The General Assembly passed a new version of House Bill 8 (HB 8) that is expected to reduce the individual income tax rate by 1 point over the next couple of years at a cost of $888 million over the biennium and that includes triggers for potential additional 0.5 point cuts in the future. The plan will disproportionately benefit the wealthy and create a growing budget hole that undermines investments in public education, human services and other public needs.

HB 8 will trigger income tax cuts over the next two years and create perverse incentives for additional cuts

HB 8 will trigger 0.5 point income tax rate cuts beginning in tax year 2023 if two conditions are met:

- The balance in the Budget Reserve Trust Fund (BRTF, or rainy day fund) is equal to 10% or more of General Fund receipts, and

- General Fund receipts equal or exceed appropriations (minus contributions to the BRTF and extra pension contributions) plus the cost of a 1 percentage point reduction in the income tax rate.

The first 0.5 point cut depends on 2021 revenues, and it is expected to go into effect automatically.1 The budget that passed the legislature leaves over 10% in the BRTF this year, allowing the first condition to be met in future years as long as that level is maintained. Kentucky currently expects a large budget surplus at the end of June this year, meaning another 0.5 point cut is expected to be triggered in tax year 2024, though under HB 8 the General Assembly will need to approve it. The result will be a 4% income tax rate (down from the current 5%) at a cost of $1.2 billion annually by 2025.

HB 8 creates perverse incentives for budget decisions beyond that. It provides an incentive for maintaining at least 10% of receipts in the BRTF in the future even if that means leaving immediate critical needs unaddressed. HB 8’s trigger also bases tax cuts around budget surpluses, which most often occur because of the difficulty in making accurate forecasts rather than because of strong economic or revenue growth. And there is an incentive to keep appropriations low in order to make room for additional income tax cuts. In effect, these mechanisms make a goal out of limiting investment in public needs.

HB 8 creates a large budget hole that will grow in the future

It’s important to note that Kentucky has temporary surpluses that are the result of the stimulus provided by the American Rescue Plan Act, CARES Act, and other pandemic-related federal relief, and there is tremendous uncertainty about revenues after that stimulus fades. HB 8 goes beyond giving away the one-time surplus by taking money from future budgets through permanent cuts in the income tax rate starting next year.

HB 8 creates new taxes on a small set of services including photography, website design, event planning, personal fitness training, ride sharing services and bodyguard services as well as fees on hybrid and electric vehicles. It taxes even fewer services than the House version of the bill, eliminating proposed taxes on travel agencies, financial services and boat launch fees. The new taxes raise approximately $100 million annually, nowhere close to the $1.2 billion lost by 2025 from HB 8’s 1 percentage point reduction in the income tax rate.

HB 8 is based on a disproven economic theory that income tax cuts will attract people and businesses. That belief wreaked havoc in Kansas, which had to roll back its income tax cuts after just five years when they spurred a budget crisis. Arizona, North Carolina, Ohio, Maine and Wisconsin also cut their income taxes at the same time and had to make budget reductions after their economies grew slower than the national average. Seven of the 10 states with the highest rates of domestic in-migration over the last decade have income taxes, most with higher top rates than Kentucky. Surveys find that taxes are also not a major factor in business location decisions, while tax cuts take resources away from investments in education, infrastructure, public health and other essentials for business growth.

The large budget hole caused by HB 8 will create pressure down the road to raise the regressive sales tax and apply it to currently exempt items like groceries, utilities and prescription drugs, force budget cuts to schools, health, infrastructure and other needs, or both.

HB 8 is a giveaway to the wealthy

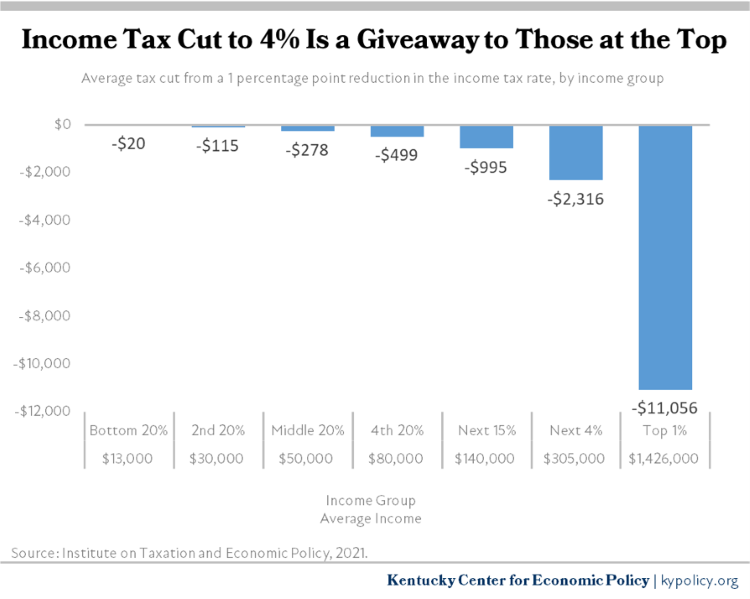

Income tax cuts go disproportionately to high-income people. According to the Institute on Taxation and Economic Policy, a 1 percentage point cut in the income tax would give an average of $11,056 to the richest 1% of Kentuckians, who make on average $1.4 million a year. In contrast, the poorest 20% of Kentuckians will get $20 on average and middle-class Kentuckians will get $278. A total of 65% of the tax cuts will go to the richest 20% of people, and 37% will go to the richest 5%.

While claims are being made that the tax cut in HB 8 will help people address rising prices of food, gas and other needs, those most harmed by rising costs are completely left out despite the fact they pay higher total state and local taxes as a share of their incomes than the richest Kentuckians.

Low-income Kentuckians. Because of an existing family size credit created on a bipartisan basis in 2005, Kentuckians with incomes below the poverty line do not pay income taxes even if they are employed, and those with incomes up to 133% of the poverty line are partially exempt from the income tax. There are 970,000 Kentuckians who live below 133% of poverty. This element disproportionately leaves Black Kentuckians out of the HB 8 tax cuts, 24.4% of whom live in poverty compared to 15% of white Kentuckians.

Seniors. Also exempted from the income tax in Kentucky is Social Security income and the first $31,110 of other retiree income. That means HB 8 will provide tax cuts to very few of Kentucky’s 547,000 retirees. The median non-Social Security retirement income in Kentucky is only $12,000 and income at the 75th percentile is just $26,000.

The income tax funds 40% of Kentucky’s state budget, and cutting it substantially as HB 8 does will damage our ability to fund crucial public services. It is a fiscally harmful plan that will benefit the powerful few while hurting the foundational investments that help all Kentuckians thrive.

- The BRTF balance was 15% of receipts in 2021, meeting the first condition. Based on a preliminary analysis, appropriated revenues minus BRTF contributions equaled $11.34 billion in 2021, which is less than receipts of $12.83 billion minus a 1 percentage point income tax reduction of $1.03 billion, meeting the second condition.