Undocumented immigrants contribute to the Kentucky communities in which they live and work in a number of ways, including through taxes. Because immigration reform would provide a pathway for full compliance with tax laws — as well as improve immigrants’ ability to earn financial and human capital — it would also increase the taxes they pay.

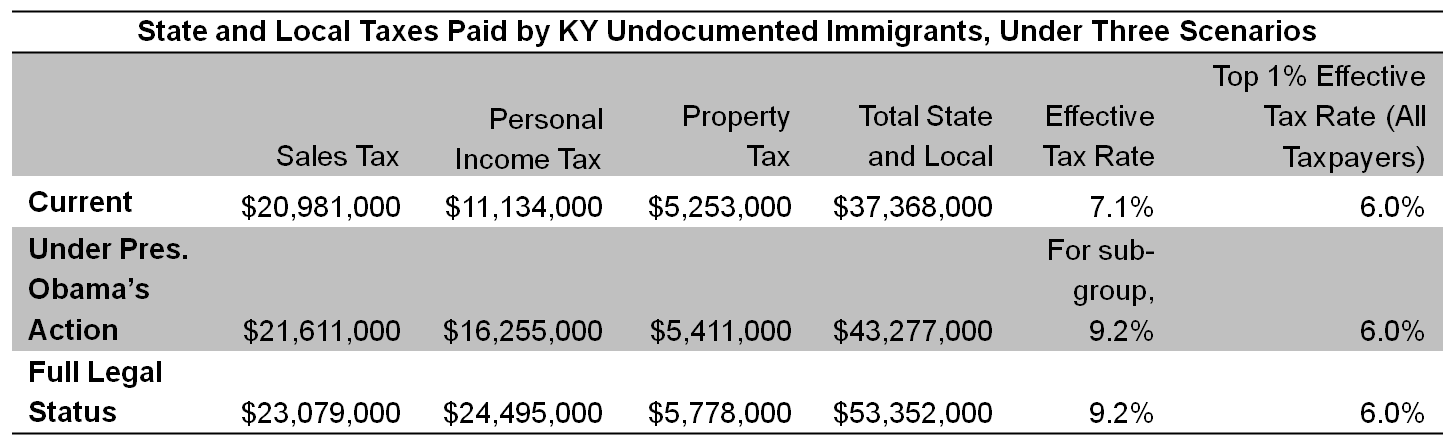

A new report from the Institute on Taxation and Economic Policy estimates the 45,000 undocumented immigrants living in Kentucky today pay $37 million every year in state and local taxes — at an effective tax rate of 7.1 percent of family income (compared to the wealthiest 1 percent of Kentuckians who pay just 6 percent). Under comprehensive reform granting them legal permanent residence, taxes would increase to $53 million and their tax rate to 9.2 percent.

The report also estimates that under President Obama’s “Deferred Action” programs which grant a temporary stay from deportation for 18,000 qualifying undocumented immigrants in Kentucky, tax contributions would increase by $6 million annually. That population includes parents of U.S. citizen children and young adults who have been in the U.S. for at least five years. DACA and DAPA, as these programs are known, are awaiting Supreme Court review.

Nationwide, undocumented immigrants contribute about $11.6 billion in taxes. This would go up by about $805 million under the Obama administration’s executive actions and would increase by $2.1 billion under comprehensive reform.

Like American citizens, undocumented immigrants across the 50 states pay property taxes as homeowners or renters (as landlords pass the costs through); sales taxes on the things they purchase; and income and payroll taxes on their earnings. Bringing them out of the shadows will benefit immigrants and the communities they live in, including public institutions that rely on tax revenue.

Source: Institute on Taxation and Economic Policy