In interviews leading up to the 2020 session, legislative leaders have expressed their desire to continue down the path of reducing income taxes and paying for the reductions by relying more on the sales tax and other consumption taxes. Just like the last time, such a shift would provide huge tax cuts for people at the top — including a cut of $6,814 for people who make $1 million a year on average — that are paid for with higher taxes for low- and middle-income Kentuckians. And it would continue worsening income inequality between white Kentuckians and Kentuckians of color.

The General Assembly started this process in 2018 with the passage of legislation that dramatically shifted tax responsibility from the wealthiest people to everyone else. The tax changes made in 2018 raised some revenue, but over half was used to pay for cuts in the income tax rate that primarily benefited corporations and the wealthy. The legislature then came back in 2019 and provided even more tax breaks for corporations and the wealthy, with significant tax reductions for banks and multinational corporations, further reducing resources needed to make critical investments in our commonwealth.

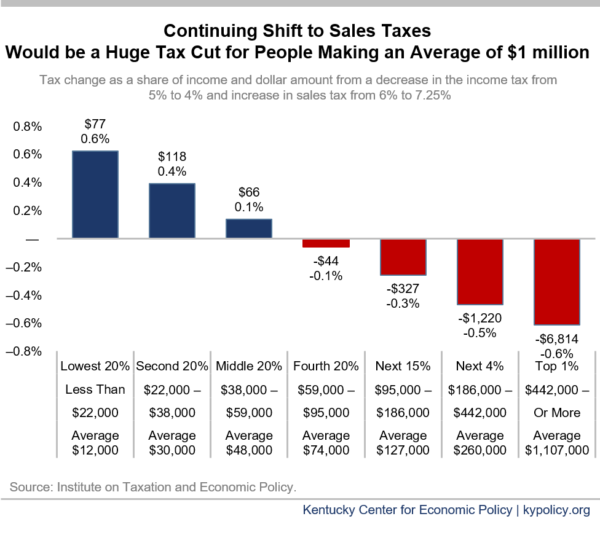

In exploring how a further shift from the income tax to the sales tax might play out, we asked the Institute on Taxation and Economic Policy (ITEP) to estimate what the sales tax rate would need to be to offset a further reduction of the income tax rate from 5% to 4%, and how such a change would impact Kentuckians. Their analysis shows that the sales tax rate would need to increase from the current 6% to 7.25% — which would tie Kentucky with California for the highest state sales tax rate in the country.

How much you make would determine how you are impacted by this shift: households in the top 20% would experience significant tax reductions, with the top 1% gaining the most and receiving an average tax cut of $6,814. Yet the bottom 60% of Kentuckians – those making less than $59,000 – would pay more in taxes, as illustrated below.

Due to historical, structural barriers that have resulted in lower incomes for people of color in Kentucky, continuing the shift from income to sales taxes will further widen income inequality between white Kentuckians and Kentuckians of color. Analysis from ITEP shows that more white Kentuckians will get big tax cuts, while more Kentuckians of color will end up paying additional taxes, under such a plan:

Due to historical, structural barriers that have resulted in lower incomes for people of color in Kentucky, continuing the shift from income to sales taxes will further widen income inequality between white Kentuckians and Kentuckians of color. Analysis from ITEP shows that more white Kentuckians will get big tax cuts, while more Kentuckians of color will end up paying additional taxes, under such a plan:

- 21% of white Kentucky households are in the top 20% of all households (receiving tax cuts), and 58% are in the bottom 60% (receiving tax increases).

- 10% of black Kentucky households are in the top 20%, and 80% are in the bottom 60%.

- 17% of Hispanic Kentucky households are in the top 20%, and 72% are in the bottom 60%.

Similarly, rural communities in Kentucky will be disproportionately harmed from further shifting to sales taxes because of lower incomes overall in Kentucky’s rural areas.

It is important to note that Kentucky’s tax system already had this upside-down quality even before the recent tax laws passed. The 2018 and 2019 tax changes exacerbated this problem, and continuing the shift would only make inequality in our state widen further.

In addition to shifting taxes from those who can most afford to pay to those who can least afford to pay, it does not bode well for our future to rely on slower-growing consumption taxes while moving away from the more productive income taxes. In an economy where nearly all of the growth is at the top, and corporations are experiencing record profits, a tax system that asks less of those with the most will fail to take advantage of that growth. The result will be revenues that do not keep pace with the economy, creating more stress on our already overextended General Fund.

Proponents of this approach maintain that with lower taxes, the wealthy and corporations will stimulate our economy. The problem is that this “trickle down” approach has never worked as described, evidenced by the failed experiment in Kansas. We already have a significant and growing structural deficit in Kentucky – which means that the revenue we take in is less than the amount we spend, and the evidence is clear on all fronts that more investment is needed if we want to thrive and prosper. In fact, public investments in our state help grow the economy by plowing resources back into communities.

Kentucky can benefit greatly from investing in good schools, public health, clean drinking water, broadband internet access, addiction treatment and so much more. And we have evidence-based policies to clean up tax breaks and generate revenue for these priorities. But we will not be able to make progress if we stay on the path of eroding state revenue through more tax giveaways to the powerful and well-off.