Expanding Medicaid in Kentucky Could Improve the Health of Women and Babies

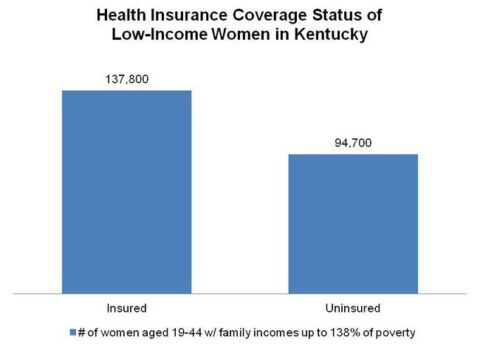

In Kentucky, nearly 41 percent of low-income women aged 19 to 44 are uninsured. However, if the state expands Medicaid...

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap