Special Tax Breaks and Preferences a Big Drain on Kentucky’s Budget

Report identifies ways to more closely scrutinize “tax expenditures”

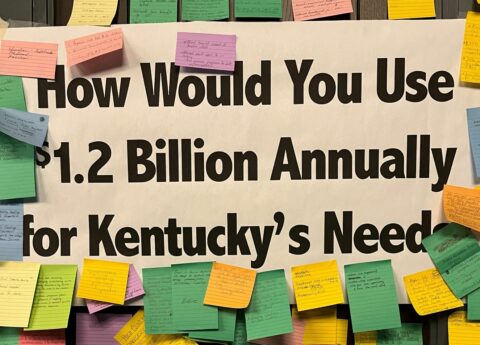

A new report, “Reforms Needed to Bring Greater Scrutiny to Tax Expenditures,” notes that Kentucky loses billions of dollars in revenue each year through provisions in the state tax code known as tax expenditures, yet does little to understand the effectiveness of these provisions.

“Special tax breaks and preferences result in billions of dollars in lost revenue at a time when Kentucky struggles to protect investments in key public necessities,” said Jason Bailey, Director of the Kentucky Center for Economic Policy. “Yet these holes in the tax code receive far less scrutiny than spending in the state budget. Kentucky has made painful budget cuts the last couple of years, but has done little to more closely scrutinize its tax expenditures.”

Kentucky’s budget office produces a document that identifies tax expenditures and estimates the lost revenue every two years, and their most recent report contains 287 tax expenditures. Significant tax expenditures include those related to businesses and economic development, the exclusion of services from the sales tax and other sales tax exemptions, the variety of income tax deductions and the state’s limitation on the property tax.

Addressing tax expenditures is central to good tax reform. Yet the state lacks the systems to understand the purpose of many tax expenditures, assess their effectiveness and make regular and informed decisions about whether individual tax expenditures are worth the lost revenue.

“We need to put tax expenditures on a more even playing field with the public necessities and investments that tax dollars pay for,” said Bailey. “The commonsense reforms included in this report will move us in the right direction and help us make better choices about our fiscal and economic future.”

Recommendations in the report include identifying who benefits from particular tax expenditures; creating a tax expenditure review committee to regularly assess the effectiveness of tax expenditures; requiring many tax expenditures to expire at least once a decade; mandating that the Executive Branch make recommendations about reviewed tax expenditures as part of its budget proposal; and creating cost caps on some tax expenditures.

The report, titled “Reforms Needed to Bring Greater Scrutiny to Tax Expenditures,” can be accessed here.

###

The Kentucky Center for Economic Policy (KCEP) was founded in 2011 with the purpose of conducting research, analysis and education on important state fiscal and economic policy issues. KCEP seeks to create economic opportunity and improve the quality of life for all Kentuckians. The Center is an initiative of the Mountain Association for Community Economic Development (MACED) and is supported by foundation grants and individual donors.