The clock is ticking on the 2015 session and legislators have yet to guard Kentucky’s city and county roads and bridges from the consequences of a pending 5.1 cent drop in the motor fuels tax rate. Nearly half of motor fuels revenue that the state collects goes back to local governments — through the County Road Aid (18.3 percent), Municipal Road Aid (7.7 percent) and Rural Secondary Aid (22.2 percent) programs — for building, maintaining and improving the transportation network that our local communities and economies rely on.

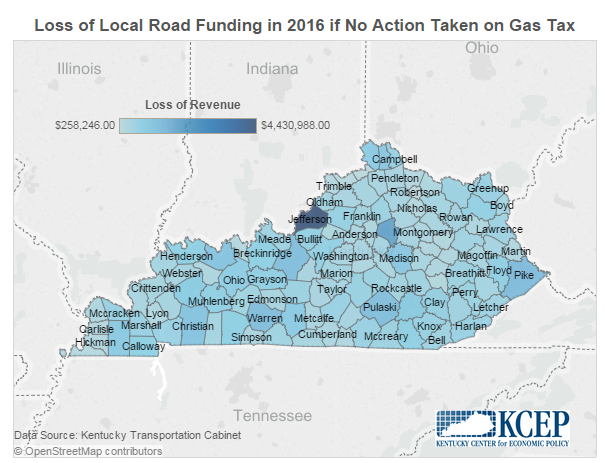

The interactive map below shows the total impact of cuts to these programs in each county for budget year 2016 that will result if lawmakers do not act. To view a larger version of the map, click here.

For cuts by program and by county, click here.