The legislative leaders meeting on an executive branch budget finalized a Free Conference Committee Report (FCCR) that covers only one year of the biennium and continues current funding levels for most services across state government. The FCCR lacks raises and new monies for needs like social workers to address the child protection crisis, and freezes funding contribution requirements for quasi-governmental organizations like health departments and community mental health centers at the current 49% of employee pay.

The FCCR is based on a more pessimistic revenue forecast than the original forecast, and spends $231 million less for 2021 than the governor originally proposed. That pessimistic forecast may prove optimistic, however, given the economic crisis and expected revenue shortfalls that are the result of the COVID-19 pandemic.

FCCR flatlines funding level for K-12 schools, removes raises

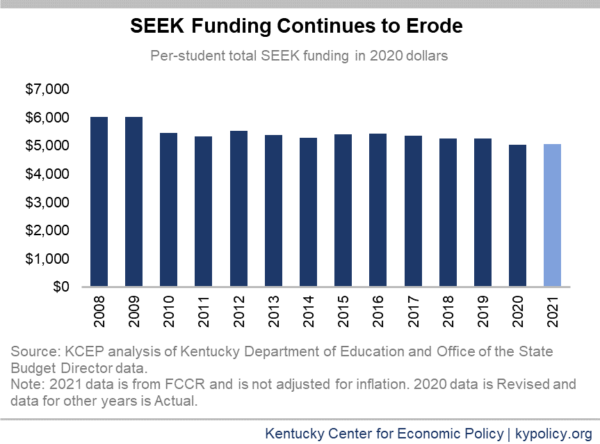

The FCCR maintains approximately the same total state funding level as currently exists for SEEK (Support Education Excellence in Kentucky), the state’s core K-12 funding formula, which will likely continue the trend of formula funding eroding with inflation, as shown in the graph below. Kentucky is already 4th-worst among states for per-pupil cuts in core funding since 2008.

The FCCR removes all raises for teachers and classified school employees included in earlier versions of the budget. It also does not increase funding for student transportation, which remains at approximately two-thirds of the statutorily required amount.

The FCCR also:

- Does not include funding for textbooks, similar to the last two-year budget.

- Adds $7.4 million (plus pension and healthcare costs) for school-based mental health service providers, half of what the House and Senate had proposed to begin addressing Senate Bill 1 (the 2019 school safety bill).

- Does not increase funding for preschool; extra funds were included in earlier versions of the budget.

FCCR flatlines funding for higher education, but requires use of performance-based system

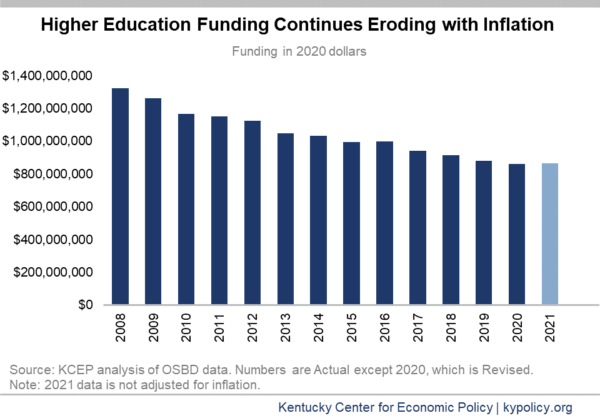

The plan provides no increase in funding for higher education institutions, as was proposed in earlier versions of the budget, and as shown in the graph below.

Despite not providing new monies, it distributes $15 million of higher education dollars through the performance funding formula. That system, as we have noted, is disadvantaging universities and community colleges with more low-income students and students of color. The governor had proposed not using the model in his budget.

Funding in the FCCR for need-based college scholarships is very similar to previous versions of the budget, with funding at 87% of the statutory funding requirement.

FCCR keeps quasi pension contributions at current 49% level, providing less than ADC and avoiding burdening frontline agencies

The FCCR provides pension contributions for state employees equal to 84% of pay, lower than the 93% Kentucky Retirement Systems (KRS) requested. That’s because the bill depends on resetting the amortization period to a new 30-year period, as in SB 249 that the legislature plans to pass separately.

The FCCR then requires quasi-governmental organizations like health departments, regional universities, community mental health centers and domestic violence agencies to make pension contributions at a lower rate of 49% of pay, just as they have for the last two years. Earlier versions of the budget also did not have quasis contributing the full amount, but had larger contribution requirements than 49% and additional funding for the quasis that helped them make part of that added payment. The approach in the FCCR means less money to KRS but also doesn’t require the quasis (some of which are on the front line of fighting COVID-19) to find additional funds elsewhere for pensions.

Since quasis make up approximately one fourth of the payroll in the Kentucky Employees Retirement System (KERS) non-hazardous plan, the combination of their 49% contribution and the state’s 84% contribution means an overall contribution rate of approximately 75% of pay. SB 249 also delays implementation of House Bill 1 (2019), the legislation requiring that these agencies choose whether to leave the retirement system.

The FCCR provides the actuarially required contribution to the Teachers’ Retirement System, including to the medical insurance fund (for which the full amount was not provided in the previous Senate and House versions). However, as described later in this brief, the FCCR opens the option of contributing lower amounts to the Teachers’ Retirement System as one way of dealing with a shortfall. It also requires that any monies above the actuarially determined contribution to the retiree medical fund (it is currently estimated that the statutory contributions exceed that amount) will roll over into the 2022 contribution.

The FCCR includes no raises for state employees, which will mean no raises for 9 of the last 11 years and continued difficulty filling vacant positions.

FCCR scales back funding for variety of human services

The FCCR does not provide monies to hire new social workers, nor to provide raises for current social workers, as in earlier versions of the budget. The FCCR also provides no new Michelle P and Supports for Community Living waiver slots that provide community-based care for individuals with disabilities, unlike all previous versions of the budget. There are over 9,000 people on waiting lists for those services.

The FCCR keeps the eligibility limit for the Child Care Assistance Program at its current 160% of the federal poverty level. It also provides the funding requested for Kentucky Wired. The plan sends a majority of coal severance monies back to coal counties, and cuts all of the state operating aid to local libraries at $2.5 million a year.

As is appropriate given the current crisis and the need for resources, no monies are added to the state’s budget reserve trust fund. It is not clear how much of the over $300 million that was expected to be available in the fund will be there once the fiscal year ends, if any, given the depth of the economic downturn.

Plan creates uncertainty around shortfall and use of federal funds

The FCCR is based on the “pessimistic” forecast developed earlier in the process, which assumes the unemployment rate will rise to 5.8% next year. The resulting revenue impact is $88 million less in 2020, $115 million less in 2021 and $174 million less in 2022 than was originally expected in the official forecast. That estimate could prove optimistic, with forecasters like Goldman Sachs predicting the unemployment rate could rise much higher and the damage could be particularly severe over the next few months.

In the FCCR’s budget reduction plan in the event of a shortfall of 5% or less, language has been added (not previously included in other versions of the budget) appearing to make it an option for the governor to reduce “contributions appropriated to pensions in excess of statutory requirements” and “contributions appropriated to pension insurance in excess of actuarially required contributions.” This language seems refer to the Teachers’ Retirement System, and could mean significantly smaller contributions to that system given the likelihood of revenue shortfalls.

The FCCR does not allocate the new monies coming to Kentucky from the CARES Act that just passed Congress, including the $1.599 billion through its Coronavirus Relief Fund. Nor does it include the dollars from the Families First Coronavirus Act whereby the federal government will pay approximately 78% rather than 72% of the costs of traditional Medicaid, and a smaller increase in the federal share of KCHIP spending (both retroactive to January 31 and until the public health emergency ends). Those increases will help free up additional funds this fiscal year.

The FCCR does adds language specifying that no federal funds from the CARES Act or other COVID-19 emergency response funds “shall be used to establish any new programs unless those new programs can be fully supported from existing appropriation amounts once all of the Federal Funds have been expended.”

The FCCR relies on $130 million in fund transfers for 2021, the same as in the Senate version of the budget. A “revenue” bill accompanied passage of the budget, HB 351. No fiscal note accompanies that bill so the official impact is unknown, but a lawmaker told the Lexington Herald-Leader the bill would raise only $5 million because its small new vaping tax is mostly offset by new tax breaks for the coal, alcohol and agricultural industries.

Since the budget covers only 2021, the General Assembly will have to pass another budget before June 2021 to cover fiscal year 2022. That budget will require a 3/5 vote in each chamber if it is passed during the regular legislative session in 2021.