This General Assembly, like prior ones, includes a slew of bills that would create new or expand existing tax breaks for a wide variety of people, businesses and activities. While most such bills typically fail to pass, some usually do each session — diminishing the revenue Kentucky has to invest in schools, healthcare, infrastructure and other needs. As of the bill filing deadline last week, legislators had introduced about 40 tax break bills.

Though there are rare exceptions, state tax breaks are often ineffective strategies to achieve particular policy goals. They typically provide only modest incentives that have little effect on behavior compared to other factors and can provide windfalls to businesses or people for actions they would take anyway. Some are simply tax cuts for particular groups or interests. Tax breaks are almost never revisited or evaluated and spending for them comes off the top before any money is appropriated for schools, healthcare, pension liabilities and other budgetary needs.

Here’s a list of the tax break bills introduced and an indication of the cost on full implementation, if available. For those described as refundable, the person or business benefitting will receive a payment if the break exceeds their tax liability. Some can also be “carried forward,” meaning if the full amount of a credit exceeds tax liability in one year, the credit can be applied to reduce tax liability in future years.

- HB 15: Provides a $1,000 refundable income tax credit for volunteer firefighters ($13.2 million).

- HB 21 and HB 44: Provides sales, individual income tax, corporate income tax and limited liability entity tax credits for companies located in the promise zone in eastern Kentucky.

- HB 37: Exempts unmined coal reserves from state and local property taxes ($278,000 state and $2.9 million local).

- HB 51: Reduces motor vehicle property tax rates by 50 percent for certain disabled veterans ($292,000 state and $752,000 local).

- HB 59 and HB 102: Constitutional amendment increasing the property tax homestead exemption for disabled veterans.

- HB 64: Provides a refundable income tax credit for cost of homeowners to mitigate airport noise ($3 million).

- HB 117: Creates a $1,000 income tax credit for hiring unemployed coal industry workers ($5.1 million).

- HB 124: Expands the film tax credit to allow enhanced incentives in five counties (Boyd, Clark, Hart, Madison and Rowan).

- HB 165: Creates a tax credit for the purchase of coal for electricity and industrial processes ($478,000).

- HB 182 and HB 399: Creates a tax credit against insurance and bank franchise taxes for contributions to a fund for investment in rural businesses.

- HB 203: Eliminates the annual cap on the use of angel investor tax credits ($6 million).

- HB 212: Exempts charitable auction receipts from the sales tax.

- HB 214: Increases the refundable income tax credit for donating food to nonprofit food programs from 10 percent to 20 percent.

- HB 216: Excludes from the income tax up to $4,000 in annual contributions for 529 college savings accounts.

- HB 295: Allows an income tax credit for adoption expenses in the amount of 20 percent of the allowable federal credit.

- HB 302: Exempts from sales tax 35% of gross receipts from sale of utilities to restaurants.

- HB 330: Extends the time limit on the tax increment financing district in Louisville from 20 years to 45 years.

- HB 339: Provides a 20 percent refundable tax credit to restaurants for food donations.

- HB 340: Creates a 40 percent nonrefundable income tax credit for donations of land for conservation.

- HB 355: Creates a credit against income taxes for affordable housing development in an amount equal to 50 percent of the federal low income housing tax credit or $5,250,000.

- HB 362: Increases the maximum reimbursement allowed from collecting and remitting sales tax from $50 to $1,500.

- HB 368: Provide a sales tax credit targeted for the new Amazon facility in northern Kentucky for purchase of jet fuel in excess of $1 million a year.

- HB 382: Allows employer contributions to an employee’s student loan debt of up to $5,250 per year to be excluded from the employee’s individual income taxes.

- HB 388: Expands the definition of projects for tax increment financing.

- HB 405: Entirely exempts military pension income from the income tax.

- HB 424: Excludes from the income tax wages from employees working in the eastern Kentucky promise zone and allows employers to keep 75 percent of sales tax otherwise due.

- HB 436: Excludes contributions of up to $10,000 per return to a 529 college savings account or disabilities-related expense account from the individual income tax.

- HB 445: Exempts charitable gaming supplies and equipment from the sales tax.

- HB 457: Expands the Kentucky Business Investment tax break program to include private infrastructure investment.

- HB 518: Creates an income tax credit for investments in abandoned buildings.

- SB 41: Exempts sales of bullion and currency from the sales tax ($745,000).

- SB 93 and HB 248: Provides a nonrefundable income tax credit of $500 for physicians who teach and supervise medical students ($950,000 – $1,000,000).

- SB 102 and HB 162: Provide a nonrefundable tax credit of 90 percent or $1 million for contributions made for scholarships to attend private schools against individual income tax, corporate income tax, limited liability entity tax and bank franchise tax ($25 million to rise to $76.25 million by 2024).

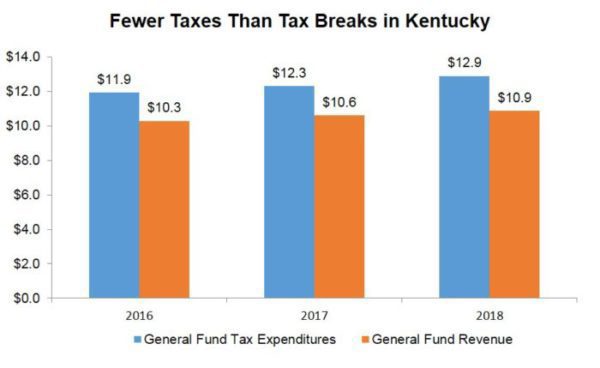

Kentucky already spends more on tax breaks than on direct investments in our communities, as the graph below shows. Instead of adding a plethora of new breaks, we should be scrutinizing the ones we already have and cleaning up the tax code. That way, we can generate a more sustainable flow of revenue for effective public investments that have been cut in recent years.

Billions of dollars. Source: Office of the State Budget Director

Billions of dollars. Source: Office of the State Budget Director

It is unclear whether any of the tax break bills proposed this year will get signed into law this session. The governor actually vetoed a tax break bill the legislature passed last year. But a big question for tax reform, which the governor says he wants to tackle in a special session this year, is whether legislators will avoid the temptation to create even more tax breaks such as the ones they are now filing – some of which have powerful special interests backing them.