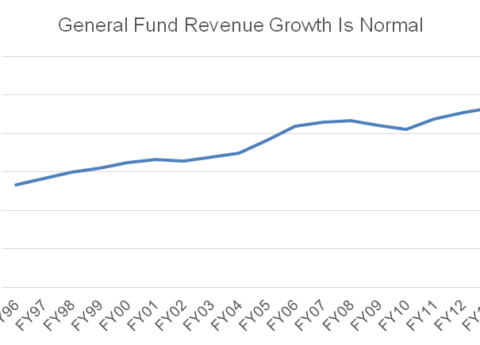

Year-End Revenue Results Underscore Need for Right Actions on Tax Reform

Kentucky ended the 2017 fiscal year with $138.5 million less in General Fund revenue than economists predicted would be collected....

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap