Analysis Shows Pension Bill Adds Huge New Costs for Teachers’ Plan

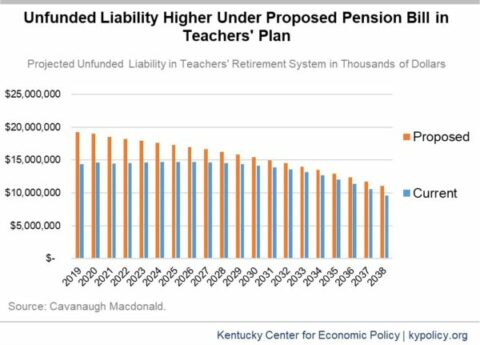

A new analysis of the proposed pension bill by the actuary for the Teachers' Retirement System (TRS) shows huge new costs...

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap