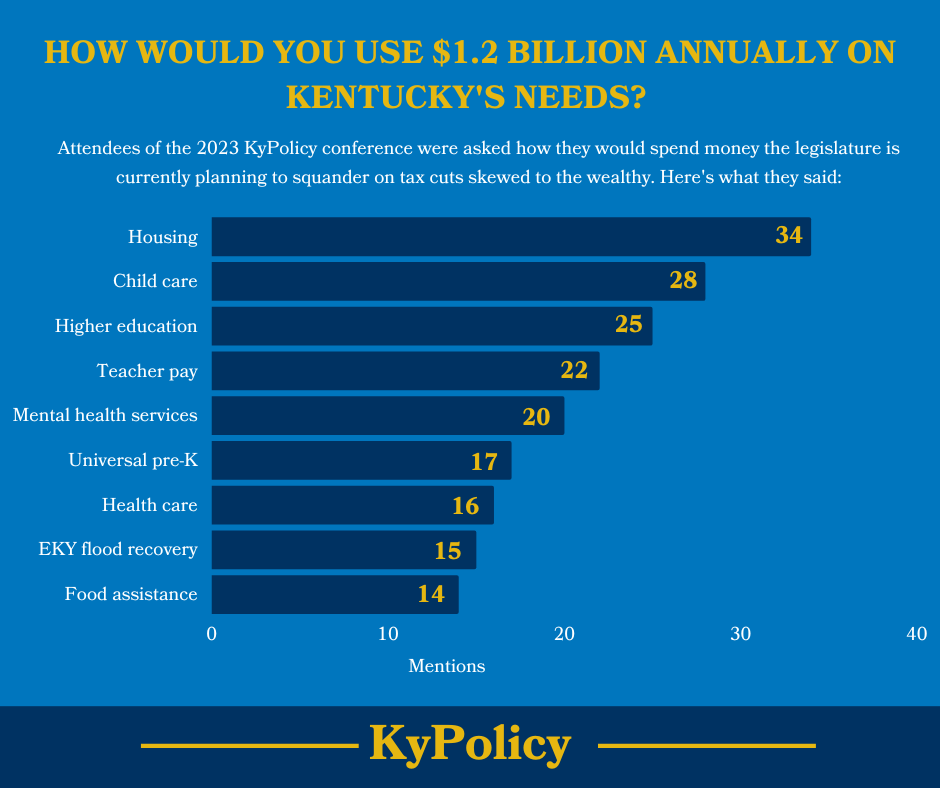

Kentucky’s state government should use the $1.2 billion lawmakers are poised to squander each year on tax cuts skewed to the wealthy to instead fund housing, childcare, education and mental health, according to a diverse group of Kentuckians who attended the 2023 KyPolicy conference.

The group of more than 150 people, which included students and retirees, first-time attendees and longtime advocates, rejected the argument that the state has met all of its needs, leaving more than a billion surplus dollars.

The legislature plans to spend that so-called surplus on an income tax reduction. House Bill 1, which would cut the income tax rate to 4%, passed the House in January and the Senate is likely to follow suit next week. Once fully implemented, a 4% income tax would reduce state revenues by $1.2 billion compared to when the rate was 5%.

Attendees of the KyPolicy conference were asked if they could envision better uses for that money. They were not short on ideas.

After the conference, KyPolicy reviewed the suggestions. The most popular idea was housing assistance, with a particular emphasis on providing homes for natural disaster victims in eastern Kentucky. Dozens of people also said Kentucky needs to do more to provide affordable and high quality child care to families across the commonwealth. Education was a topic of great concern. Conference attendees said Kentucky needs to invest more in higher education, raise pay and address the teacher shortage, and expand early childhood education.

Kentucky has no shortage of unmet needs. Right now, we have the money to begin meeting many of them. Lawmakers should seize this opportunity and fund more of the transformative investments that will build a better Kentucky.