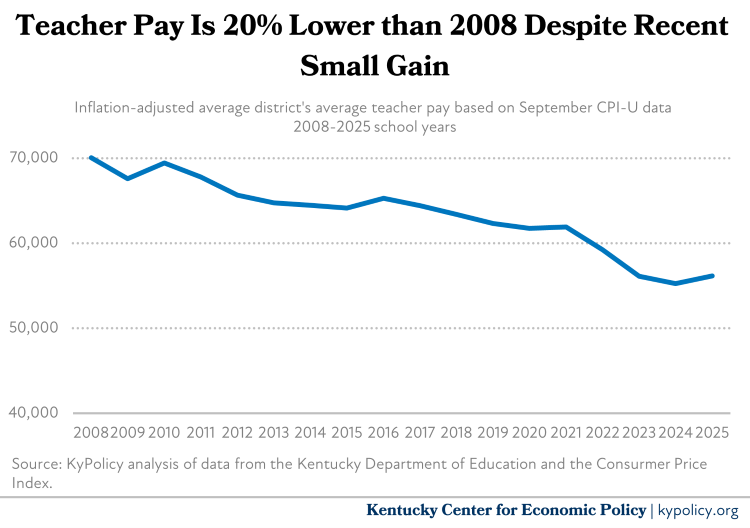

This school year, average district pay for Kentucky teachers is $13,888 less than 2008 once adjusted for inflation, according to new data from the Kentucky Department of Education. That’s a 19.8% decline.

This dramatic reduction in real pay comes despite average pay for teachers in 77% of Kentucky’s school districts slightly rising above inflation this school year. Statewide, average teacher pay rose an inflation-adjusted $908 this year, which amounts to a 1.6% increase.

The state of educator pay in Kentucky has affected teachers in every school district and contributed to a growing teacher shortage in the commonwealth, straining public school systems and making it more difficult for students to succeed in the classroom. Addressing lagging teacher pay is just one of the many budgetary needs facing the commonwealth as the General Assembly considers further reducing our state revenue through income tax cuts in the 2025 session.

Real teacher salaries in Kentucky are much lower than 16 years ago

The long-term erosion in state funding for local schools — despite a constitutional mandate that makes public education a state responsibility — is the major cause of declining real teacher pay. Years of stagnant funding means that base SEEK (the core funding formula for public education) will be an inflation-adjusted 26% less in 2025 than it was in 2008.

Yet the problem of public employee compensation has been on the radar of the Kentucky General Assembly for the past several years. Recognizing years without state employee raises, lawmakers appropriated funds for state worker raises in the 2022-2024 and 2024-2026 budgets, but left teachers out. In the current budget, the legislature left it up to local districts to stretch existing state and local dollars to cover teacher and school employee raises. The last time Kentucky teachers received a state-mandated dedicated raise above 2% was in 2008. This lack of adequate state funding and/or dedicated extra dollars for teacher pay resulted in the average school district paying teachers 19.8% below what they were being paid in 2008.

Looking at the district level, teachers have seen an inflation-adjusted pay cut on average in every district between the 2008 and 2025 school years, ranging from -30.6% in Eminence Independent to -1.3% in Fayette County.

Compared to 2024, however, 132 out of Kentucky’s 172 school districts saw inflation-adjusted average teacher salaries grow by 2.6% on average in the 2025 school year. This means that for 40 school districts, average teacher pay fell an inflation-adjusted 1.4% (average teacher pay fell outright for four school districts, even without adjusting for inflation).

The problem may even be worse than the data suggest because the teacher workforce has been skewing toward more years of service recently. Analysis from 2024 shows 18% fewer new teachers (those with nine or fewer years of experience) than in 2008, and 50% more teachers with 10 to 34 years of experience. Because teachers with more years of experience are paid higher salaries, the shift since 2008 toward a larger share of higher-paid teachers will have pulled the average wage up, obscuring the real extent of the fall in pay.

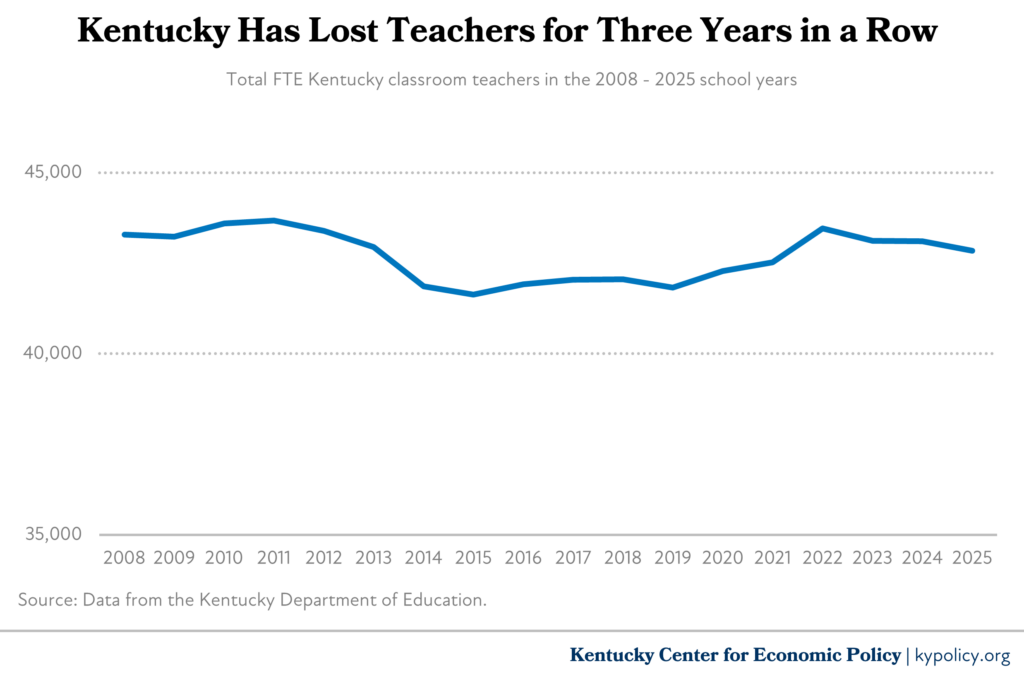

In addition, new teachers hired since 2022 have far less generous pension benefits than prior generations of teachers received. Falling compensation makes recruitment and retention very difficult in a labor market where private sector wages have far outpaced public sector wages. As a recent legislative report outlined, more teachers are leaving the profession and fewer are entering it. Pay, lack of respect and burnout are major contributors, according to that analysis.

The result of declining wages and poorer benefits is that the number of Kentucky teachers has fallen for the third consecutive year. In the 2025 school year, Kentucky had 623 fewer full-time-equivalent (FTE) classroom teachers than in the recent peak of 2022.

The General Assembly’s long-term underfunding of education is to blame, more income tax cuts will make problem worse

State funding cuts to public education in the wake of the Great Recession, and funding increases that haven’t kept up with inflation thereafter, have been the main cause of slipping teacher pay. That problem will become much worse if the General Assembly continues to cut the individual income tax. Until recently, the income tax was Kentucky’s largest source of revenue before lawmakers reduced the rate by a full percentage point. Each half-point reduction in the income tax costs the state budget approximately $650 million annually. Another cut enacted this session will not be fully implemented until the next two-year budget period, and will make it even harder for the state to regain the ground that has been lost in average teacher pay.