The Bevin administration submitted its waiver proposal to the Department of Health and Human Services (HHS) today, keeping the problematic approach that was in the original plan with modifications in a handful of areas. The proposal includes work requirements, premiums, lockout periods and other measures that would reduce the number of Kentuckians covered, some of which have been consistently rejected by the federal government in other state proposals.

The revised proposal includes the following measures:

Work Requirements for Participation

The plan includes a requirement that non-disabled adults without children engage in certain work and/or community requirements beginning after three months in the program. These activities start at 5 hours a week and ramp up to 20 hours a week after 1 year. Failure to do so results in suspension of benefits. One small change in the new plan is that caretaking for a disabled adult dependent or a non-dependent relative such as an elderly parent counts toward the work requirement.

Work requirements have been consistently rejected by HHS in waiver proposals, and rigorous evaluations show attaching similar requirements to safety net programs doesn’t work to reduce poverty.

Premiums with Lockouts for Failure to Pay and Other Penalties

Members will have to pay $1 to $15 in premiums a month based on income. After a year in the program, premiums continue climbing for those with incomes above the poverty line, up to $37.50 a month. A change in the new plan is that premiums are paid per household rather than per individual as originally proposed. Co-pays from the current program are eliminated for those paying premiums, though those co-pays are often not collected currently.

Enrollees must pay premiums within 60 days of becoming eligible. Those above the poverty line who do not pay are locked out of the plan for six months; they can re-enroll before that time if they pay three months’ worth of premiums and take a financial or health literacy course. For those below the poverty line, members not paying premiums keep benefits but must begin contributing co-pays and will lose access to their MyRewards account mentioned below. In the new waiver plan, those considered “medically frail” will not lose coverage if they do not pay premiums (and they are exempt from co-pays), but they also lose access to their MyRewards account if premiums are not paid.

Premiums have been attempted in past Medicaid experiments, and strong evidence suggests they significantly reduce the number of people covered.

Elimination of Vision, Dental and Transportation Benefits

Dental coverage would no longer be part of the regular Medicaid benefits package despite Kentucky’s poor oral health, and neither would vision coverage (the elimination of vision and dental benefits are delayed for the first three months of the demonstration in the revised plan). Also eliminated is help with transportation for non-emergency medical visits. The revised plan reinstates benefits for allergy testing and private duty nursing, which had been eliminated in the original proposal through a State Plan Amendment.

Elimination of Retroactive Coverage and a Lockout for Those Who Miss Signing Back Up

Currently, Medicaid provides retroactive coverage to new members for up to three months prior to enrollment. However, the proposal would make coverage start on the first day of the month payment is received (a pre-payment can be made to begin coverage for those not yet determined eligible). Because some people may not seek coverage until they have a serious health problem, this could mean facing unpayable health care bills.

If a member does not re-enroll for coverage before the expiration of each 12-month period, he or she loses coverage. The member then will have three months to re-enroll and if they do not must wait an additional six months to reenroll unless they take a financial or health literacy course. According to the Center on Budget and Policy Priorities, that’s something “no state has proposed doing.”

Complex New Administrative Systems

As before, the plan includes complex and expensive administrative systems to approve and track work and community engagement activities, financial and health literacy courses, and healthy behavior activities; to charge and collect premiums; to assess, manage, and track the costs and benefits of employer-sponsored health insurance programs; and to maintain two Health Savings Accounts (HSAs) – one for a high deductible account and the other for what’s called a MyRewards account.

Medicaid members would have a $1,000 deductible each year, though the plan contributes $1,000 to each member in a health savings account to make the payment. Half of the unused deductible each year will go into a second health savings account, called MyRewards. The MyRewards account is also set up to receive funds for certain health, community and job training activities. The monies in that account can be used for benefits not covered, and a new provision allows them to be used to pay fees associated with taking the GED. Monies are taken out of the account as a penalty for non-emergency use of the emergency room and potentially for “excessive missed healthcare appointments,” which is new to the final waiver request.

Attempts to Link Medicaid to Private Employer-Based Insurance

The waiver proposal attempts to link Medicaid to employer-provided insurance for those employers that offer coverage to workers who are Medicaid recipients. Members with access to these plans are encouraged — and ultimately required — to enroll in the employer-sponsored plans, and are given monies for the premiums (minus the Medicaid premium payment above). Medicaid pays for benefits the employer does not provide. According to a recent study of similar ideas, there are challenges with such programs and “more research is needed” to know how to administer them.

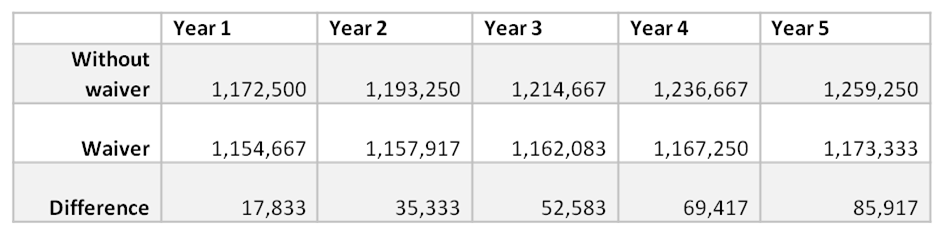

As in the original waiver proposal, the plan would result in fewer Kentuckians covered — in fact the proposal contains the same estimate of numbers of people who would lose coverage as in the original plan. (Data from report presents “member months,” and the table below converts that to number of members by dividing by 12).

Source: KCEP calculations from Kentucky HEALTH document.

Now that the waiver request has been submitted to HHS, there will be a 15 day review period to ensure the application has been completed correctly. Then the federal comment period will be opened for 30 days, and during that time comments can be made through the HHS waiver website by searching for Kentucky’s 1115 waiver. Once that period ends there is no deadline for approval or rejection, but past demonstration waivers have taken 6-12 months of negotiation during this phase.

Kentucky has been on the right track for the past two and a half years, and erecting barriers, reducing benefits, and creating confusing and expensive administrative systems will only move us backward on our health progress. It is crucially important that during negotiations between HHS and state officials the gains we have made are preserved.