Governor’s Budget Proposal Would Worsen College Affordability

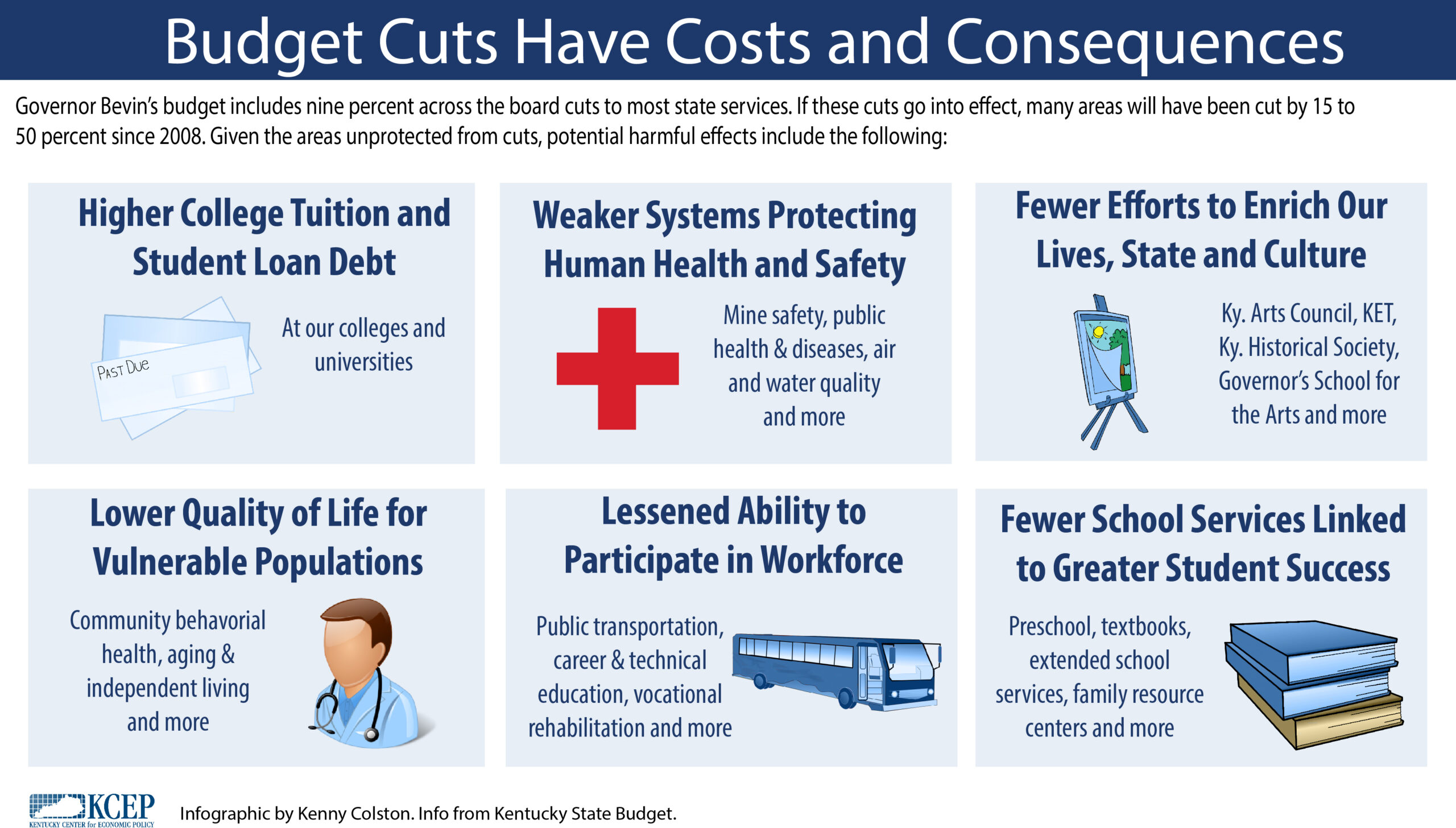

Governor Bevin’s budget proposal would not improve — and would even worsen — the state’s college affordability problems. Deep budget...

Research That Works for Kentucky

Copyright © 2024 KyPolicy Privacy Policy Terms & Conditions Sitemap