In the waning days of the 2018 General Assembly, legislators passed House Bill 366 (HB 366), a regressive tax package that gives a tax break to the wealthiest and shifts more over to everyone else, especially low-income Kentuckians. In addition to widening income disparities, these changes will exacerbate existing racial and geographic inequality in our state.

Tax Law a Shift to Lower-Income Families Across the State

As established in previous posts, the new tax law is regressive (another tax bill was passed on the very last day of session with relatively small alterations to HB 366 that does not change its regressive nature). With a flat income tax at 5 percent compared to the current graduated structure with a 6 percent top rate, cigarette tax increase and an expansion of the sales tax to a number of services, the new law represents a shift in our tax system from income taxes to sales and excise or “consumption-based” taxes. In fact, a majority of the revenue raised by HB 366 actually goes to pay for the cost of providing income tax rate cuts disproportionately benefitting the wealthy rather than to invest in the important services like schools and public health that benefit all Kentuckians. Income taxes ask more of the wealthy and consumption taxes depend more on low-income families, so the combination of an income tax cut and sales tax expansion has a regressive impact.

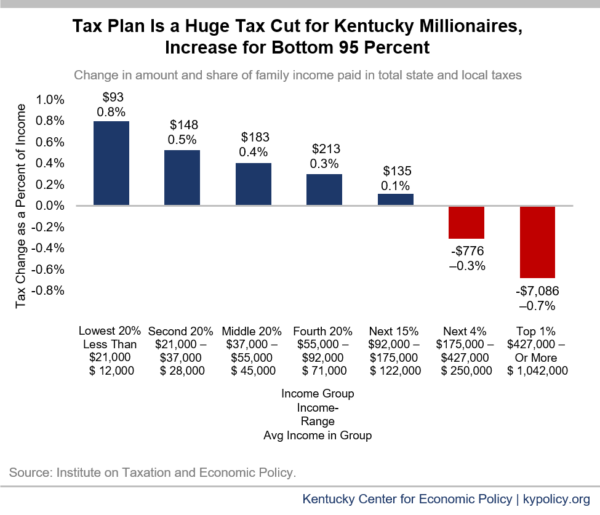

The graph below illustrates the “upside-down” impact of HB 366 in which the top five percent of Kentuckians get a huge tax cut while everyone else pays more on average (some middle- and upper-middle income people pay more in part because fewer income tax deductions and exclusions outweigh the law’s income tax rate cuts).

Law Has Communities of Color and Poorer Counties Pay for Tax Cuts at the Top

The graph above shows the estimated impact on Kentuckians overall, but because of racial and income inequality in our economy and between parts of the state, HB 366 will impact groups of people differently, worsening disparities.

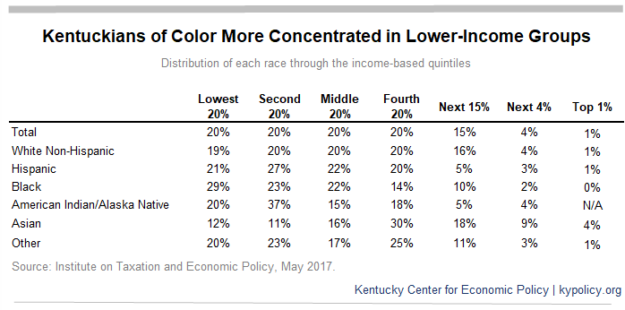

Due to persistent race wage gaps and inequality in educational and employment opportunities stemming from structural barriers for people of color in Kentucky, they are overrepresented in lower-income groups and under-represented in higher income groups as the table below shows. This means more Kentuckians of color will face tax increases, and fewer will receive tax cuts, than white Kentuckians under HB 366; 39 percent of White Non-Hispanic Kentuckians are in the bottom two quintiles – groups facing a tax increase on average of 0.5 percent of income or higher – whereas 52 percent of Black and 48 percent of Hispanic Kentuckians are in these lower-income groups.

Kentucky currently does not require racial impact analyses of proposed legislation (a bill was filed during the 2018 session to do so but did not receive a committee hearing), but if it did, the analysis would have almost certainly highlighted how the tax changes will somewhat worsen racial income inequality.

Similarly, in economically distressed areas of the commonwealth – where communities have higher unemployment and lower incomes than Kentucky on average – fewer people will receive tax cuts and more will pay higher taxes. For example, in 2016, median household income (5-year ACS estimates) in McCreary County was $18,972 but more than four times that in Oldham County at $86,324. Incomes of the top 1 percent in McCreary County start at $117,742 a year while the top 1 percent in Oldham County make more than $597,937 a year, a recent report by the Economic Policy Institute shows. Therefore, more people in Oldham than in McCreary will get tax cuts under the new law and the pattern is reversed for who will get tax increases. The counties that benefit the most from the tax shift are in northern Kentucky, and those that benefit the least are in eastern Kentucky.

Kentucky’s tax code was regressive before the passage of the new law, with low- to middle-income Kentuckians paying a larger share of their income in state and local taxes than wealthy people to support the public investments that benefit us all. The tax cuts included in HB 366 strongly favor affluent white communities at the expense of low-income Kentuckians and Kentuckians of color. Widening existing gaps will make it harder to build a Kentucky that works for everyone.