Preschool through 12th grade public education has become less of a Kentucky budget priority in recent years, according to the official analyses of enacted budgets published by the Office of the State Budget Director.

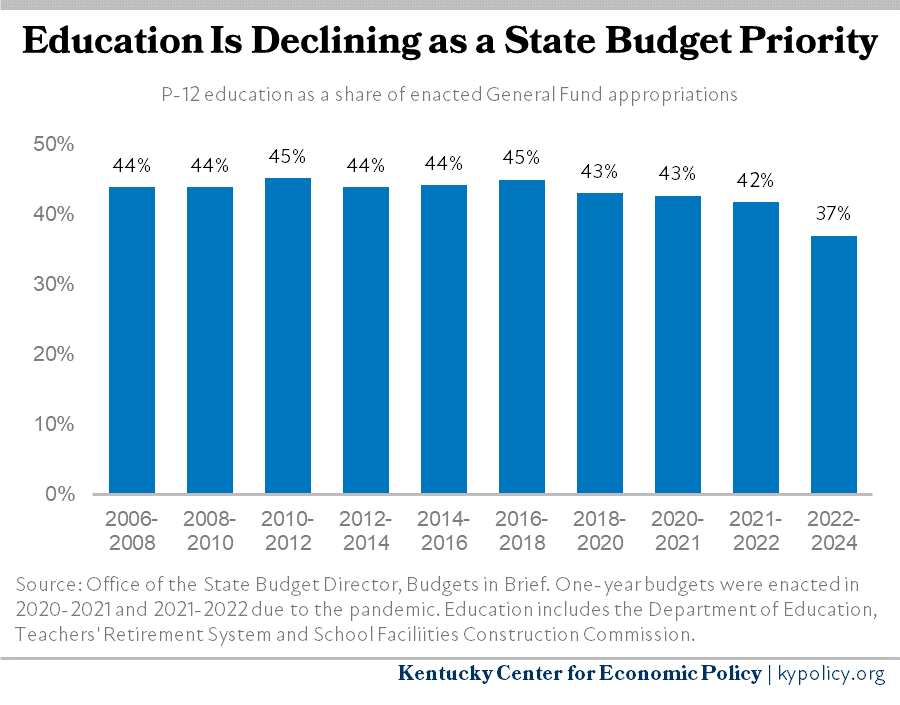

P-12 education received between 43% and 45% of total General Fund appropriations in the eight budgets between 2006 and 2021, but received only 37% in the 2022-2024 budget. These numbers include money appropriated to the Department of Education as well as to the Teachers’ Retirement System and the School Facilities Construction Commission.

State revenues have increased substantially in the last few years due to a strong recovery spurred by federal pandemic aid. However, as shown in the chart below, the General Assembly did not use these resources equally across existing state services, with P-12 education in particular receiving far less emphasis. If the legislature funded P-12 education in the current budget at the same share it did in 2006-2018, it would mean over $1 billion more a year for schools.

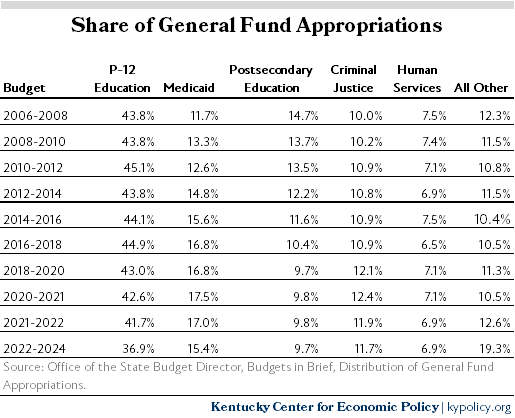

With that money schools could afford significant pay raises to address the teacher shortage, reduced class sizes and better funding for student mental health, among other investments. As the chart shows, postsecondary education has also declined as a priority over time, a disinvestment that has led directly to rising student loan debt.

In the current budget, the main areas receiving more money are in what the Office of the State Budget Director labels “All Other.” Closer analysis of this broad category shows additional amounts appropriated for infrastructure, business subsidies and catch-up contributions for state employee pension liabilities, among other uses. The General Assembly has also set aside an increasing amount of money in the state’s emergency savings account, known as the Budget Reserve Trust Fund, and has intentionally not appropriated a growing amount of available funds, leaving a larger cash balance at the end of the budget year.

The legislature is using those reserve and unappropriated funds to ensure that it meets artificial targets the General Assembly established in statute to allow large, expensive reductions in the state income tax rate. The 5% rate became 4.5% in January 2023, and will drop to 4% in January 2024. These tax cuts are very costly because the individual income tax previously provided 41% of state General Fund revenues, making it the largest single budget source.

While Kentucky has many important priorities, and there is no magic number for what share education should receive, it is clear that public schools have recently become less of a budget priority. This reduced emphasis on education follows years after the Great Recession in which state funding for public education and average teacher pay failed to keep up with inflation. Many fear it’s also part of a larger effort to move away from public education and shift state funding to private schools.

The next time the General Assembly meets in early 2024 it will create a new two-year state budget. It will do so with less revenue that it would otherwise have from the income tax and without federal pandemic funds that temporarily reduced state costs for Medicaid and other expenses. With another expensive cut in the income tax rate to 3.5% possible next session, the community cornerstone of public education faces serious funding risks that all Kentuckians should understand.