Few people like Tax Day. Filling out forms and mailing off checks doesn’t usually inspire reflection on the bigger purpose of taxes.

Yet most people can agree on the priorities our tax dollars pay for. With them — and through our local, state and federal governments — we invest in good schools and universities, well-kept roads and bridges, social services for vulnerable children and adults, safe and beautiful communities and other public structures essential for shared prosperity in the Commonwealth.

In other words, taxes are a critical tool for doing important things together that we cannot do alone. Here in Kentucky, state tax dollars go for:

Education: Early childhood education and child care; K-12 education; higher education; adult education; worker training; vocational education; libraries; public television.

Health Care: Health insurance for people with disabilities, pregnant women, low-income children and parents, and the elderly in nursing homes through Medicaid; public health; mental health services; disability services; substance abuse services.

Human Services and Supports: Child and domestic violence protection; foster care and adoption; housing; nutrition assistance; support for low-income families; support for veterans; support for the elderly.

Infrastructure: Roads; water and sewer systems; public transit.

Environmental Protection: Land conservation; enforcement of laws protecting land, air and water; state parks; forest protection and management.

Public Safety and Justice: Court system; public defenders and prosecutors; state police; jails and prisons; disaster relief; consumer and worker safety protection.

Economic and Community Development: Small business development; tourism; job development; agricultural development; arts and culture.

Kentucky is projected to collect about $9.8 billion in revenue in its General Fund in 2015. Fourty-one percent of the General Fund is expected to come from the individual income tax; 32 percent from the sales tax; six percent from the property tax; seven percent from corporate taxes and the remaining from the coal severance tax, cigarette tax, lottery and other sources.

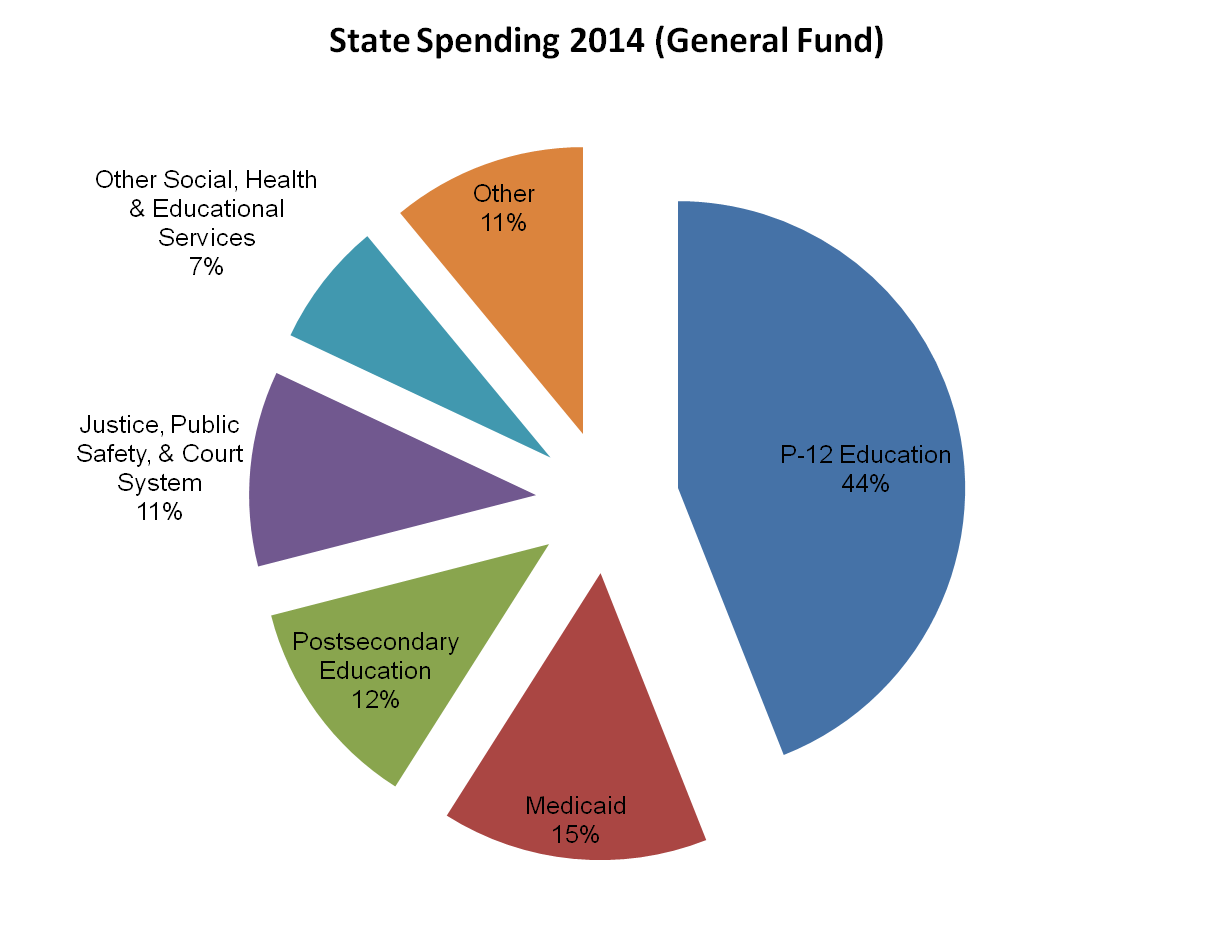

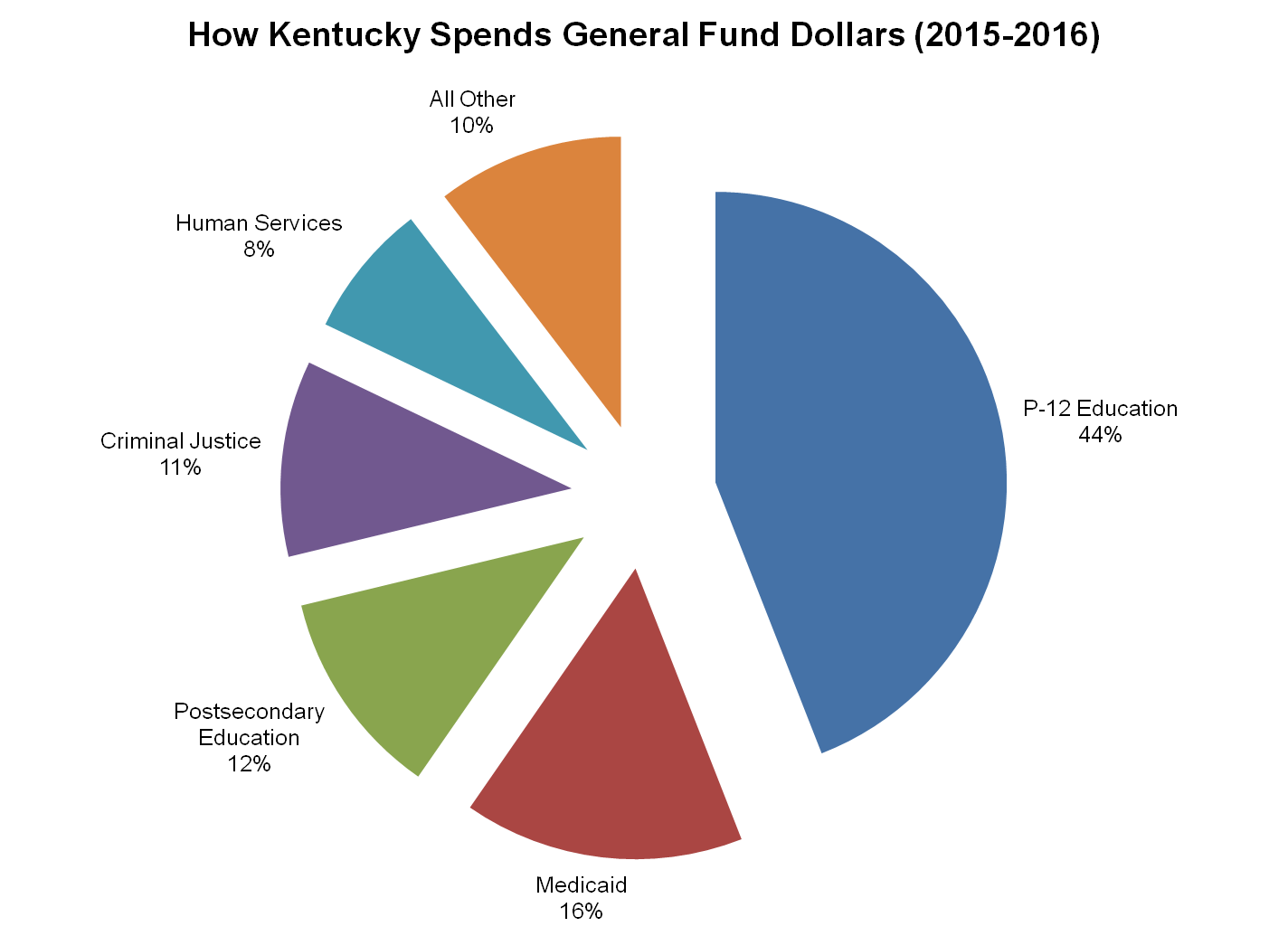

For 2015-2016, General Fund resources are allocated as follows:

Source: Office of the State Budget Director

For a closer look at how our state tax dollars get appropriated to different budget areas, click here. And to see where federal tax dollars go, click here.

Unfortunately, those seeking to shrink or eliminate many of these investments capitalize on our distaste for tax forms and payments by telling us we’d be better off with more tax cuts. But that would starve the very public systems and structures we need for a strong workforce and economy — often through policy choices that let wealthy individuals and businesses off the hook while shifting responsibility for public investments onto the middle class and poor Kentuckians. Furthermore, we know individual and corporate income tax cuts aren’t the way to a stronger economy and more jobs.

What we actually need is tax reform to fix our eroding tax base and restore investments in the things that make us truly competitive like good schools and healthy workers. The state currently faces a $14 billion unfunded liability in the teachers’ retirement system. SEEK, the state’s main funding formula for P-12 schools, is still 10 percent lower per pupil than it was in 2008, once inflation is accounted for. And many other public needs go unfilled after 14 rounds of budget cuts totaling $1.7 billion since 2008.

Bad news aside for another day, the important takeaway on Tax Day is that tax dollars pay for investments that benefit all Kentuckians.