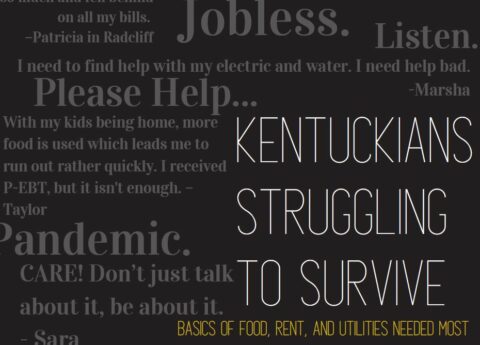

New Survey Shows Extreme Hardship Among Kentuckians as President Halts Talks on New COVID-19 Aid Bill

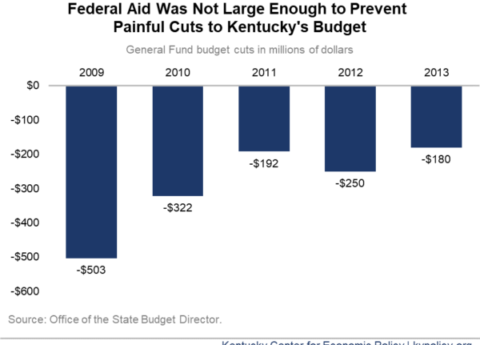

Yesterday President Trump tweeted that he was ending Congressional talks on a critical new aid package. A new survey of...

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap