The Senate’s pension legislation, introduced as SB 1, includes cutting teachers’ cost of living adjustments, moving new employees into a less secure hybrid cash balance plan and requiring an expensive method of paying unfunded liabilities known as “level dollar.”

Major components of the bill include the following:

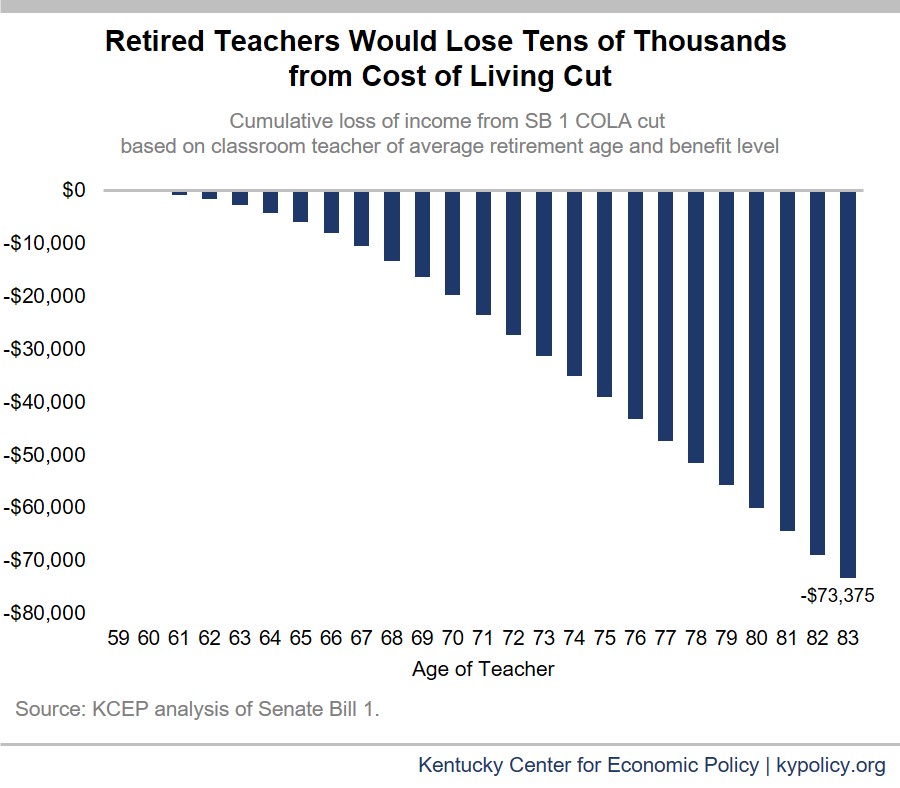

Current employees and teachers lose benefits

The bill includes a number of reductions to benefits for current teachers and employees. For teachers, it cuts in half the annual cost of living adjustment (COLA) received in retirement for 12 years, reducing it from 1.5 percent to 0.75 percent. For a 59-year old classroom teacher who lives until age 83 and receives the average pension benefit, the result is more than $73,000 in lost lifetime income (see graph below). That cut is a little more than the nearly $72,000 in lost lifetime income from the 5-year COLA freeze proposed by the governor in the fall.

Kentucky teachers’ COLAs are part of the inviolable contract and are pre-funded through contributions made by teachers and employers. They are in recognition that teachers are not in Social Security, which has a COLA that has averaged 2.1 percent over the last 20 years.

SB 1 also caps the use of sick days in the calculation of teachers’ retirement benefits to the amount accrued as of July 31, 2018. And it ends the current rule for long-serving teachers that uses their highest three years’ salaries to calculate retirement benefits. After July 31, 2018, except for those who already have more than 20 years’ service, the formula can be used only by those who have at least 35 years of service and are at least 60 years old.

For Kentucky Retirement Systems (KRS) employees, SB 1 caps the amount of accumulated sick leave that can be used for service credit as of July 31, 2018, and prevents sick leave from being used to determine eligibility for retirement after August 1, 2018. The bill requires those hired in KRS systems between 2003 and 2008 to contribute an additional phased-in amount up to 3 percent of their pay toward retiree healthcare benefits. As noted here, Kentucky’s retiree health plans are already on a strong growth trajectory without the need for additional contributions, with the KERS hazardous health plan over 100 percent funded.

For KRS non-hazardous employees in the hybrid cash balance plan, the bill reduces the guaranteed rate of return on investments and changes how the rate is calculated. Whereas currently, members are guaranteed a rate of return of 4 percent on their individual accounts and receive 75 percent of the investment earnings above 4 percent, under SB 1 members would receive an inferior credit of 85 percent of the investment earnings above a 0 percent rate of return. The rate of return calculation is changed from a 5-year average to a 10-year average. Under this calculation, it is very unlikely the 15 percent not awarded to employees’ accounts would ever be needed by the system. A 10-year average return below 0 percent is extremely rare, and hasn’t come close to happening in the last couple of decades despite big drops in the financial markets during the early 2000s and in the Great Recession. That 15 percent would go instead to paying down the unfunded liability and lowering employer costs.

New teachers moved to hybrid cash balance plan

The bill would put new teachers into a hybrid cash balance plan in place of the current defined benefit plan. In a hybrid plan, workers have an individual account like in a 401k but monies are pooled as in a defined benefit plan. The teacher contribution to the hybrid plan would be the same as in the current defined benefit plan, and accounts would be credited with an employer contribution equal to 8 percent of pay. Unlike the existing pension plan, ultimate benefits are not promised to workers but are dependent on investment earnings during their working years. Like the state workers’ hybrid plan under SB 1, teachers’ accounts would receive 85 percent of investment income based on a 10-year average return rate.

The bill eliminates the inviolable contract for new employees except for the amount accumulated in their account balances, meaning nothing could prevent future legislatures from lowering the 8 percent employer pay credit or the 85 percent investment return contribution in subsequent years. And because hybrid plans are individual accounts with a final balance, the plan includes no extra post-employment benefit in the form of a cost of living adjustment as exists in the teachers’ current pension plan (annuities could potentially be structured under the cash balance plan so retirees receive higher incomes later in life, but only by sacrificing benefits in earlier years.)

SB 1 requires front-loading costs, putting strain on state and localities

SB 1 requires KRS and TRS to begin paying down their unfunded liabilities using what is called the “level dollar” method starting in 2021. That approach heavily front-loads the cost of paying down liabilities, which will put a large, unnecessary strain on the budgets of the state, local governments, school districts and other entities. The additional up-front annual cost is $392 million for TRS alone, other data show. SB 1 also requires school districts to contribute an additional 2 percent of pay for new teachers who are part of the hybrid cash balance plan. That change would add to the broader shift of costs from the state to local school districts, a number of which are under serious strain already.

Updated on February 27, 2018.