Though the details remain unknown, Governor Bevin has described the kind of tax reform he’ll introduce in a special session this year as shifting Kentucky toward a “consumption-based” tax system, or from income to sales taxes. As shown in multiple other states that have enacted such a shift, this approach would give more tax breaks to the wealthiest Kentuckians and leave the state with less revenue over time to invest in our commonwealth. 1 In contrast, HB 263, filed in Kentucky’s 2017 General Assembly by Rep. Jim Wayne with 12 co-sponsors, is an example of comprehensive tax reform that would address inequities in our tax system and strengthen our ability to make the investments that build thriving communities. 2

The bill draws from the best elements of Kentucky’s 2012 Blue Ribbon Commission on Tax Reform along with other needed changes to make the state’s tax system more adequate, fair and reliable. According to the Legislative Research Commission’s fiscal note, HB 263 would raise $579 million annually at full implementation. 3 It would clean up tax breaks for powerful interests and help address the upside-down nature of Kentucky’s tax system, which asks the least of those with the most as a share of income. It would also result in revenue better keeping up with growth in the economy, improving Kentucky’s ability to sustain investments in our schools, health, infrastructure and more while paying down our liabilities.

HB 263 Cleans Up Expensive, Extensive Tax Breaks

Shifting from income taxes to greater reliance on sales taxes would be a huge tax cut for the wealthy; and Kentucky already spends billions of dollars on income tax breaks that primarily benefit those with the greatest ability to pay taxes. 4 Reducing those breaks, as HB 263 proposes, would generate more revenue for the investments that benefit all Kentuckians. Related to the individual income tax, the bill would:

- Cap itemized deductions at $17,500 and index the amount to inflation, raising $200 million annually. High-income filers typically have more deductions and therefore benefit disproportionally from this tax expenditure. The majority of Kentucky’s neighbors allow little or no income tax deductions.

- Phase out the pension income exclusion over $35,000, generating $220 million a year and helping ensure wealthy retirees don’t receive a large income tax break. Kentucky’s current exclusion is more generous than what the vast majority of states provide, and it will cause an increasingly large hole in the budget as baby boomers retire in the coming years. 5

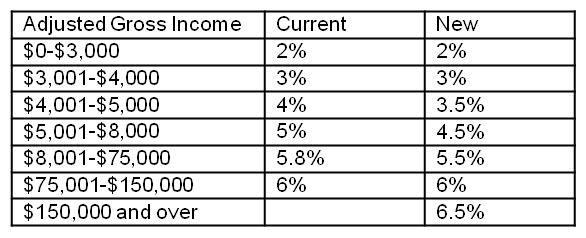

- Create a new higher top tax rate and reduce rates for brackets under $75,000. Though this particular measure would cost $110 million a year, it would make our tax system less upside-down overall by asking more of those with greatest ability to pay (at the very top of our income distribution) and less of low to middle-income families.

The bill would raise $25 million by reinstating the estate tax on wealthy Kentuckians as it existed before federal tax changes in 2003 eliminated it. 6 Only very few, very wealthy estates pay the tax.

At the corporate level, HB 263 would:

- Lower the income threshold for the limited liability entity (LLE) tax from $3 million to $1 million and phase it in to $2 million instead of $6 million, generating $13 million in revenue a year. The threshold is currently so high that 82 percent of LLEs don’t even pay the tax (paying the $175 minimum instead), even though some are subsidiaries of large corporations.

- Tighten loopholes that allow profitable corporations to avoid taxation by enacting a “throwback rule” on income from goods produced in Kentucky not taxed elsewhere; and by requiring corporations to report on their tax returns profits from all related subsidiaries, including in offshore tax havens. To address tax dodging, the majority of corporate-income taxing states require that method, called combined reporting. These measures would generate $66 million a year. 7

- Trim $9 million from what we spend on ineffective corporate incentives to the film industry and businesses with production activity in the U.S. (the latter incentive does not require that production take place in Kentucky). 8 The bill would also create a review and sunset process for all “economic development tax incentives,” ensuring greater scrutiny of the cost-effectiveness of what we spend on businesses through the tax code. 9

Ending these individual and corporate income tax breaks would help address the core problem with Kentucky’s tax system: revenue growth is not keeping up with the economy, making it impossible to sustain investments over time. Because consumption does not grow as quickly as income in our economy – and because such a large share of the gains from economic growth are going to those at the very top – shifting from income taxes to sales taxes (from the wealthy to everyone else) would worsen this flaw.

Other elements in HB 236 would also help restore the relationship between our economy and revenue system by:

- Expanding the sales tax base to include a number of luxury services. Despite operating in a service economy, Kentucky’s sales tax base includes very few services. Adding more, and starting with luxury services such as golf course and country club fees, landscaping and armored car services, would raise $104 million a year.

- Freezing the property tax rate at 12.2 cents. Since 1979, Kentucky’s real property tax rate has fallen from 31.5 cents to 12.2 cents as a result of a cap on revenue growth that was enacted by the legislature. That cap (a less strict version of which also exists at the local level) has made Kentucky’s property taxes among the lowest in the country. Freezing the rate and letting state property tax revenues rise with property values will compensate for times when property values grow slowly, such as the years after the Great Recession.

Additionally, the bill would help offset the high public cost of tobacco use by increasing taxes on cigarettes and other tobacco products, including e-cigarettes. Though tobacco taxes are not a reliable revenue source over time, this measure would generate $155 million initially and would provide important benefits by serving as a disincentive to tobacco use.

HB 263 Would Make Kentucky’s Taxes Less Upside-Down

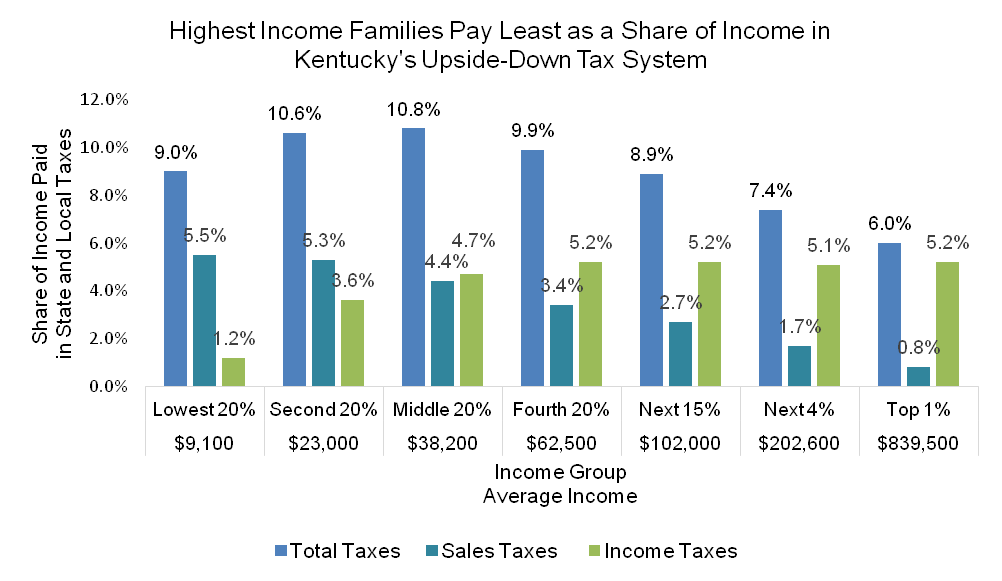

Because Kentucky’s income taxes are mostly progressive and sales taxes are regressive, an income-to-sales tax shift would worsen the imbalance in Kentucky’s existing tax system (see below). In other words, such a shift would make our system even more upside-down than it already is, asking less of the wealthiest Kentuckians and more of lower income families.

Source: Institute on Taxation and Economic Policy.

In contrast, HB 263 would ask more of those at the top and less of low- and middle-income people who currently pay a larger share of their income in taxes. To further help with inequities, the bill would create a state level Earned Income Tax Credit (EITC) – an effective poverty-fighting tool that supports work and helps families afford basic living expenses, pay off debt and invest in education. At 15 percent of the federal EITC, this refundable credit would cost $115 million a year. 10

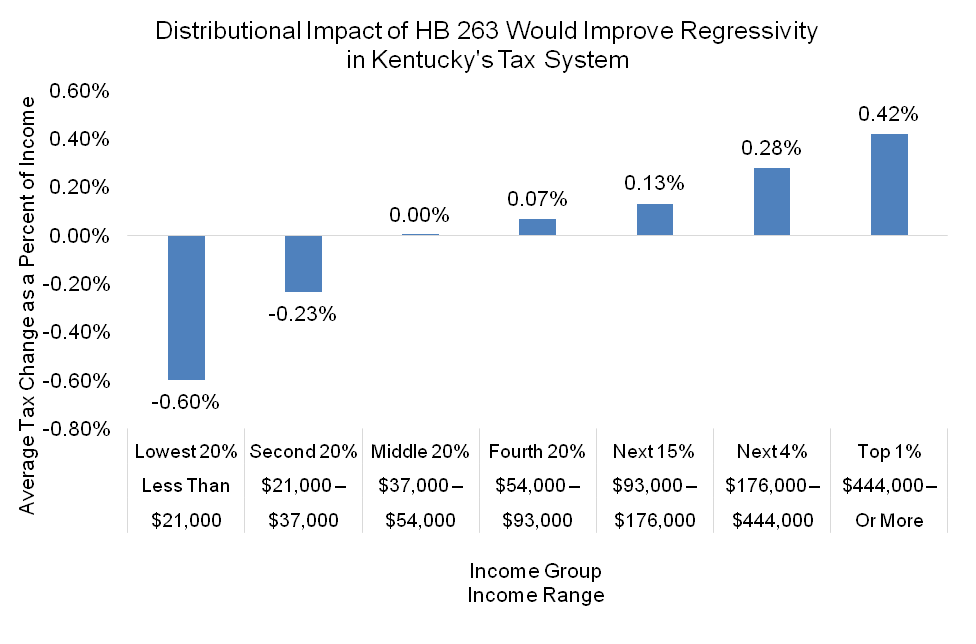

Combining the distributional impact of HB 263’s individual income tax changes including the EITC; the expansion of the sales tax base to luxury services; and gas tax, cigarette and “other tobacco products” tax increases shows that HB 263 would make our tax system less upside-down overall even as it generates more revenue for investments that benefit all Kentuckians.

Source: Institute on Taxation and Economic Policy (ITEP).

As legislators consider what kind of tax changes deserve to be called “tax reform,” and what kind of tax reform warrants a special session, HB 263 provides a good example of the kind of sound approach that is needed: one that cleans up tax breaks and generates revenue for stronger investments in our commonwealth. It also provides a clear benchmark against which harmful tax-shift proposals should be measured.

- Nic Albares, “Moving from Budget Cuts to State Investments: A Blueprint for a Stronger Louisiana,” Louisiana Budget Project, February 22, 2017, http://www.labudget.org/lbp//www/wp-content/uploads/2017/02/Blueprint-for-a-stronger-Louisiana.pdf. Anna Baumann, “Kentucky Should Not Follow Kansas Down the Income Tax Cutting Road,” Kentucky Center for Economic Policy, November 28, 2016, https://kypolicy.org/kentucky-not-follow-kansas-income-tax-cutting-road/. Tazra Mitchell and Cedric Johnson, “2017 Fiscal Year Budget Falls Short of Being A Visionary Plan for North Carolina’s Economic Future,” North Carolina Budget and Tax Center, July 2016, http://www.ncjustice.org/sites/default/files/BTC%20Reports%20-%20FINAL%20BUDGET.PDF. Zach Schiller, “The Great Ohio Tax Shift,” Policy Matters Ohio, August 18, 2014, http://www.policymattersohio.org/tax-shift-aug2014. ↩

- HB 263, “An Act Relation To Taxation,” Kentucky General Assembly, 2017, http://www.lrc.ky.gov/record/17RS/HB263.htm. ↩

- Legislative Research Commission, “Commonwealth of Kentucky State Fiscal Note Statement,” 2017 Regular Session, http://www.lrc.ky.gov/recorddocuments/note/17RS/HB263/FN.pdf. ↩

- Anna Baumann, “Revenue Options that Strengthen the Commonwealth,” Kentucky Center for Economic Policy, February 2, 2016, https://kypolicy.org/new-report-kentucky-can-take-balanced-approach-to-budget-with-revenue-options/. ↩

- Jason Bailey, “Retirement Income Growing Much Faster than Wages, Spelling Trouble for State Revenues,” Kentucky Center for Economic Policy, July 14, 2015, https://kypolicy.org/retirement-income-growing-much-faster-than-wages-spelling-trouble-for-state-revenues/. ↩

- Anna Baumann, “Reinstating Kentucky’s Tax on Extreme Wealth a Part of Making State Taxes Fair and Adequate,” Kentucky Center for Economic Policy, September 24, 2015, https://kypolicy.org/reinstating-kentuckys-tax-on-extreme-wealth-a-part-of-making-state-taxes-fair-and-adequate-2/. ↩

- Jason Bailey, “Closing Corporate Tax Loopholes to Fund Investments in Kentucky Families,” Kentucky Center for Economic Policy, February 10, 2015, https://kypolicy.org/closing-corporate-tax-loopholes-fund-investments-kentucky-families/. ↩

- Anna Baumann, “Expanding Kentucky’s Film Tax Credits Not a Strategy that Will Pay Off,” Kentucky Center for Economic Policy, February 10, 2015, https://kypolicy.org/expanding-kentuckys-film-tax-credits-strategy-will-pay/. ↩

- Jason Bailey, “Report’s Findings Suggest Kentucky’s Business Tax Incentives Not Very Cost-Effective Way to Create Jobs,” Kentucky Center for Economic Policy, July 19, 2012, https://kypolicy.org/reports-findings-suggest-kentuckys-business-tax-incentives-cost-effective-way-create-jobs/. ↩

- Ashley Spalding, “State EITC Would Help Working Kentuckians Afford Necessities,” Kentucky Center for Economic Policy, February 5, 2014, https://kypolicy.org/state-eitc-help-working-kentuckians-afford-necessities/. ↩