Some Federal Lawmakers Want to Use New Tax Cuts for the Wealthy as Cause to Undermine Basic Supports for Kentucky Families

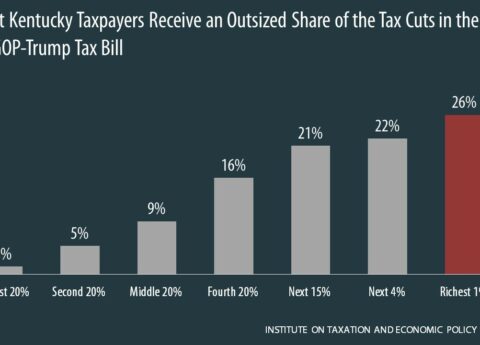

The tax bill Congress passed yesterday was the first in a two-step plan to cut taxes for the wealthy and...

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap