The House plan to repeal healthcare reform, known as the American Health Care Act (AHCA), provides a tax cut to the wealthiest people while reducing the number of Americans with health coverage by an estimated 24 million, according to the Congressional Budget Office. Because Kentucky has relatively few high earners, we benefit even less from the tax cuts than almost any other state even while Kentucky has among the most to lose from people becoming uninsured under the plan.

Two of the biggest tax cuts in the AHCA are repeal of taxes on investment income and earned income that apply only to people who make more than $200,000 a year.

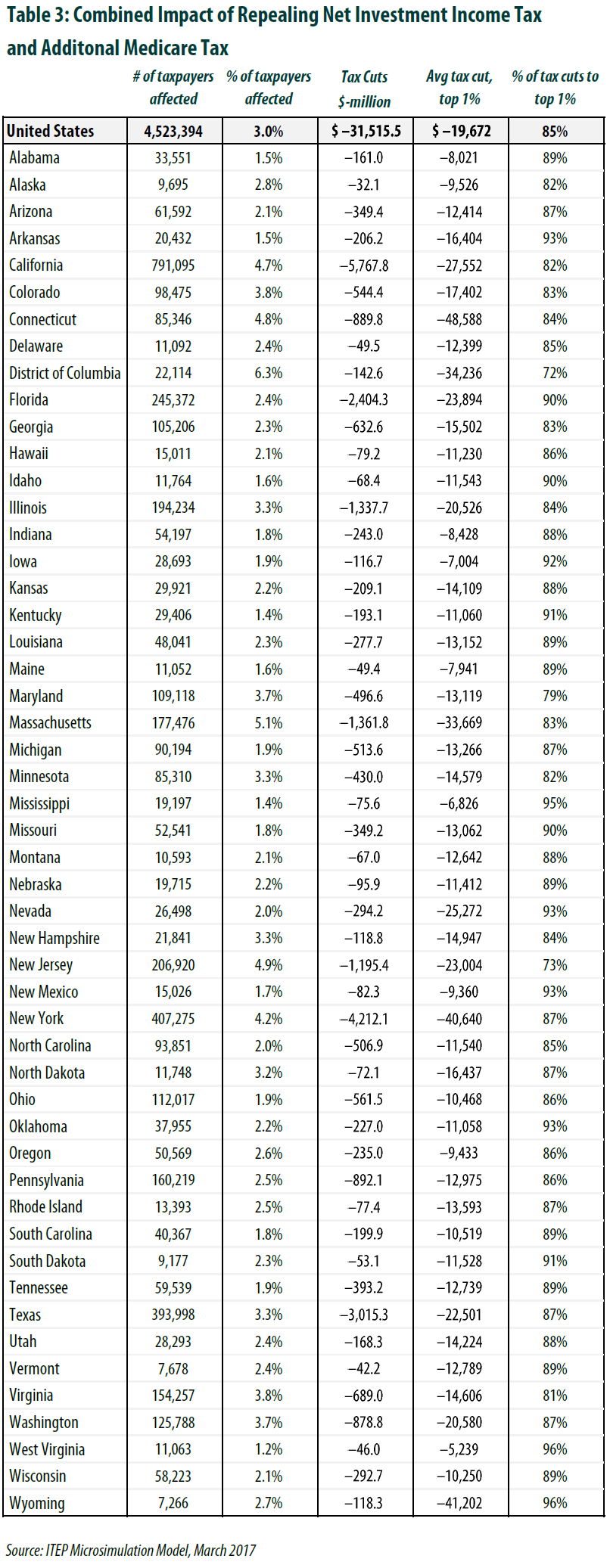

Cutting those taxes would benefit only 1.4 percent of Kentuckians, according to an analysis by the Institute on Taxation and Economic Policy (ITEP). That’s less than half of the three percent of Americans who would receive tax cuts. Of all the states, only West Virginia has a smaller share of the population getting tax cuts, at 1.2 percent.

ITEP estimates that in Kentucky 91 percent of the tax cuts will go to the top 1 percent of people, who will receive an average cut of $11,060. The total tax cuts in Kentucky amount to $193 million while $5.8 billion in tax cuts would go to high-income people in California and $4.2 billion in New York.

See the table below for more information on who benefits from these tax cuts: