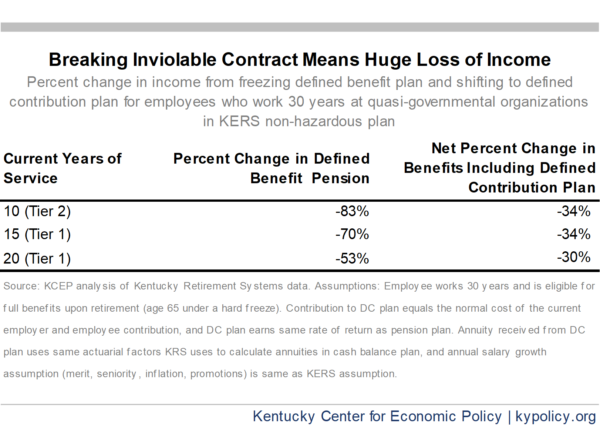

Pension proposals for quasi-governmental organizations that attempt to break the inviolable contract for current employees will result in a huge loss of retirement income for those affected, with career employees at risk of losing approximately a third of their benefits.

The Senate version of HB 358 included a “hard freeze” of pensions for current employees at these 118 “quasi” agencies, which include regional universities, health departments and community mental health centers. That means current employees would no longer accrue service credit in the existing defined benefit pension plan and would be immediately shifted to a 401k-style defined contribution plan for the remainder of their years.

For mid-career employees who intend to retire from their jobs, that would be a huge loss of benefits because of the way defined benefit and defined contribution plans work. Defined benefit plans depend on years of service and final average salary, both of which would be cut off prematurely under a hard freeze. Defined contribution plans are worth far less the fewer years an individual pays into them due to the power of compounding interest, making starting a plan later in a worker’s career of limited value.

As shown in the table below, current employees with 10, 15 and 20 years of service would see a net loss of benefits of an estimated 30 to 34 percent. Many workers would lose well over $100,000 in lifetime retirement income.

The General Assembly left without agreement on a plan to relieve quasi-governmental agencies of unnecessarily spiking pension costs, and may address the issue on the session’s final day, March 28. Any proposal must be considered with full awareness of the impact on employees.

There are 9,075 workers at quasi-governmental agencies in the Kentucky Employees Retirement System (KERS) non-hazardous plan, most of whom are Tier 1 or Tier 2 employees. A hard freeze for these employees is clearly at odds with the inviolable contract, and for good reason — it breaks the promise under which they were hired and drastically reduces their income in retirement.