A couple of legislators have floated the idea of raising the sales tax by one percentage point rather than taking action on a tax reform package. But such a plan would make Kentucky’s tax system less equitable while doing nothing to address the fundamental challenge of long-term revenue growth.

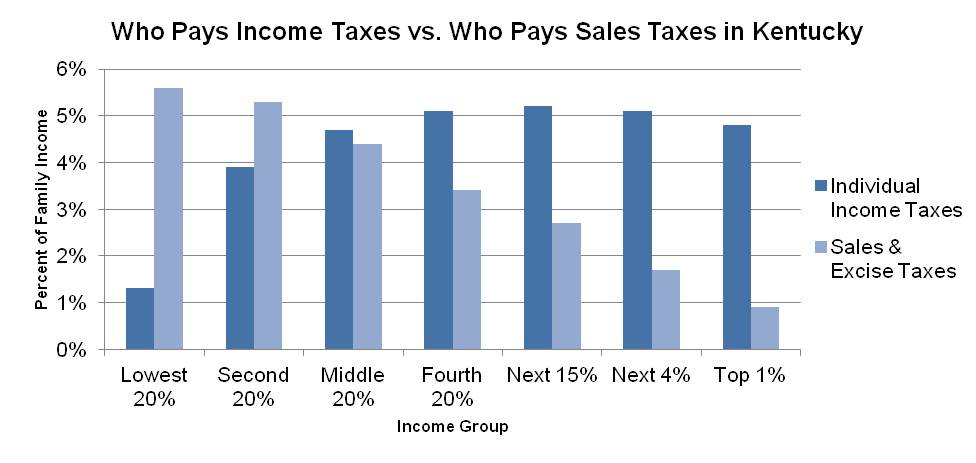

Increasing the sales tax would be a very regressive approach, meaning that it would impact low- and middle-income Kentuckians more than those with higher incomes. Research by the Institute on Taxation and Economic Policy (ITEP) shows that the poorest 20 percent of Kentuckians pay over six times more of their income in sales taxes than the richest one percent of Kentuckians do.

Source: Institute on Taxation and Economic Policy

In contrast, the Governor’s tax reform commission proposed a more balanced income and sales tax package. Several of the income tax proposals, including those limiting itemized deductions and phasing out the exclusion of retirement income for those with greater means, would ask more of wealthier Kentuckians. And the 15 percent state earned income tax credit recommended by the commission would make Kentucky’s tax system fairer for those working low-wage jobs.

And fairness should be a high priority. As ITEP has shown, the richest one percent of Kentuckians pay only 6.1 percent of their income in state and local taxes, while low and middle-income Kentuckians pay between 9.4 percent and 10.8 percent.

Also, increasing the sales tax by a penny would do nothing to stop the erosion of sales tax revenue. That can happen only through modernizing the tax by applying it to services that are now untaxed. The Governor’s commission recommended an expansion to some services, and identified a number of criteria to use in selecting specific services—including a focus on luxury purchases.

Kentucky ranks among the states with the fewest services in its sales tax base, taxing only 28 of 168 services taxed by at least one state. These exclusions are a growing problem because services make up an increasing share of the economy. Kentucky’s sales tax base has fallen from about 54 percent of the state’s economy in 1979 to approximately 41 percent in 2008.

There is no question Kentucky needs more revenue to roll back devastating budget cuts; invest more in education, health and other critical areas; and pay back existing debt. But it must do so in a way that is fair—recognizing the vast difference in ability to pay between wealthy Kentuckians and the poor—and that improves the state’s troubling long-term revenue trends.