results in a subsequent decline in pension incomes (which are tied to an employee’s salary at the end of their career).12 Furthermore, moving to a 401k-style defined contribution plan would make it more expensive to pay down existing liabilities over time, worsening the challenge we now face.13

A Responsible Approach: Short-Term Aid and Long-Term Consistency

A sound approach would protect already-reasonable benefits and provide responsible funding levels in the near term to get the plans on the right path so that challenges diminish over time. The General Assembly has already made major strides in that direction recently. In 2015, the state began paying the full actuarially required contribution (ARC) for the KERS non-hazardous system and paid $58 million above the ARC in 2017 and $68 million above the ARC in 2018. And, as mentioned previously, in the 2017 and 2018 budget, the state paid about 94 percent of the ARC for the teachers’ plan after paying only about 50 percent in the prior year.

A responsible plan would include additional aid to the KERS non-hazardous plan, which needs higher contributions for the time being than its prior actuarial assumptions would suggest. Given that system’s depleted state, extra caution and resources are warranted to help the plan get back on its feet and headed in the right direction.

The state should contribute an amount that would improve the short-term financial condition for KERS non-hazardous. At a minimum Kentucky could target funding to the amount needed to pay benefits each year. By preventing negative cash flow, that would free up the plan’s existing $2 billion of assets from being liquidated to pay benefits — allowing it to maximize its investment portfolio for long-term returns.

How much is that? In 2017, the plan paid $948 million in benefits and it received $703 million in employer contributions, so a payment achieving that target would be at least $245 million or 35 percent above what is now being contributed. That’s a big increase in the next budget, but is less than the consultant group’s suggestion that the plan needs $474 million or 67 percent above the current contribution for the KERS non-hazardous plan.

While KERS non-hazardous needs special attention, other plans like the local workers’ plan (CERS) and teachers’ plan are in much better shape and will be on their way to healthy funding levels as long as annual required contributions continue to be made (local governments must make those full contributions by law). Since the state paid 94 percent of the teachers’ contribution in the current budget, that means an additional contribution in the neighborhood of $50 million a year beyond that level. There is not a demonstrated need for dramatic changes in assumptions for these plans. If their boards wished to err on the side of caution, they could phase in modestly lower assumptions over a period of years rather than making large changes all at once.14 PFM actually recommends such a cap for CERS in how much annual contributions change due to assumption changes, but does not apply the same logic to the state-level plans.

Some will inevitably charge that an approach ratcheting down the alarmism around assumptions across the board is just “kicking the can down the road.” But, as noted above, Kentucky is only recently beginning to make much more aggressive contributions to these systems, and the suggestions above would increase contributions further. Pension liabilities cannot be paid off overnight, but the obligations are also not owed to retirees immediately, and getting the systems back to healthy funding levels will take decades.

Additional Revenue is Key

The real challenge we face now is this: even just replicating the historic increase in pension contributions made in the current budget looks to be very difficult moving forward. That’s because the budget was built with significant one-time money unlikely to be available for the next budget.15 Revenue growth is modest with another shortfall of $200 million expected at the end of the year, and the state is on track to deplete its rainy day fund in 2018.16 There is also pent-up demand for reinvestment after years of budget cuts that have led to strain on nearly every public service the state provides, soaring college tuition and a lack of employee raises.

Our budget challenge can be solved, but we need to take a responsible approach and not one based on overgeneralizations about assumptions. The key to solving it will be action to clean up the tax code and raise new and more sustainable revenue — to meet our obligations to employees and retirees and invest in a stronger Kentucky.17

- PFM, “Pension Performance and Best Practices Analysis, Report #3: Recommended Options, Summary Presentation to Public Pension Oversight Board,” August 28, 2017, https://pensions.ky.gov/Documents/2017%2008%2028%20-%20KY%20Report%203%20FINAL%20PFM%20Briefing%20Presentation%208.28.pdf. ↩

- Conference of Consulting Actuaries, “Actuarial Funding Policies and Practices for Public Pension Plans,” October 2014, https://www.ccactuaries.org/Portals/0/pdf/CCA_PPC_White_Paper_on_Public_Pension_Funding_Policy.pdf. ↩

- PFM, “Pension Performance and Best Practices Analysis, Interim Report #2: Historical and Current Assessment,” May 22, 2017, https://pensions.ky.gov/Documents/2017%2005%2022%20-%20Report%202%20FINAL%205.22.17%20-%20Historical%20and%20Current%20Assessment.pdf. ↩

- Legislative Research Commission, “Payroll Growth Assumption,” Public Pension Oversight Board, March 27, 2017. ↩

- Rates of return for KRS are: 1-year 13.47%, 5-year 8.08%, 10-year 4.86%, 20-year 6.46%; inception to date 9.16%. KRS Monthly Performance Update, June 2017, https://kyret.ky.gov/Investments/Documents/June%202017%20Monthly%20Update.pdf. Rates of return for TRS are: 1-year 15.37%, 5-year 10.1%, 10-year 6.3%, 30-year 8.1%. TRS, “Teachers’ Pension Fund Gains 15% with New Funding,” https://trs.ky.gov/news/. ↩

- National Conference on Public Employee Retirement Systems, “Economic Loss: The Hidden Cost of Prevailing Pension Reforms,” May 2017, http://www.ncpers.org/files/NCPERS_2017%20Economic%20Loss.pdf. ↩

- NASRA Issue Brief, “Public Pension Plan Investment Return Assumptions,” February 2017, http://www.nasra.org/files/Issue%20Briefs/NASRAInvReturnAssumptBrief.pdf. ↩

- NASRA, “Public Pension Plan Investment Return Assumptions.” ↩

- Horizon Actuarial Services, “Survey of Capital Market Assumptions: 2016 Edition,” http://www.horizonactuarial.com/blog/2016-survey-of-capital-market-assumptions. ↩

- Jason Bailey, “PFM Report Uses Exaggerated Claims to Justify Harsh, Counterproductive Cuts,” Kentucky Center for Economic Policy, August 28, 2017, https://kypolicy.org/pfm-report-uses-exaggerated-claims-justify-harsh-counterproductive-cuts/. Jason Bailey, “Clawback of Cost of Living Adjustments Would Be Major Hit to Retiree Checks,” Kentucky Center for Economic Policy, August 30, 2017, https://kypolicy.org/clawback-cost-living-adjustments-major-hit-retiree-checks/. ↩

- Jason Bailey, “Pension Benefits Inject $3.4 Billion into the Economies of Kentucky Counties,” Kentucky Center for Economic Policy, June 6, 2017, https://kypolicy.org/pension-benefits-inject-3-4-billion-economies-kentucky-counties/. ↩

- Jason Bailey, “Kentucky Public Pensions Are Not Expensive — If You Fund Them,” Kentucky Center for Economic Policy, June 21, 2017, https://kypolicy.org/kentucky-public-pensions-not-expensive-fund/. ↩

- Jason Bailey and Stephen Herzenberg, “Switch to 401k-Type Plan for Kentucky Public Employees Will Cause More Harm,” Kentucky Center for Economic Policy and Keystone Research Center, August 22, 2017, https://kypolicy.org/switch-401k-type-plan-kentucky-public-employees-will-cause-harm/. ↩

- The Board of Kentucky Retirement Systems already recently lowered the investment return assumption of CERS from 7.5% to 6.25 %. ↩

- Jason Bailey, “Budget’s Reliance on One-Time Funds Presents Challenge Next Time Around,” Kentucky Center for Economic Policy, August 30, 2016, https://kypolicy.org/budgets-reliance-one-time-funds-presents-challenge-next-time-around/. ↩

- Pam Thomas, “Four Added Concerns About Kentucky’s Fiscal Outlook,” Kentucky Center for Economic Policy, August 4, 2017, https://kypolicy.org/four-added-concerns-kentuckys-fiscal-outlook/. ↩

- Anna Baumann, “Revenue Options that Strengthen the Commonwealth,” Kentucky Center for Economic Policy, February 2, 2016, https://kypolicy.org/new-report-kentucky-can-take-balanced-approach-to-budget-with-revenue-options/. Anna Baumann, “What Good Tax Reform Looks Like,” Kentucky Center for Economic Policy, April 17, 2017, https://kypolicy.org/good-tax-reform-looks-like/. ↩