228,300 Kentuckians Have Likely Lost Health Coverage Since the Beginning of the COVID-19 Pandemic

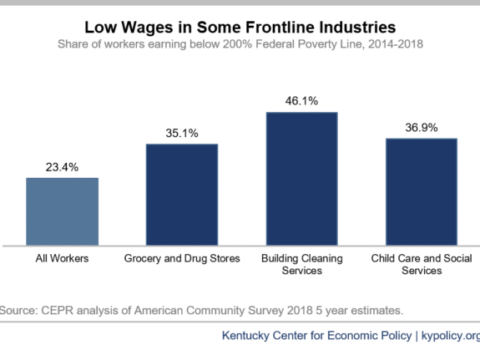

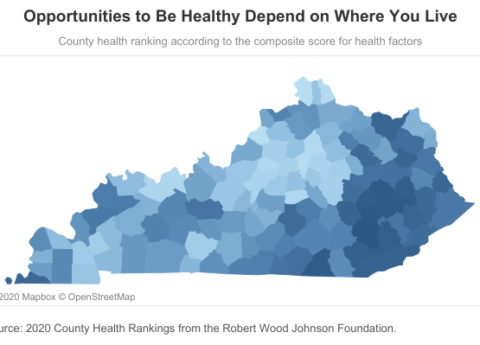

In the context of unprecedented job loss due to COVID-19, much attention has rightly been paid to the surge in...

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap