Kentucky is experiencing record revenue surpluses due to high inflation and temporary federal stimulus that spurred a faster-than-expected recovery from the pandemic recession. But under House Bill (HB) 8, lawmakers are considering large permanent tax cuts based on these unique conditions. Understanding the significant role of inflation makes these surpluses much less impressive than they seem — and HB 8’s tax cuts even more dangerous for Kentucky’s future.

Recent revenue growth is strong, but weaker once inflation taken into account

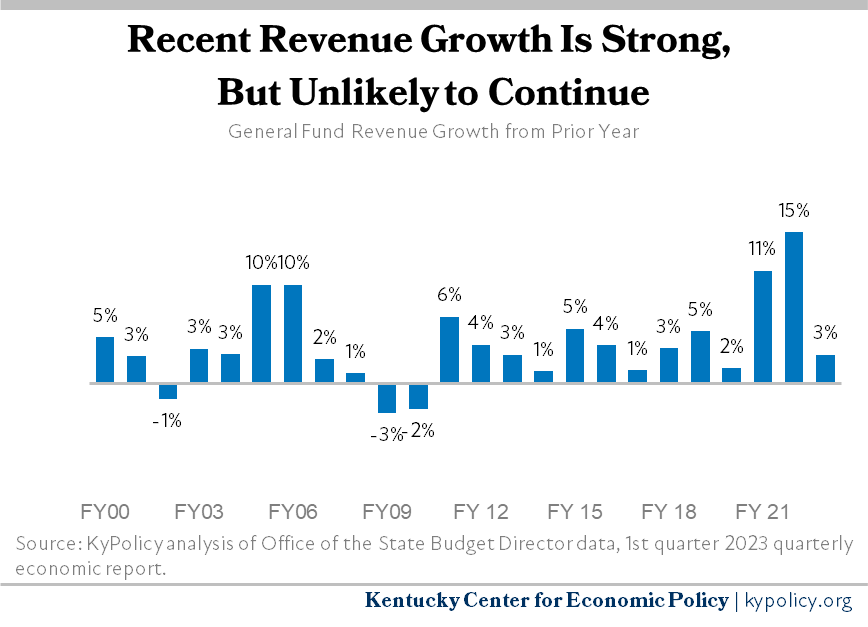

Kentucky is experiencing major revenue surpluses that are growing the state’s rainy day fund to a record balance, and a recent state forecast projected another $1.4 billion revenue surplus at the end of June 2023. As shown in the graph below, Kentucky had 11% revenue growth in 2021 and 15% in 2022. However, this result is in part because of a job recovery that was faster than state forecasters predicted. The federal government provided much-needed pandemic aid (over $45 billion came to Kentucky) that stimulated strong economic growth. That aid is now drying up, which along with tax cuts described below is contributing to a drop in revenue growth to only a projected 3% this year, according to a recent state estimate.

Inflation has also climbed due to pandemic-related supply chain problems and the war in Ukraine. And when prices rise so do state revenues, in part because sales and income tax receipts reflect more expensive purchases and higher wages. Rising prices make it seem like there’s more extra money than actually exists though, since inflation also increases state costs to hire and retain public employees, buy supplies and equipment, and more. Those higher costs weren’t fully reflected in the last state budget, which for example included no dedicated teacher and school employee raises despite a rising shortage.

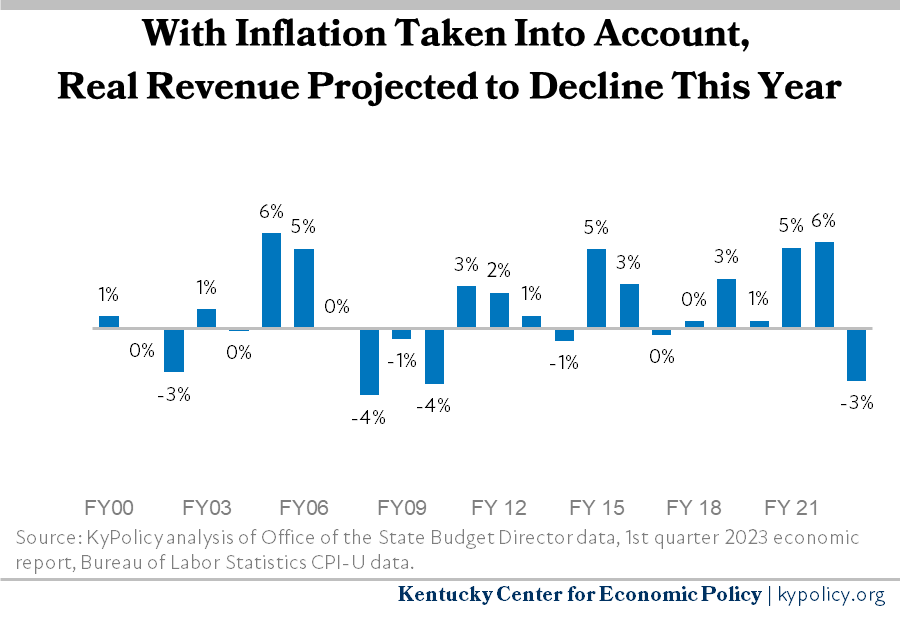

The recent strong revenue growth in 2021 and 2022 is less impressive once you adjust for inflation (with 5% growth in 2021 and 6% in 2022), as shown in the graph below. And the current state projection is that revenue will decline by 3% in the current year once inflation is taken into account.

Inflation is already starting to come down, state should not make permanent tax cuts based on it

Price increases are beginning to ease as supply chain problems resolve. The Federal Reserve is also acting aggressively to increase interest rates with the goal of bringing inflation down. That action brings the risk of pushing the economy into a recession, which in addition to creating economic hardship would cause state tax receipts to falter further.

However, HB 8 passed by the General Assembly in 2022 consists of a flawed formula that makes permanent cuts to the income tax rate based on a one-time snapshot of revenue conditions. The first cut happens automatically on January 1 (reducing the rate from 5% to 4.5%), and the legislature will consider the next cut (from 4.5% to 4%) in the 2023 legislative session. That second cut, the conditions for which are already met under the HB 8 formula, would go into effect in 2024. The formula is so problematic that under HB 8 revenues could actually decline in the current fiscal year after adjusting for inflation — which they are currently projected to do, as shown above — and the HB 8 trigger could still recommend another rate cut in the following year: from 4% to 3.5%.

Since the income tax provides 41% of all General Fund revenue, these reductions will be hugely expensive for Kentucky’s budget. Cutting the income tax rate from 5% to 4% costs more than the state spends on all 8 universities and 16 community colleges.

Kentucky needs tax revenue to meet immediate needs coming out of the pandemic and two natural disasters, and to fund important commitments in education, health care, infrastructure and other areas where costs have increased. Passing permanent tax cuts that go primarily to the wealthy based on unique and temporary factors will cause serious problems for the commonwealth in the not-too-distant future.