Tax Day is an important time for Kentuckians to consider the role of government in our state and nation. Taxes are a critical tool for doing things together that we cannot do alone. They support investment in education, health care, infrastructure, social services and other public structures essential for the common good in Kentucky.

These days, taxes are the subject of great controversy. The April income tax due date is a time when those seeking to shrink or eliminate many of the functions of government argue for more cuts. But tax dollars pay for investments on which we can agree: advancing economic development; contributing to improved health and safety; creating educated workers and citizens; stewarding our natural and other resources; and fostering community. When our public systems and structures are starved of resources, our quality of life is threatened. When they are adequately supported and effectively implemented, they make a better Kentucky possible.

Yet the recession and current slow recovery mean meager levels of revenue to pay for needed investments. Because we face a structural imbalance in our revenue system in Kentucky and have not enacted comprehensive and sufficient tax reforms, we will fail to generate adequate revenues even once the economy fully recovers.

Meanwhile, the current political debate largely ignores that tax dollars support essential public services. A real public conversation about the appropriate level of taxes must start with where those tax dollars go.

In 2013, state taxes support a wide variety of important functions, including the following:

Education: Early childhood education and child care; K-12 education; higher education; adult education; worker training; vocational education; libraries; public television.

Health Care: Health insurance for people with disabilities, pregnant women, low-income children and parents, and the elderly in nursing homes through Medicaid; public health; mental health services; disability services; substance abuse services.

Human Services & Supports: Child and domestic violence protection; foster care and adoption; housing; nutrition assistance; support for low-income families; support for veterans; support for the elderly.

Infrastructure: Roads; water and sewer systems; public transit.

Environmental Protection: Land conservation; enforcement of laws protecting land, air and water; state parks; forest protection and management.

Public Safety & Justice: Court system; public defenders and prosecutors; state police; jails and prisons; disaster relief; consumer and worker safety protection.

Economic & Community Development: Small business development; tourism; job development; agricultural development; arts and culture.

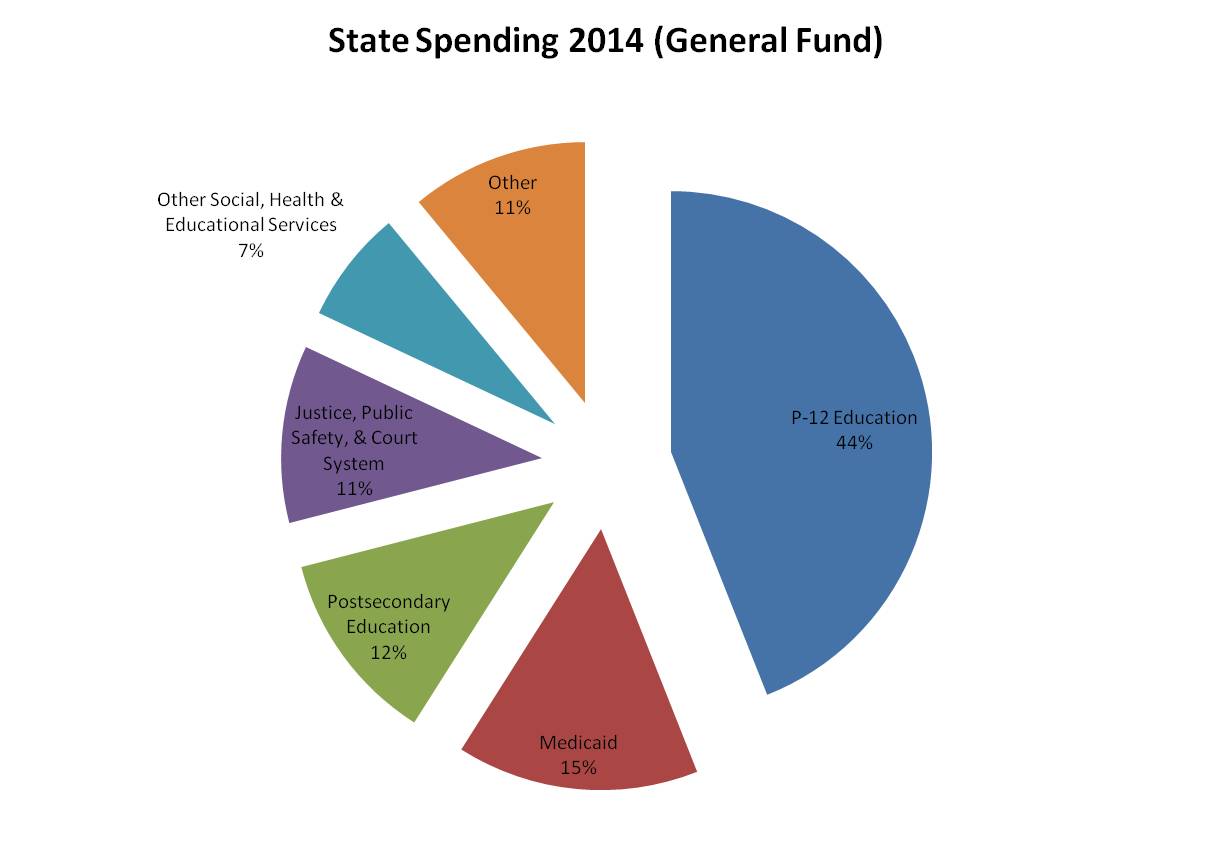

Kentucky is projected to collect about $9.5 billion in its General Fund in 2014. Thirty-nine percent of the General Fund is expected to come from the individual income tax; 33 percent from the sales tax; six percent from the property tax; four percent from corporate taxes and the remaining from the coal severance tax, cigarette tax, lottery and other sources.1

Those dollars are allocated according to the following pie graph.

Source: Budget of the Commonwealth 2012-2014, HB 265 2012

To see where federal tax dollars go, click here.

The Kentucky Center for Economic Policy is a non-profit, non-partisan initiative that conducts research, analysis and education on important policy issues facing the Commonwealth. Launched in 2011, the Center is a project of the Mountain Association for Community Economic Development (MACED). For more information, please visit KCEP’s website at www.kypolicy.org.

- Office of the State Budget Director, “2012-2014 Executive Budget,” Budget in Brief, http://www.osbd.ky.gov/NR/rdonlyres/1ADF4A09-F159-40BE-9DD0-2156ACCD0276/0/1214BOCBudInBrief.pdf ↩