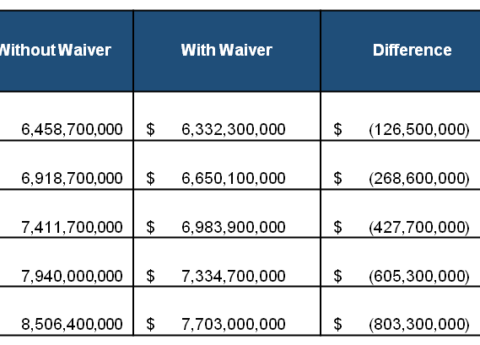

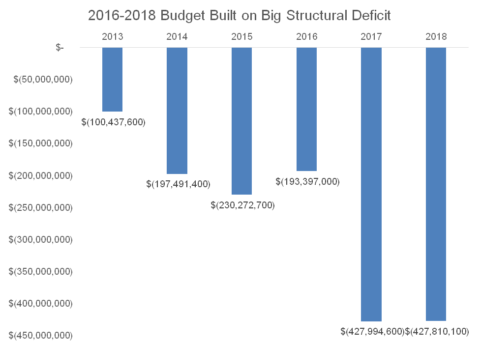

Modest Savings from Medicaid Waiver Ignore Added Costs and Mostly Don’t Come from Expansion Population

The Bevin administration has submitted the revised version of its request to make changes to Kentucky’s Medicaid program and continues...

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap