The House budget plan includes many of the same priorities that the governor proposed, but contains a different emphasis in a variety of areas. Compared to the governor’s budget, the House budget proposes a smaller raise for teachers and a 1% raise for other school district employees not included in the governor’s plan; fewer new social workers but higher social worker salaries; and more money for the rainy day fund with an additional $89 million as opposed to $10 million more in the governor’s plan. Unlike the governor proposal, the House budget includes no new revenue.

Both proposals stop the trend of budget cuts, but in many areas funding will continue to erode due to inflation, which is projected at approximately 2.5% a year according to the Congressional Budget Office.

Budget spreads out teacher raise, provides slightly less to core school funding overall

The House budget provides a 1% pay increase each year for all teachers and other school employees, in contrast to the governor’s proposed $2,000 raise (3.7% on average) restricted to teachers with no additional raise the second year of the budget.

It provides a $61 increase in the Support Educational Excellence in Kentucky (SEEK) per-pupil base guarantee in 2021 and an additional $51 in 2022. That 1.5% increase the first year and 1.3% the second is higher than the 1% increase in the governor’s plan, which applied only to the first year. However, the House proposal includes the 1% pay raise as part of that school funding increase, whereas the governor’s proposed $2,000 raise per teacher was outside of the base SEEK guarantee.

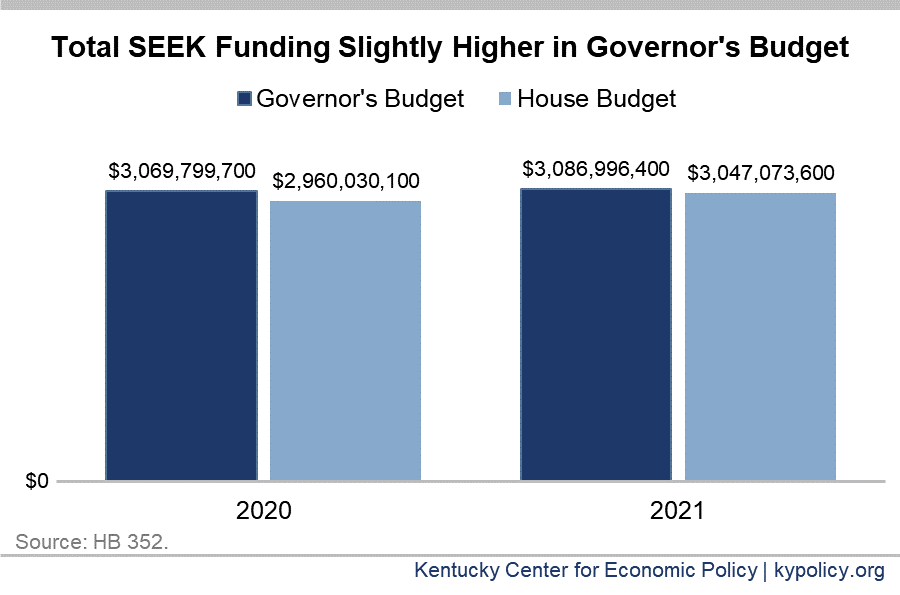

That makes the overall SEEK formula funding in the House budget somewhat smaller than in the governor’s budget, as shown in the graph below. As in the governor’s plan, the House budget does not increase funding for student transportation, which remains at approximately two-thirds of the statutorily required amount. In both budgets, per-pupil funding for SEEK will continue to erode with inflation. Kentucky is already 4th-worst among states for per-pupil cuts in core funding since 2008.

The House budget makes other changes to education spending compared to what the governor proposed:

- The House budget adds $39 million (plus pension and health costs) over the biennium to hire new mental health professionals, a portion of the counseling staff intended in the school safety bill (2019 SB 1). Funding for these additional counselors was not included in the governor’s proposal. Also the House funds the $18.7 million in school building safety improvements through appropriations rather than through borrowing as proposed in the governor’s budget.

- The House adds $5 million a year for textbooks compared to $11 million a year in the governor’s plan.

- The House budget cuts $7.5 million a year contained in the last budget in grants for collaboration between private child care centers and preschools (though it increases childcare funding, see below). It adds $4 million to raise eligibility for preschool to 175% of the federal poverty level (FPL) in 2022. The governor’s proposal, in contrast, added $5 million each year of the budget to support preschool in low-income districts.

Like the governor’s budget, the House budget does not increase funding for Extended School Services, which was cut by 6.25% in the last budget. As proposed by both the governor and the House budget, some of the additional funding for P-12 education comes from $85 million in SEEK funds originally budgeted in the current year but now expected to go unspent.

Proposal provides small increase for higher education, requires performance funding

The plan provides an amount for universities and community colleges similar to the governor’s proposed 1% increase the first year and provides additional dollars on top of that the second year. The budget puts $64 million of that appropriation over the biennium through the performance funding system which, as we have noted, is disadvantaging universities and community colleges with more low-income students and students of color. The governor had proposed not using the model in his budget.

Funding for need-based college scholarships is very similar in the House budget to what the governor proposed. The House budget provides 88% and 86% of the statutory funding requirement for need-based aid in 2021 and 2022 respectively.

Budget changes approach to social workers, puts more to the rainy day fund

The budget provides for 100 new social workers across the biennium to deal with the crisis in child protective services, significantly fewer than the 350 new social workers the governor proposed. Instead it increases the pay for new social workers by 10% and provides a 5% raise for existing social workers and an additional $960 in retention pay each year. It provides 200 new Michelle P waiver slots and 50 new Supports for Community Living waiver slots that provide community-based care for individuals with disabilities (the governor’s budget had proposed 500 and 100 new slots, respectively). There are over 9,000 people on waiting lists for those slots.

The House also provides $15 million per fiscal year to raise the eligibility limit for the Child Care Assistance Program (CCAP) from 160% of FPL to 175% FPL (which, for a family of four is $41,920 and $45,850 respectively).

The House budget does not provide $34 million a year in General Fund dollars to support Kentucky Wired, as the governor had provided, leaving it to rely only on restricted funds. The House sends 100% of the coal severance tax monies to the coal regions, as the governor proposed, but reduces the flexibility in how those monies can be spent. The House cuts $2.5 million a year in operating aid to local libraries that was in the governor’s proposal and, unlike the governor’s plan, did not provide funding for the Commission on Women.

The House budget adds $89 million to the rainy day fund compared to $10 million added in the governor’s plan. That would bring the fund up to $392.4 million, or 3.3% of revenue — less than the 5% goal set in statute as a minimum benchmark to help prepare for a recession. That level would still keep Kentucky’s rainy day fund among the poorest funded in the country; the median state rainy day fund was at 11.1% as of 2018.

Budget includes 1% raises for employees and changes funding formula for quasi pensions

Like the governor’s budget, the House budget provides a 1% raise for most all state employees in 2021 and another 1% in 2022; they had not received across-the-board raises for 8 of the previous 10 years. It also provides cost of living raises for state police and employees of the state police lab.

The House budget fully funds the actuarially recommended pension contribution to the Kentucky Retirement Systems for state employees, including funding at 93% of pay for non-hazardous state workers. For quasi-governmental organizations like community mental health centers, health departments, regional universities and domestic violence agencies, it takes a different approach than the governor’s proposal. The governor’s plan provided $50 million more a year to help agencies pay half of the cost of getting their contribution to 83% of pay. The House budget instead adopts the “fixed dollar” funding formula of HB 171 in which agencies’ individual contribution levels differ widely based on their actual liability. It then provides monies to help with a significant portion of the payments.

The budget provides full funding for the Teachers’ Retirement System pension contributions, but only provides the first year of $62 million in appropriations for health insurance coverage for teacher retirees under the age of 65, relying on the retiree health fund (or a surplus should it materialize) to cover the second year (as was included in the last two-year budget). The governor had proposed funding these benefits through the budget for both years.

Plan doesn’t include new revenue and uses one-time dollars

Unlike the governor’s proposal, the House does not include a revenue-raising plan. The governor’s plan included $73 million in new revenue the first year and $75 million the second from tobacco taxes, sports betting and a higher limited liability entity fee. Separately, however, the House has passed HB 32, which is estimated to raise $27 million in 2022 by taxing vaping and imposing a higher tax on other tobacco products.

The House proposal includes $250 million in executive branch fund transfers over the biennium, less than the $276 million used in the governor’s budget. The biggest sources are the Petroleum Storage Tank Fund, from which it transfers $43 million (the governor’s budget swept $93 million and bonded a portion of that). Like the governor’s budget, the House budget does not take money from the public employees’ health fund, as had been used in the past.