Across the commonwealth, Kentuckians are filing their taxes this week; and many are wondering if and how the Governor’s intention to do tax reform this year will impact what they pay in the future. The principles of good tax reform are clear (that it generates new revenue to invest in our communities in a fair and reliable way). Tax Day is a good time to remember what our contributions pay for, and why we should make sure that everyone is chipping in.

Through local, state and federal governments, tax dollars are pooled together and invested in schools and universities, roads and bridges, social services for vulnerable children and adults and other public services essential for shared prosperity and thriving communities across the Commonwealth.

In other words, taxes are a critical tool for doing important things together we cannot do alone. Here in Kentucky, state tax dollars go for:

Education: Early childhood education and childcare; K-12 education; higher education and need-based financial aid; adult education; worker training; vocational education; libraries; public television.

Health Care: Health insurance for people with disabilities, pregnant women, working poor families, and the elderly in nursing homes through Medicaid; public health; mental health services; disability services; substance use disorder services.

Human Services & Supports: Child and domestic violence protection; foster care and adoption; housing; nutrition assistance; support for low-income families; support for veterans; support for the elderly.

Infrastructure: Roads and bridges; water and sewer systems; public transit.

Environmental Protection: Land conservation; enforcement of laws protecting land, air and water; state parks; forest protection and management.

Public Safety & Justice: Court system; public defenders and prosecutors; state police; jails and prisons; disaster relief; consumer and worker safety protection.

Economic & Community Development: Small business development; tourism; job development; agricultural development; arts and culture.

Kentucky is projected to collect about $10.6 billion in revenue in its General Fund in Fiscal Year 2017. Forty-two percent of the General Fund is expected to come from the individual income tax; thirty-three percent from the sales tax; six percent from the property tax; eight percent from corporate taxes and the remaining from the coal severance tax, cigarette tax, lottery and other sources.

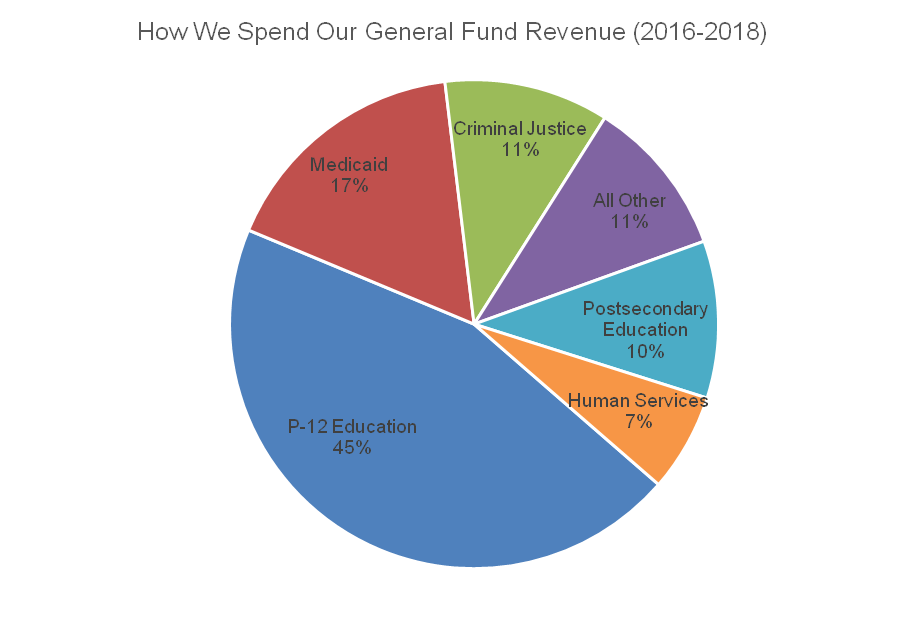

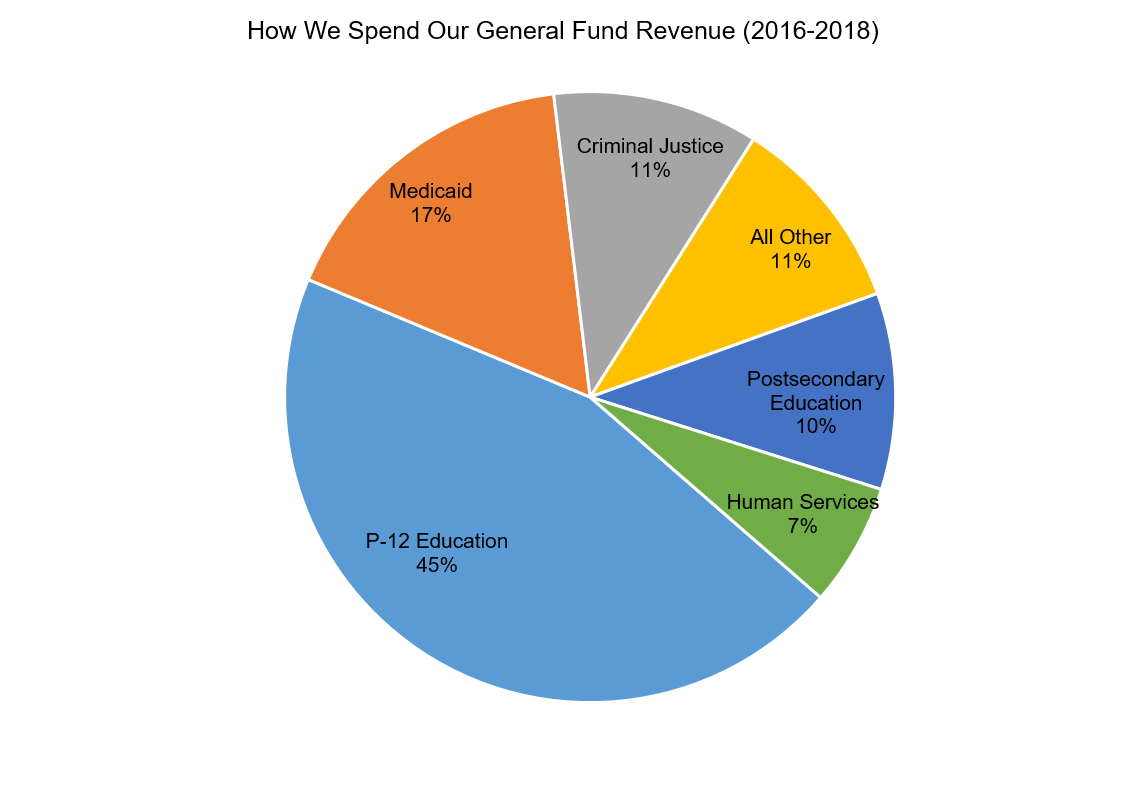

Over the current biennium, General Fund resources are allocated as follows:

Source: Office of the State Budget Director

For a closer look at how state tax dollars get appropriated to different budget areas, click here. And to see where federal tax dollars go, click here.

All these essential public services are why taxes matter and why we need good tax reform to address current underinvestment and ensure reliable funding in the future. Shifting our reliance from state income taxes to sales taxes, the current fad in other states, is not good reform: besides shifting our tax system even more onto middle and low income families, doing so would leave us with less revenue over time to build a thriving Commonwealth. That’s because sales taxes don’t grow as well as income taxes.

What’s good tax reform then? Here’s an example.

Paying taxes inspires aggravation in many, but we all benefit from the results. Taxes are one way we all roll up our sleeves and work together to make Kentucky an even better place to call home.