A new report from the credit rating agency Standard and Poor’s (S&P) says that growing income inequality is making it harder for states to generate the revenue needed to fund education and other public services, especially in states more dependent on sales taxes.

The report should be read both as a warning to Kentucky not to go down the road of a consumption-based tax system and as more evidence that the state should rely on progressive income taxes to better fund needed public services.

The report is a follow-up to a recent S&P study that suggested growing income inequality is actually harming U. S. economic growth by reducing consumer spending, limiting social mobility and creating more of a boom and bust economy. It extends that analysis to inequality’s impact on state revenues, and finds that the weaker economic growth resulting from rising inequality has meant a slowdown in annual state revenue growth over the last few decades. It’s also meant greater volatility in revenues since they’re more closely linked to the performance of financial markets.

S&P then analyzes how states with different mixes of taxes have performed in relation to growing inequality. They look at the ten states most dependent on income taxes and the ten states most dependent on sales taxes (Kentucky is in neither group, but Tennessee and Texas are among the sales tax-reliant). S&P finds that income inequality has a stronger negative effect in sales-tax dependent states than income tax-dependent states and is only statistically significant for the sales tax-reliant states.

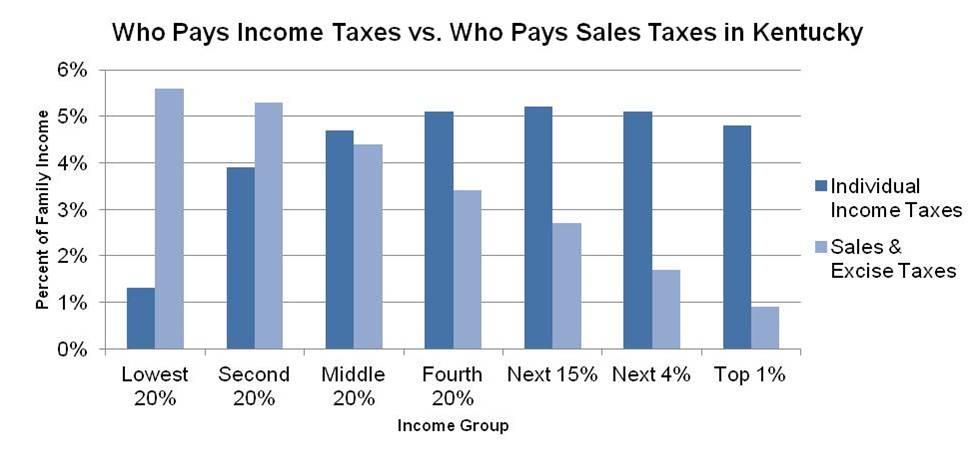

What does this mean? That states with a less regressive tax structure—one that asks more in taxes from higher income people than those at the middle or on the bottom compared to other states—have been able to mitigate much of the effect of income inequality on revenues by aligning their tax systems to where incomes are growing: at the top. The income tax is a progressive tax while the sales tax is just the opposite, as seen in the graph below on who pays income taxes and sales taxes in Kentucky.

Source: Institute on Taxation and Economic Policy

The report suggests that states choosing to introduce new higher income tax rates for the rich in recent years have helped counteract the effects of the growing income gap on their budgets. The report does say that those states more reliant on income taxes face the problem of revenue volatility—bigger fluctuations in revenue from year to year—as widening income inequality has meant a greater share of income comes from investments as opposed to wages and salaries. But that challenge can be addressed by building up bigger rainy day funds in good times to help in bad times.

Income inequality is growing in Kentucky and the nation. Since 1979, nearly half of the income gains in Kentucky have gone to the top one percent. To protect and strengthen investments in schools, health and other services needed to improve quality of life, Kentucky would be wise to ignore partisans of a shift to greater reliance on sales taxes and make changes that create a fairer and more sustainable revenue system that recognizes the growing gap in incomes.