Across the commonwealth, Kentuckians are filing their taxes this week; and many are wondering if and how the federal tax changes passed in late 2017 and the state changes passed by the 2018 General Assembly will impact what they pay. Both packages are comprised of large tax cuts for the wealthy that raise taxes on working families on average and over time will lead to revenue shortfalls and cuts to vital services.

Despite these major setbacks, Tax Day is a good time to remember these services which our contributions pay for, and why we should make sure that everyone is chipping in for the investments that build thriving communities.

Through local, state and federal governments, tax dollars are pooled and invested in schools and universities, roads and bridges, social services for vulnerable children and adults and other public services essential for shared prosperity and growing communities across the Commonwealth.

In other words, taxes are a critical tool for accomplishing important things together that we cannot accomplish alone. Here in Kentucky, state tax dollars are used for:

Education: Early childhood education and childcare; K-12 education; higher education and need-based financial aid; adult education; worker training; vocational education; libraries; public television.

Health Care: Health insurance for people with disabilities, pregnant women, working poor families, and the elderly in nursing homes through Medicaid; public health; mental health services; disability services; substance use disorder services.

Human Services & Supports: Child and domestic violence protection; foster care and adoption; housing; nutrition assistance; support for low-income families; support for veterans; support for the elderly.

Infrastructure: Roads and bridges; water and sewer systems; public transit.

Environmental Protection: Land conservation; enforcement of laws protecting land, air and water; state parks; forest protection and management.

Public Safety & Justice: Court system; public defenders and prosecutors; state police; jails and prisons; disaster relief; consumer and worker safety protection.

Economic & Community Development: Small business development; tourism; job development; agricultural development; arts and culture.

Kentucky is projected to collect about $10.7 billion in revenue in its General Fund in fiscal year 2018 (which ends June 30, 2018). Forty-two percent of the General Fund is expected to come from the individual income tax; thirty-three percent from the sales tax; six percent from the property tax; nine percent from corporate taxes and the remaining from the coal severance tax, cigarette tax, lottery and other sources.

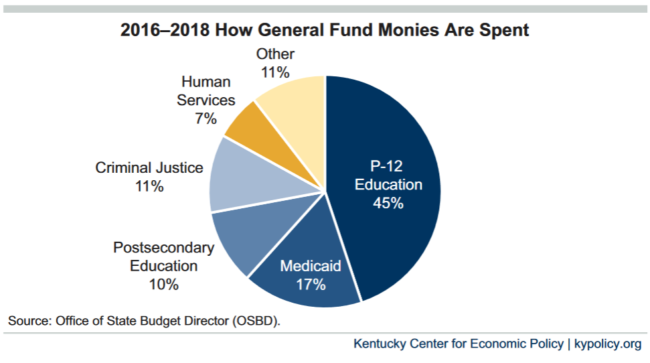

Over the current biennium, General Fund resources are allocated as follows:

For a closer look at how state tax dollars get appropriated to different budget areas, click here. And to see where federal tax dollars go, click here.

Paying taxes may not be a favorite pastime, but we all benefit from the results. Taxes are one way Kentuckians roll up their sleeves and work together to make the commonwealth a great place to call home.