Governor Beshear’s budget proposal to the General Assembly contains small increases in spending for P-12 education and provides funding for other targeted areas including relief for quasi-governmental organizations facing spiking pension costs and money to hire more social workers. The plan stops the overall trend of budget reductions Kentucky has been experiencing, though in many areas its modest funding levels are not enough to prevent continued erosion due to inflation, which is projected at approximately 2.5% a year according to the Congressional Budget Office.

The governor proposes to pay for additional spending by raising $148 million in new revenue over the biennium from tobacco taxes, sports betting and a higher limited liability entity fee. The budget uses $288 million of one-time fund transfers and $64 million from other new resources.

Budget provides targeted dollars to P-12 public education

The budget provides monies for a $2,000 raise for teachers in 2021, which is equivalent to a 3.7% increase on average (those funds are provided again in 2022 but with no additional raise, and no increase is provided for classified employees). The budget provides a 1% increase in the SEEK per pupil base guarantee for schools in 2021, and a 0% increase in 2022. As in the past, a growing share of the guarantee will come from local school districts (the state portion goes down), and the guarantee will decrease once inflation is taken into account. The broader SEEK formula also does not increase funding for student transportation, which remains at approximately two-thirds of the statutorily required amount.

The budget provides some funding that had been completely cut for textbooks in the last budget, putting in $11 million each year; funding for textbooks had been $21 million back in 2008. It does not restore the 6.25% cut to preschool contained in the last budget, but does provide $5 million each year to support preschool in low-income areas. The budget does not increase funding for Extended School Services, which had also been cut by 6.25%. It funds the $18.2 million in school building upgrades mandated by last year’s school safety legislation through bonding, but does not fund the rest of the legislation.

Some of the additional funding for P-12 education comes from $85 million in SEEK funds originally budgeted in the current year but now expected to go unspent.

Proposal provides 1% increase for higher education

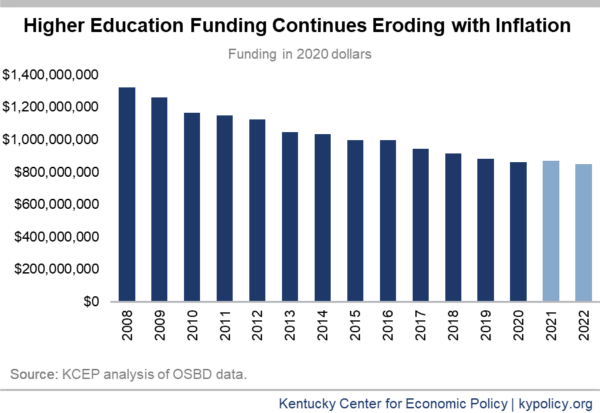

The plan provides a modest 1% increase in funding for higher education institutions in 2021, or $8.6 million, following substantial cuts stretching back to 2008. It does not put any of the higher education appropriations into the performance funding system which, as we have noted, is disadvantaging universities and community colleges with more low-income students and students of color — especially in a context of declining resources to higher education institutions. While the increase in the first year stops the pattern of cuts to universities and community colleges, funding for higher education institutions will still be $191 million behind 2008 levels, not even counting for inflation (and 36% behind with inflation).

Funding for need-based college scholarships improves compared to the prior budget (7,300 need-based College Access Program (CAP) scholarships per year), though it goes down compared to what was funded in the current year due to a one-time lottery surplus. The budget improves funding for need-based aid up to 87% of the statutory funding requirement.

Budget provides targeted funding in several areas, 1% raise each year for state employees

The budget provides for 350 new social workers to deal with the crisis in child protective services, a big increase to help deal with caseloads that are currently twice the recommended level. It provides funding to protect Medicaid expansion and the extra dollars needed to match federal funding for the Kentucky Children’s Health Insurance Program, as well as $1 million each year for outreach to help address disturbing recent decreases in health coverage for kids. It provides 500 new Michelle P waiver slots and 100 new Supports for Community Living waiver slots that provide community-based care for individuals with disabilities.

The budget fully funds the actuarially recommended pension contribution to the Kentucky Retirement Systems for state employees, including funding at 93% of pay for non-hazardous state workers. For quasi-governmental organizations like community mental health centers, health departments, regional universities and domestic violence agencies, it provides significant relief by freezing their funding at a lower level of 67% of pay and providing dollars to help make that contribution. It prevents those agencies from leaving the retirement system, an option created under House Bill 1 this summer that would freeze the pensions for up to 6,700 employees and shift costs back to the system. The budget provides full funding for the Teachers’ Retirement System, including the funding for health insurance coverage for teacher retirees under the age of 65.

The budget provides a 1% raise for state employees in 2021 and another 1% in 2022; they had not received across-the-board raises for 8 of the previous 10 years. It also provides raises for state police, and additional dollars for the state police lab. It reinstates funding for a few small areas that had been cut, including the Commission on Women and the University Press of Kentucky.

The budget adds only $10 million to the rainy day fund. That brings it to $316 million, or only 2.6% of the budget — less than the 5% goal set in statute as a minimum benchmark to help prepare for a recession. That keeps Kentucky’s rainy day fund among the poorest funded in the country; the median state rainy day fund was at 8% as of 2020, and 15 states have at least a 10% balance.

Plan raises some new revenue and uses one-time dollars

The governor’s proposal includes a small revenue plan. It raises the cigarette tax by 10 cents, puts a tax on e-cigarettes/vaping, increases the tax on other tobacco products and raises the limited liability entity (LLE) minimum tax from its current $175 to $225. LLEs are businesses that are not organized as corporations, but that receive the same legal protections. According to one estimate, 82% of LLEs only pay the minimum fee because the tax exemption from paying the full LLE tax is so generous. The $175 fee was not indexed for inflation when it was created in 2006, and $225 simply makes the inflation adjustment over that time period. The budget is also built on the assumption of revenue from legalizing sports betting.

The budget uses $288 million in fund transfers over the biennium, less than the $609 million used in the last budget. The biggest sources are the Petroleum Storage Tank Fund, from which it transfers $93 million (the budget proposes to issue $50 million in bonds related to this fund), and Department of Insurance fees, from which it transfers $62 million. It does not take money from the public employees’ health fund, as had been used in the past. In addition, the budget counts on $64 million in other resources including $36 million from enhanced revenue collection through the hiring of additional staff.