The General Assembly introduced a tax bill today that is a shift in taxes away from corporations and high-income people and over to low- and middle-income Kentuckians. Although the official estimate is that it would bring $248 million more in net revenue by the second year, the plan relies heavily on a fading source in a cigarette tax increase and very uncertain new revenues from conformity to the federal tax code. By moving away from more productive income taxes to slower-growing consumption taxes, it will worsen Kentucky’s budget problems in the future.

Plan cuts individual and corporate income taxes – a tax cut for the wealthy

The bill moves away from reliance on income taxes through a steep and expensive cut in income tax rates from a top rate of six percent to a flat rate of five percent. That rate cut itself costs more than $500 million a year in individual income tax revenues, according to earlier analysis by the Institute on Taxation and Economic Policy. House Bill 366 tries to partially make up that lost revenue by lowering the threshold of exempt retirement income from $41,110 to $31,110 (a change that was later proposed to be taken back in a late-night amendment that passed the House and is now in the Senate), by limiting some itemized deductions and credits and by adopting the federal tax code as of December 31. It will result in $61 million in lost individual income tax revenue by the second year, assuming the revenue estimates accompanying the bill prove correct.

The tax plan also contains a substantial cut in corporate income taxes, with a net loss of $50 million the second year of the budget — or about 8 percent of Kentucky’s corporate income tax revenues. The plan:

- Cuts and flattens the corporate income tax rate to five percent;

- Adopts the “single sales factor” approach to apportioning corporate income, which provides a major windfall to a handful of large corporations. A 2012 letter arguing for this change from the “Kentucky Single Sales Factor Coalition” mentioned a membership including Amazon, Brown-Forman, Marathon Oil, Papa Johns, UPS and Yum Brands;

- Creates a credit against the income tax based on amount paid in business inventory tax;

- Adopts the federal tax code as of December 31, 2017, which includes a huge 20 percent deduction for companies organized as pass-through entities that will encourage corporations to reorganize and could mean even more lost revenue in the future.

On a positive note, the bill also limits some tax breaks including suspending the angel investor tax credit, a large subsidy to wealthy investors, and capping the film tax break. But as a whole it cuts individual and corporate income taxes by $111 million in 2020.

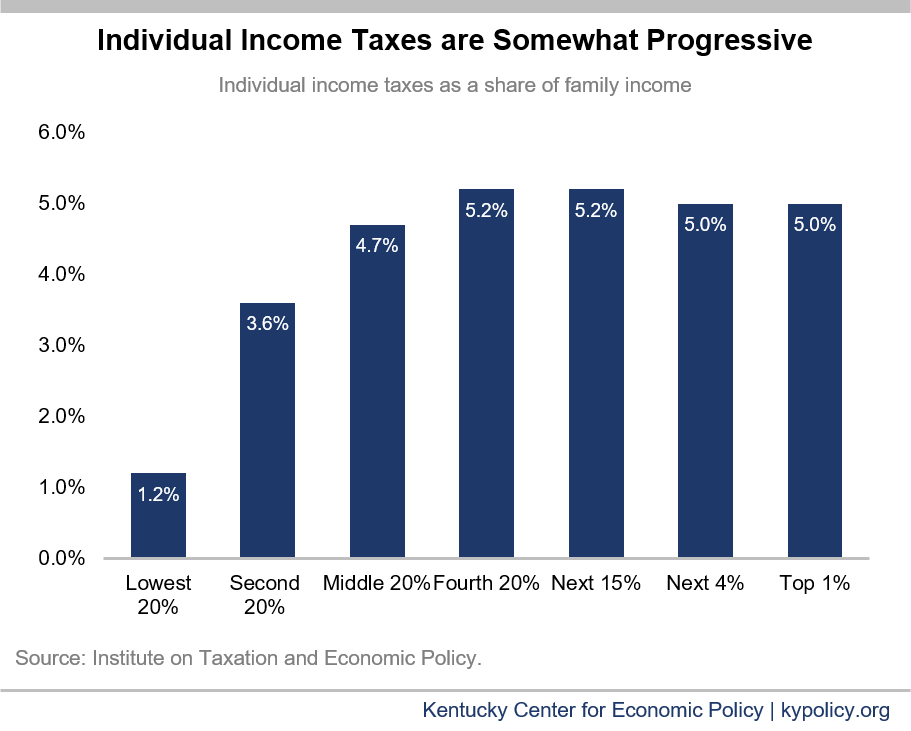

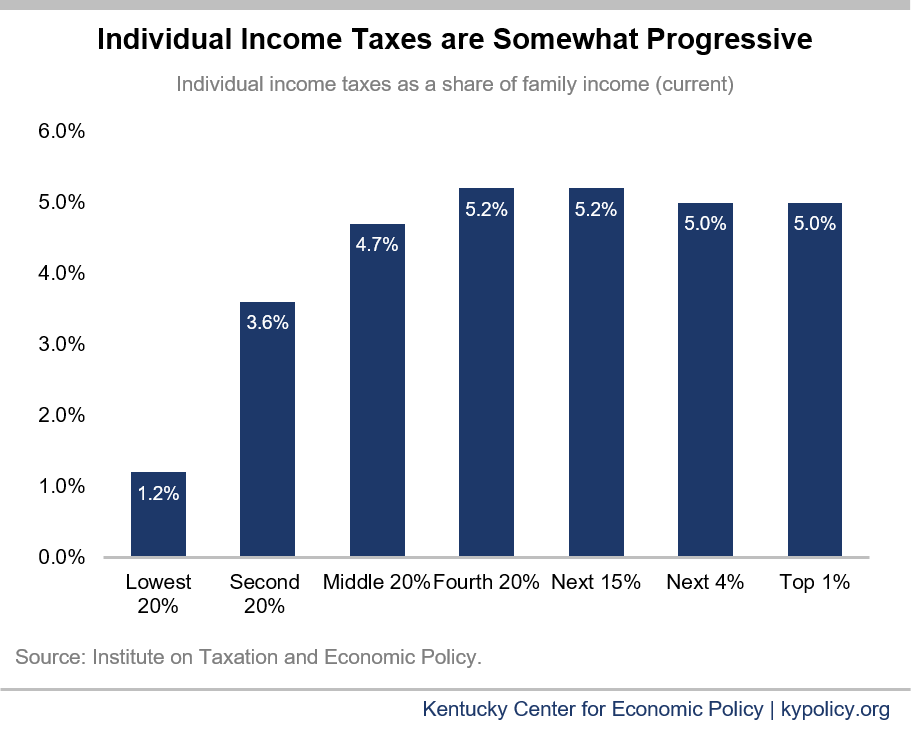

Because income and corporate taxes ask more of the wealthy and corporations, these changes mean high-income people and businesses will contribute a smaller share to Kentucky’s budget needs. Below is the distribution of who pays individual income taxes currently in Kentucky by income group.

Plan relies more on consumption taxes that ask more of low- and middle-income Kentuckians

The revenue generators in the plan come from consumption taxes, with $248 million in the second year coming from sales taxes. The majority will come from a tax on the labor and services associated with the repair, installation and maintenance of taxable personal property, bringing in $146 million according to the state’s tax expenditure report. The biggest item in that category is the tax on automotive repair and maintenance at $84 million. The bill also includes taxes on some services including landscaping services ($40 million) and janitorial services ($29 million).

The other big increase in the plan is a bump in the excise tax on cigarettes to 50 cents per pack and a tax on electronic cigarettes. That will raise $133 million in the first year and $112 million in the second year. This increase will not have as large an effect on decreasing youth smoking as the proposed $1 a pack increase. But it will be a regressive tax, taking a bigger share of income from the poor.

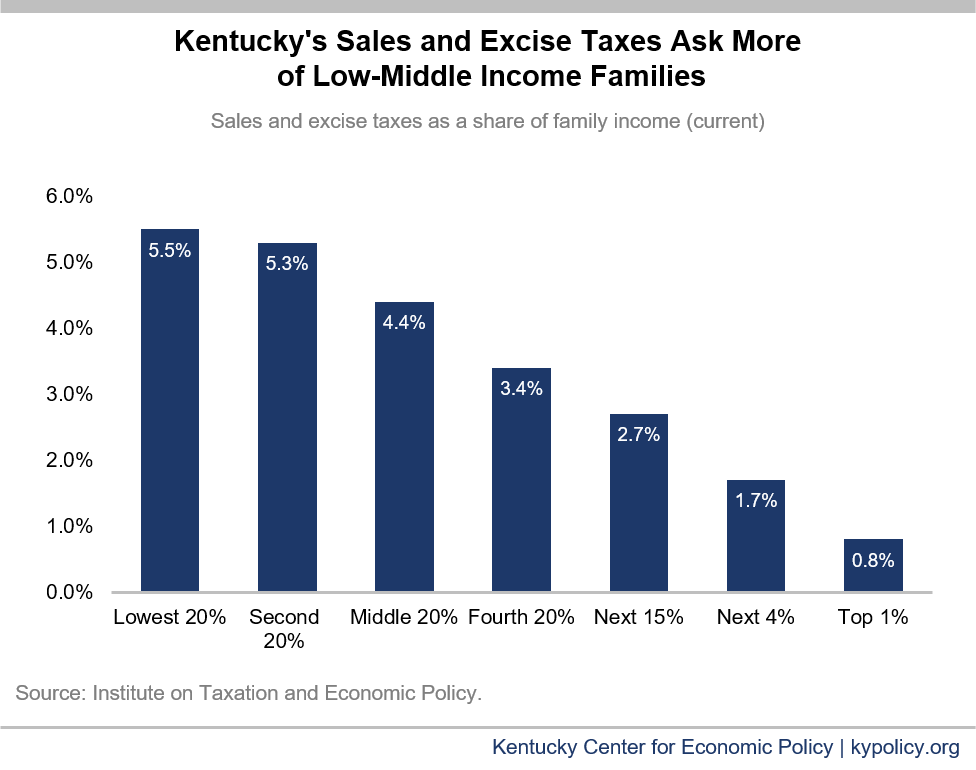

As detailed in the graph below, sales and excise taxes make up a bigger share of income for lower- and middle-income people than for high-income people. Relying more on consumption taxes results in a shift in who pays taxes to an even more upside-down tax system.

Long-term effects on revenue could be negative

Although the bill purports to generate $248 million in total net new revenue by 2020, its revenue impact is uncertain and its long-term revenue impact is likely to be negative. The revenue estimate relies in part on expected revenue from conformity to the federal tax code, as mentioned above, including changes made in the federal tax plan adopted in December. Yet the impact of those changes on state tax codes is in fact very uncertain, and the deduction for pass-through income mentioned earlier could be a growing drain on revenue.

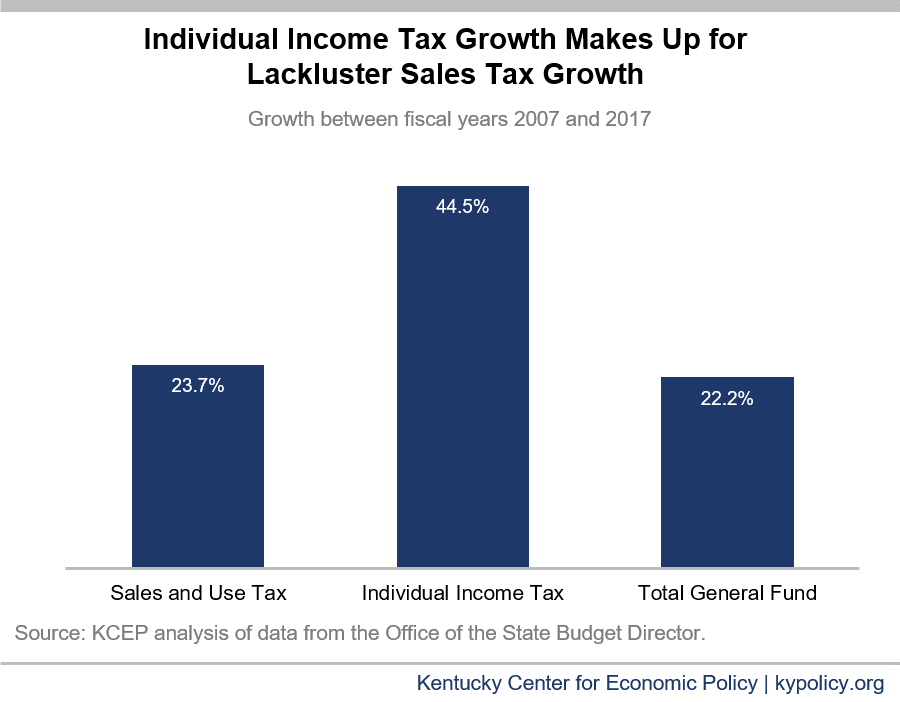

Secondly, the plan relies on slower-growing consumption taxes for increases while moving away from more productive income taxes. In an economy where most income growth is at the top and where corporations are experiencing record profits, a tax system that taxes them less while taxing low- and middle-income people more will result in slower revenue growth. Historical performance of the General Fund (see graph below) shows that growth in the individual income tax revenue has outpaced sales tax revenue, making a shift from the former to the latter a harm to the General Fund over time. Especially since the plan relies on a tobacco tax increase for approximately half the net new revenue, Kentucky will not be able to sustain the added revenue as consumption of tobacco products continues to decrease.

Plan will not propel Kentucky’s economy nor result in compensating revenue growth

Claims that these tax changes will make Kentucky more “competitive” and generate more revenue by attracting businesses and individuals to Kentucky are unfounded, and have been disproved by experiments in numerous other states including Kansas, North Carolina, Ohio and Louisiana. State business taxes are a very small part of the cost of doing business, and matter little in business location decisions. Few individuals migrate and those who do so base it on job opportunities, family considerations or climate and not income or other taxes. Meanwhile, income tax cuts undermine revenue growth, leading to more cuts in the public investments like education and infrastructure that are the very building blocks of our communities and economy.