The 2017 federal Tax Cuts and Jobs Act (TCJA) provided substantial windfalls to America’s highest earners at the expense of programs vital to the wellbeing and security of everyone else. Now, Congress is considering making many provisions of the TCJA permanent. To make matters worse, the inequitable tax cuts in the “TCJA 2.0” are being paired with devastating budget cuts to already vulnerable programs that people across Kentucky rely on every day, such as Medicaid and the Supplemental Nutrition Assistance Program (SNAP).

The TCJA made sweeping changes to the federal tax code, including cutting the corporate tax rate, reducing individual income tax rates, doubling standard deductions and expanding the child tax credit. To reduce the overall cost of the legislation, certain provisions of the original TCJA were restricted to a ten-year budget window. Some substantial provisions— primarily those benefiting corporations—were already made permanent, such as a reduction in the corporate tax rate from 35% to 21%. Other key provisions will expire at the end of this year if they are not extended, including reductions in personal income tax rates, reductions in estate taxes, increases in standard deductions and increases in the child tax credit.

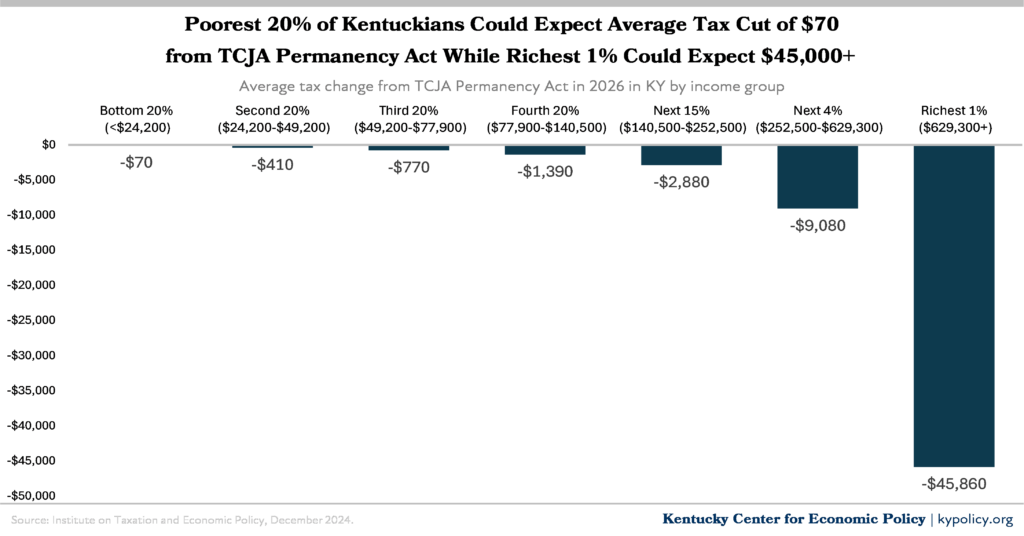

However, Congress is now crafting another budget that would permanently extend the 2017 cuts and cost an estimated $466 billion of revenue in just the first year. Much like the recent Kentucky state income tax cuts, components of the original TCJA disproportionately benefited the wealthiest in our state, and the extension of the expiring provisions will perpetuate those tax cut disparities across income groups, as illustrated in the graph below.

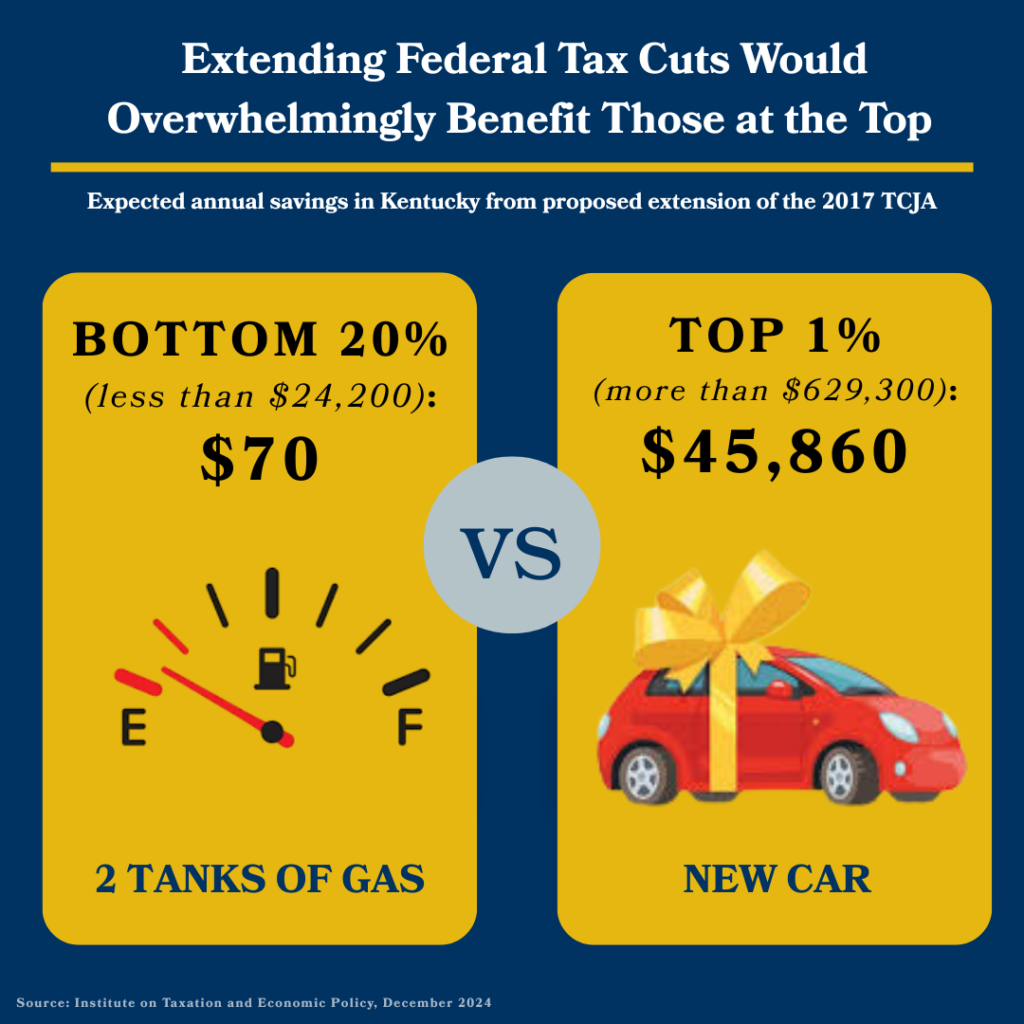

Under the “TCJA 2.0,” the poorest Kentuckians with average incomes of less than $24,000 would expect to receive a tax cut of around $70 annually, not even enough to cover the cost of two tanks of gas. Meanwhile, the top 1% of earners in the state would pocket over $45,000 each year, enough to purchase a new car. Additionally, the total impact of the tax cuts, proposed budget cuts and Trump administration tariffs would result in a net harm to the bottom 80% of income earners who will pay more for goods due to higher prices and many of whom will lose SNAP and Medicaid coverage.

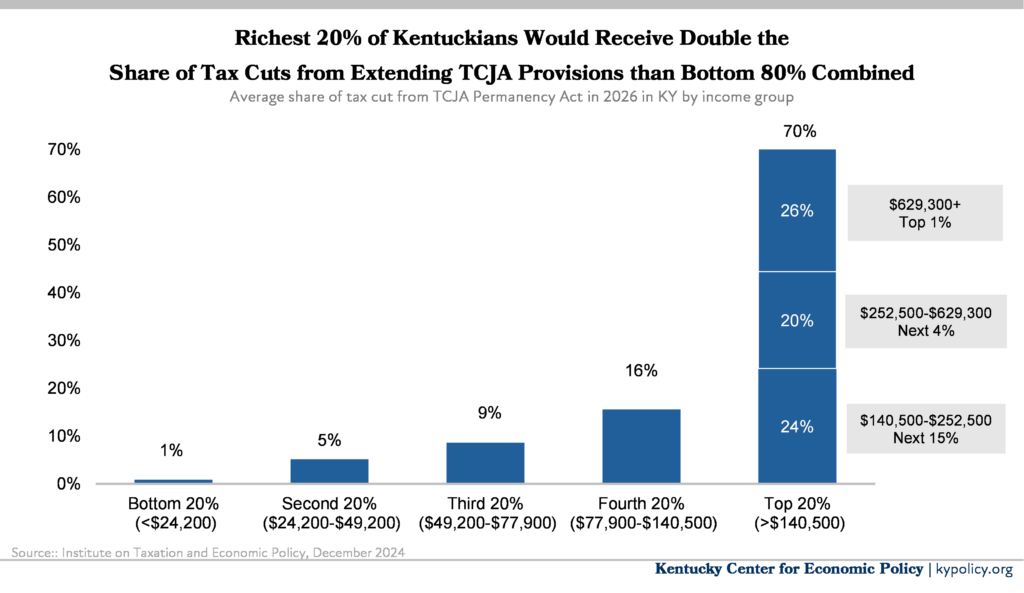

When considering the proposed tax cuts overall, shares of the pie would be unevenly distributed across income groups, as reflected in the graph below. Even differences of tax cut shares between those within the top fifth of salary ranges — grouped as the top 1%, the next 4%, and the next 15% — are notably varied. Generally, the richest 20% of Kentuckians would receive more than double the share of tax cuts compared to the other 80% of residents.

Etching the TCJA provisions in stone will require raising further the national debt, decreasing our base of revenue and restricting funding to the programs that support families and communities and keep society functioning. As consequences of diminishing state revenue sources continue to unfold, Kentuckians don’t need the federal government to also jeopardize funding for essential needs by giving more breaks to the already wealthy.