Tiny Fraction of Wealthiest Kentuckians Gain from Tax Cuts in Health Repeal

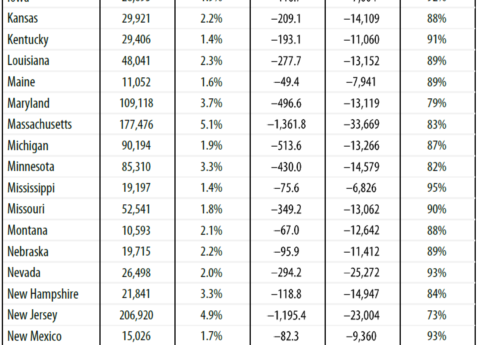

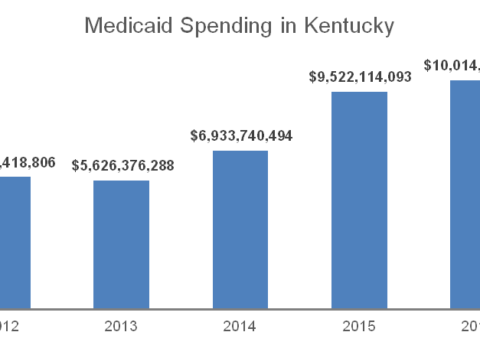

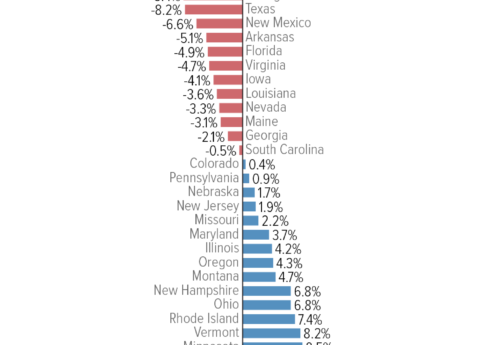

The House plan to repeal healthcare reform, known as the American Health Care Act (AHCA), provides a tax cut to...

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap