Local Economies Harmed If Lawmakers Fail to Safeguard Road Fund

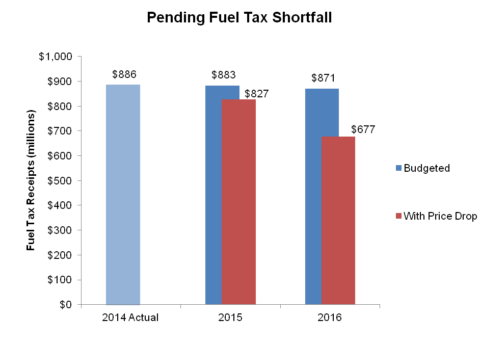

With just two days left in the 2015 General Assembly, legislators are running out of time to protect the Road...

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap